With all of the current information surrounding Greece’s debt disaster and the digital cascade of financial stories and different market-moving information occasions that occur every day, it might probably appear overwhelming to attempt to sustain with all of them. What’s a dealer to do?

My resolution is easy and very efficient; I ignore all of it. I tune all of it out and it’s essentially the most liberating and stress-free method you may presumably commerce, to not point out it’s a lot better to your buying and selling outcomes and may even be the important thing to saving your buying and selling account…

Commerce the now, not the longer term

Have you ever ever observed {that a} Foreign exchange forex pair will usually transfer the other way of what you thought after a specific financial information report comes out?

There’s a motive for this, it’s as a result of persons are the primary driving drive behind the markets and folks commerce the market based mostly on their beliefs or expectations of the longer term. A lot so, that when the information occasion or financial report comes out that they have been anticipating, the value transfer based mostly on it has already taken place. That is the place the previous saying “Purchase the hearsay, promote the actual fact” comes from.

Worth motion is a mirrored image of what’s taking place in a market proper now, and it offers us clues as to what may occur sooner or later, actual, actionable clues. Understanding that individuals are likely to commerce their expectations of future occasions available in the market proper now, logic dictates that by the point that future occasion approaches, it isn’t going to have an effect on the market the way in which we’d suppose it’ll. The purpose is that this; there’s merely no level in making an attempt to commerce based mostly on how a information occasion may have an effect on the market sooner or later, when it’s affecting a market principally earlier than it happens (now) and we will see its impact on a market by way of value motion.

Thus, we wish to commerce the ‘now’ of the market, as a substitute of making an attempt to guess about how a specific information occasion may affect the market sooner or later. By the point the longer term will get right here, the information occasion will have already got influenced value and there might be a brand new one the horizon that persons are buying and selling on. In case you attempt buying and selling information occasions as they happen, you’ll be late to the get together and all the time chasing your tail. Follow the value motion because it displays the whole lot that’s presently taking place in a market.

One caveat right here, that you simply is likely to be questioning about; what about ‘random’ information occasions like shock rate of interest hikes or pure disasters, and so on.? Good query, however, as we clearly haven’t any earlier information to those occasions, we will’t take into consideration how they may have an effect on a market sooner or later, thus, all we have now is the value motion that they go away behind on the chart after they happen. Once more, value motion ‘wins’ and buying and selling it within the ‘now’ makes essentially the most senes. In these eventualities, you may watch for the occasion to unfold after which watch the charts for value motion indicators within the volatility that follows.

How attachment to information can kill your buying and selling account

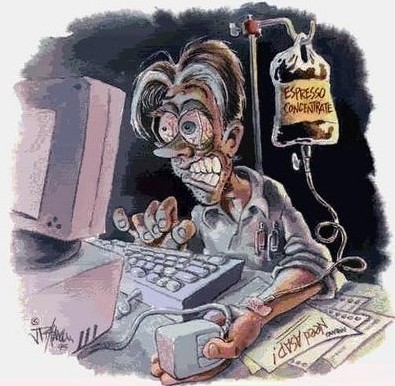

Merchants actually develop into obsessive about information occasions and watching financial information calendars. They get sucked right into a ‘black gap’ of observing financial information calendars from their dealer or elsewhere and making an attempt to ‘work out’ what may occur on account of them, this can be a horrible place to be mentally and it’s very dangerous to your buying and selling.

Merchants actually develop into obsessive about information occasions and watching financial information calendars. They get sucked right into a ‘black gap’ of observing financial information calendars from their dealer or elsewhere and making an attempt to ‘work out’ what may occur on account of them, this can be a horrible place to be mentally and it’s very dangerous to your buying and selling.

When you persuade your self that XYZ is ‘going to occur’ based mostly on a sure upcoming information announcement, you’ve gotten set your self up for the destruction of your buying and selling account. All logic and objectivity goes out the window whenever you suppose you realize ‘for positive’ what the market goes to do sooner or later sooner or later.

The principle key to buying and selling success, is remembering that buying and selling is a sport of chances, not certainties, and buying and selling in-line with that information. If you commerce this manner, you’ll naturally handle your danger correctly and keep on with your buying and selling plan, since you are remembering that anybody commerce could be a loser and that you simply by no means know what’s going to occur ‘for positive’ at any level sooner or later.

Conversely, whenever you commerce with the assumption that you simply ‘know’ what’s going to occur based mostly on some information occasion, there’s nothing stopping you from jacking up your danger to unsafe ranges. That is the primary motive why ignoring the information can save your buying and selling account. Ignoring the information removes plenty of the potential so that you can persuade your self that you realize one thing ‘for positive’ about the way forward for the market. It additionally removes plenty of second-guessing and confusion, and considerably simplifies the buying and selling course of.

The extra we focus solely on value motion, danger administration and buying and selling psychology, the nearer we get to working from an ideally suited buying and selling mindset. Usually, the most important impediment to a dealer’s success, is solely flushing out after which ignoring all the knowledge they’re uncovered to every day. You wish to commerce from a ‘pure’ mindset and making an attempt to analyse information and work out the way it could or could not have an effect on a market is sort of a futile sport of whack-a-mole that can in the end lead to you blowing out your buying and selling account.

To get began on the trail of ‘pure’ buying and selling, targeted solely on value motion, danger administration and buying and selling psychology, take a look at my Worth Motion Buying and selling Mastery Course.