There are quite a few misconceptions and incorrect assumptions that surrounding buying and selling. These myths are held each by aspiring merchants in addition to the general public. Not solely are they unfaithful, they’re hurtful each to you as a dealer and your possibilities off success but additionally to the fame of buying and selling within the minds of the general public who know subsequent to nothing about it.

On this article, we’re going to dispel 11 of the most typical myths of buying and selling and clarify to you why they aren’t true…

Hopefully, after ending immediately’s lesson, you’ll have a greater understanding of the truth of buying and selling, what to anticipate and the best way to revenue from it. Every buying and selling delusion will likely be adopted by the reality and a proof of each:

The Myths of Buying and selling:

Delusion: Buying and selling is all about making that fast-cash man!

Fact: Buying and selling is about not shedding cash, you will need to be taught to try this if you wish to make any…

Maybe the largest delusion about buying and selling in most people’s thoughts, is that it’s all about creating wealth quick. Excessive threat, quick cash, quick automobiles, and many others. and many others. The stereotypes that encompass buying and selling are so widespread that the majority starting merchants get into buying and selling because of these stereotypes and they also begin off with the entire mistaken mindset and expectations. These expectations come to a crashing realization as soon as they lose a couple of trades and actuality units in. As the good Warren Buffet so famously stated:

Rule No.1: By no means lose cash. Rule No.2: Always remember rule No.1. – Warren Buffett

That’s proper, buying and selling is about not shedding cash far more than it’s about making it. The reason being, if you wish to become profitable within the markets, you should be a threat supervisor greater than something, a capital preservationist, if you’ll. If you wish to make the most of massive strikes out there, you’ve bought to be taught to protect your buying and selling capital by bidding your time and being affected person within the face of fixed temptation.

You can be in battle not solely in opposition to all different merchants buying and selling the markets you take a look at, but additionally in opposition to your self, which is maybe the toughest ‘opponent’ to defeat. When you get to the purpose the place you may protect your buying and selling capital and solely apply it to buying and selling alternatives that meet your strict, pre-defined standards specified by your buying and selling plan, then you’ll have conquered your self and you’ll begin taking cash from different market members relatively than giving it to them.

Delusion: You should be an Ivy-League, Wall Road hotshot to make it as a dealer

Fact: You don’t should be tremendous good, buying and selling is as a lot talent as it’s math…

Guess what? You don’t should be a university graduate to be a profitable dealer. Buying and selling isn’t just for some super-genius math wiz who sits there coding algorithms all day. Actually, identical to being overly-emotional might be dangerous for buying and selling so can being overly-analytical. Those that are too analytical are inclined to over-think and suppose themselves proper out of completely good buying and selling alternatives.

Ideally, you need to have a very good mixture of intestine really feel and analytical buying and selling talents. Your intestine really feel provides you with many buying and selling concepts and the need to take them however your analytical /ahead pondering talents would be the verify that retains your buying and selling in steadiness. Solely when a commerce thought passes each your intestine really feel and your logical, goal evaluation do you have to think about getting into it.

The purpose of the matter is that school levels, IQ’s and different ‘credentials’ are nothing however background noise to the market. Those that succeed at buying and selling are masters of themselves. Grasp your individual actions and conduct and talent to manage them and you’ll succeed at buying and selling. All of the books and an IQ of 180 gained’t do you any good in case you over-trade or threat an excessive amount of or can’t stay disciplined.

Delusion: You have to have good timing to become profitable within the markets to select highs and lows precisely

Fact: Buying and selling isn’t about choosing the highs and lows, it’s about studying the charts from left to proper…

You don’t have to select actual market turning factors to become profitable buying and selling like many individuals suppose. You do should learn the chart, the story on the chart and perceive what it’s making an attempt to inform you. You then search for worth motion indicators that ‘make sense’ with that chart’s story.

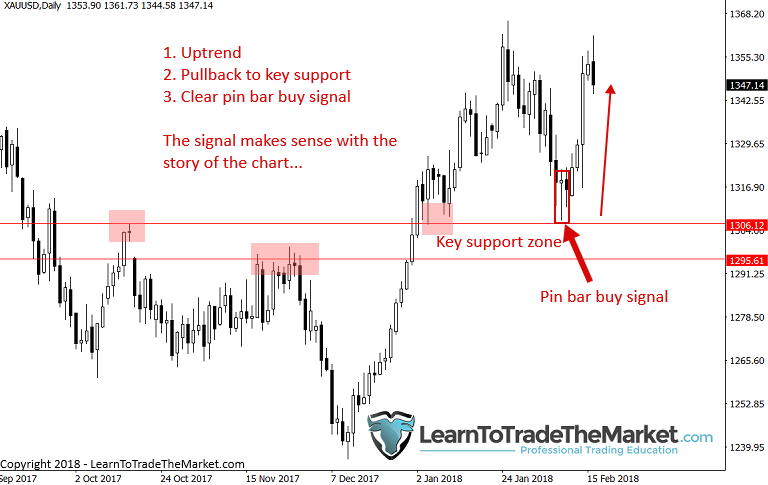

On this latest Gold chart, we will see that the story on the chart was this:

An uptrend was in place on the each day chart as seen beneath. Then, we drew in the important thing horizontal ranges of assist to search for indicators at. Then, worth pulled again to assist and fashioned an apparent pin bar reversal sign there, indicating an extended entry was applicable. You possibly can see what occurred subsequent. We’re studying the chart and contemplating the context a possible commerce entry types inside, not simply making an attempt to select the precise excessive or low with no rhyme or purpose.

Delusion: You want some huge cash to face any probability at creating wealth out there

Fact: You don’t should have some huge cash to begin, a very good dealer can become profitable no matter account dimension…

Typically, merchants consider that to succeed at buying and selling they want a giant buying and selling account. However, that is merely not true. IN truth, you may lose cash on a giant buying and selling account simply as quick as you may on a small buying and selling account. It’s greatest to begin with a smaller account even when you have some huge cash to commerce with. Will a big buying and selling capital reserve enable you to make more cash sooner? Certain. However, fi you don’t know what you’re doing you can too lose that cash sooner.

The methods, abilities and psychological attitudes you should succeed at buying and selling will work on a small account the identical as a giant account. It’s at all times greatest to begin on a small account and hone your abilities, then whenever you’re prepared you may deposit extra money when you have it or simply hold constructing that small account.

Don’t be in a rush! For those who construct a observe report of profitable buying and selling on a dwell account, even a small one, you can be a profitable dealer. Constructing a profitable dwell account observe report over a interval of a 12 months or extra is one thing that FEW folks can do. For those who try this, even on a small account, your success will begin to snowball.

Delusion: It’s important to know what will occur subsequent in a market to become profitable.

Fact: You don’t should be proper or know what is going to occur subsequent to become profitable, you will need to perceive which you could by no means know for certain what is going to occur…

One large delusion about buying and selling is that to become profitable you will need to know what is going to occur subsequent. This couldn’t be farther from the reality and actually, it’s not even attainable. A part of buying and selling is that there’s a random expectation for anybody commerce you’re taking. That means, any particular person commerce, checked out in a vacuum, so to talk, has basically a random consequence. It’s because there are hundreds, perhaps even thousands and thousands of variables affecting a market at any given day at any given time. Consequently, a commerce actually can go both route, even in case you consider you’re 100% proper about it.

The place your buying and selling technique or buying and selling edge is available in, is that over-time, given sufficient trades, in case you comply with your technique with self-discipline, it’ll play out in your favor. Most buying and selling edges or methods are merely making the most of repetitive market patterns or worth motion patterns that kind due to repetitive human interactions with the market. So, while your buying and selling edge might need 60%-win price, any singular commerce has basically a 50/50 probability of figuring out. So, don’t begin convincing your self “I’M RIGHT!” about your subsequent commerce since you’ll begin risking an excessive amount of and getting too emotionally hooked up to that commerce, which is a recipe for catastrophe.

As an alternative, notice and perceive that there’s something referred to as a random distribution of wins and losses, which basically means what I described above. For any given buying and selling edge or technique, over time and over a big sufficient pattern dimension of trades, that buying and selling edge will present a randomly distributed sample of wins and losses. So, while you do want confidence in your buying and selling skill and chart studying abilities, you can not afford to turning into satisfied you’re ‘proper’ about anybody commerce and you will need to at all times keep in mind that ANY commerce could be a loser. For extra on this matter, checkout my article on buying and selling legend Mark Douglas.

Delusion: You want a high-percentage of your trades to be winners to become profitable

Fact: You don’t should win a high-percentage of your trades, you will need to maximize your winners as an alternative…

You’ve in all probability heard of threat reward ratios, however do you actually perceive their energy? You don’t have to win all of your trades to make some huge cash out there, in actual fact, you don’t even have to win most of your trades! How is that attainable you ask? By understanding and successfully using threat reward ratios.

Let’s say you set a threat reward of 1:3 for each commerce you’re taking. Meaning, you threat 1R the place R = {dollars} threat to make 3R or 3 instances your {dollars} risked. At this threat reward ratio, you solely have to win 25% of your trades to breakeven and about 27% of them to make a revenue (after commissions / spreads).

Let’s take 100 trades. Say you lose 70% of them that will be 70 out of 100; you’ve got misplaced 70R which for examples sake we’ll say is $700 or $10 per commerce ($10 = 1R). Now, when you have a 1:3 threat: reward, you’re making $30 on all of your winners, however you solely had 30 winners, proper? Nevertheless, that’s nonetheless $900 in revenue! So, you misplaced $700 however made $900, revenue of $200 although you misplaced 70% of the time!

Threat reward ratios: You solely have to win 27 – 30% of the time to become profitable in case your winners are 1:3. With a 1:2 threat reward you solely should be proper about 35% of the time. Merchants get caught up in making an attempt to win on each commerce, however it is a idiot’s sport, very irritating / time consuming and easily not attainable.

A 50%-win price, which is completely attainable in case you’re a grasp of worth motion, could make you a really giant sum of cash every year by buying and selling with a 1:2 or 1:3 threat reward. Most merchants consider they need to win at a really excessive proportion, nevertheless it’s merely not correct and never conducive to a correct buying and selling mindset.

Delusion: Automated buying and selling robots or indicators (methods) are the ticket!

Fact: Not if you wish to succeed long-term or on any stage of magnitude…

All you should do is learn a number of the Market Wizards books and you’ll rapidly notice that many of the world’s best merchants usually are not shopping for Foreign currency trading robots and easily loading them onto their computer systems and getting wealthy. This pipedream offered by pc programmers who know nearly nothing about the best way to learn the charts, is a big buying and selling delusion.

Any totally mechanized buying and selling system or algo-trading methodology goes to fail over time. Buying and selling situations change steadily and even quickly. It takes an skilled, educated and expert human thoughts to discern between good buying and selling situations and dangerous. If buying and selling was as straightforward as putting in some software program in your pc and pushing the purchase or promote button when the software program tells you to, everybody could be a billionaire.

Take into consideration probably the most well-known merchants and buyers you already know: Warren Buffet, George Soros, Paul Tudor Jones, any of the merchants within the Market Wizards books; they’re utilizing their minds not buying and selling robots. Don’t fall for the hype, be taught to commerce correctly after which use your thoughts to make buying and selling choices.

Delusion: You possibly can solely become profitable in trending markets or ‘straightforward’ market situations.

Fact: If you understand how to commerce with worth motion, any market situation is sport…

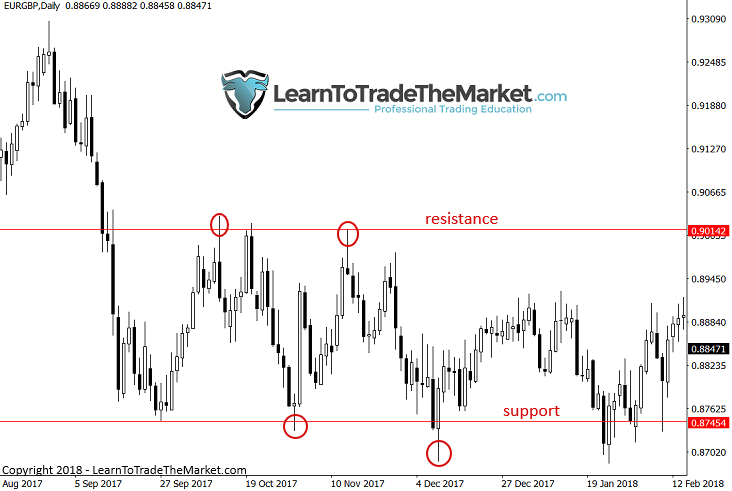

A talented worth motion dealer can become profitable in a trending market, in a market that’s swinging extensively and never in a good pattern, in a range-bound / sideways market and even counter-trend. Clearly, there are occasions when a market is simply too uneven to commerce, however that is the place your worth motion abilities are available once more; studying that chart from left to proper and figuring out whether or not or not situations are ripe for a commerce. One of many lovely issues about worth motion is that it can provide you good trades in trending or sideways markets. As we see beneath, a market that’s confined to a buying and selling vary can present many good buying and selling alternatives for the savvy worth motion dealer…

Delusion: Day-trading is the quickest option to become profitable and get a Lamborghini.

Fact: Day-trading will in all probability trigger you to lose cash sooner than a visit to the on line casino…

Shorter time frames offer you extra alternatives, to lose cash perhaps! – Shorter time frames include extra uneven, meaningless worth motion and false-signals that may grind you all the way down to a bloody pulp. TRUST ME – WAAY extra profitable and fewer irritating to give attention to the each day charts and see a sign, enter it /set it up, then stroll away for every week, versus always obsessing on low time-frame charts. You’ll save transaction charges, time, psychological power, and you’ll make more cash buying and selling by taking one or a number of excessive time frame trades a month with minimal involvement by set and overlook, than you’ll day buying and selling.

Delusion: I can’t use broad stops as a result of I don’t have a lot cash.

Fact: Cash has nothing to do together with your skill to put broad stops and broad stops are what you want more often than not…

Have you ever heard of place sizing??! Right here it’s – say you need to place a 150 pip cease loss as a result of that’s the greatest cease loss placement for the commerce you need to take. However, you solely have a $500 account – suppose that cease is just too broad for you? Improper.

All you should do is decrease your place dimension. If you wish to threat about $30 per commerce on that account, you’d simply want to regulate your place dimension to 0.20 mini heaps on a that 150 pip cease, that’s $30 on any XYZUSD foreign money pair.

For those who don’t perceive place sizing, you definitely have to just remember to do earlier than you begin buying and selling dwell. Once more, you don’t want some huge cash to tackle wider cease losses! You merely want to scale back your place dimension! I’m all about wider stops as they’ll hold you in good buying and selling concepts and enable you to from getting stopped out prematurely like many merchants do.

Delusion: My relative or buddy or instructed me buying and selling is like playing.

Fact: It may be, in case you let it!

Lastly, maybe the largest buying and selling delusion out there’s that Foreign currency trading or any sort of speculating on monetary markets is similar as playing. It is a broad generalization / stereotype that the general public who don’t commerce and know nothing about it, maintain of their minds.

The fact is that if you wish to gamble, you are able to do it within the markets. Nevertheless, you can too deal with buying and selling like a high-class, upper-echelon career that takes time and persistence to get good at. In contrast to playing at a on line casino, you may put the percentages in your favor as a dealer via correct buying and selling schooling, studying from these extra skilled from you and display screen time. While you go to the slot machine on the Bellagio, your odds are at all times about the identical; extraordinarily slim. A talented worth motion dealer could make a full-time residing buying and selling the markets, simply successful 35% to 65% of their trades. You’ll by no means go to a on line casino and win even 20% of the time. So, buying and selling might be playing, in case you enable it to be, as many merchants do. However, if you wish to succeed at it it’s important to focus and change into expert so that you simply make right into a high-skill sport of likelihood and psychological fortitude, one which has nothing in any respect to do with luck.

What did you consider this lesson? Please share it with us within the feedback beneath!