I get a whole lot of emails from merchants asking me whether or not or not my methods work on sure markets that is probably not mentioned typically on my website. The reply is principally, sure. The proprietary worth motion buying and selling technique I take advantage of is relevant to many various international markets, not simply Foreign exchange.

Nonetheless, with Foreign currency trading turning into so widespread and simply accessible lately, many merchants assume I simply have a look at Forex, however this couldn’t be farther from the reality.

For us worth motion merchants, studying to learn the footprint of cash on the chart means we will commerce and return a revenue on just about any market we wish. Nonetheless, I’m not saying exit and apply my methods to each worth chart on this planet, not even shut! In reality, I like to recommend and train my college students to turn into “specialists” in a choose handful of markets. This lesson discusses a few of the essential particulars and worth motion tendencies of my favourite markets as a way to get a really feel for them and perceive why I commerce them.

Don’t Restrict Your Buying and selling Choices

Alternatives exist globally and I commerce a plethora of markets to reap the benefits of these alternatives, from indices to commodities to Foreign exchange and generally even equities. You don’t need to restrict your self to only one asset class as a result of doing so additionally limits your probabilities of long-term success within the markets.

Limiting your self to only Foreign exchange, for instance, means that you’re not going to do nicely when the most important Foreign exchange pairs are consolidating, and plenty of instances all of them consolidate without delay. Increasing your focus to different markets and alternatives will increase potential alternatives and potential returns. For a lot of good causes, hedge fund merchants look to a diversified portfolio of devices and as personal retail merchants we must always do the identical!

As well as, for these of you solely centered on Foreign exchange, the very fact is that volatility shouldn’t be all the time current within the main FX pairs we have a look at. So, it stands to motive that you need to look exterior of Forex repeatedly so that you’re not with out alternatives to revenue. If there’s very low volatility there are going to be only a few buying and selling alternatives. In brief, you must commerce what’s MOVING to make any cash as a dealer!

Understanding MetaTrader Product Specs

OTC, CFD, Spot, Futures, Foreign exchange, Commodities, Indices, to the start dealer all these totally different merchandise and acronyms can appear very complicated and considerably bewildering. Let’s simplify all of it right here and now….

Spot Markets – The “spot worth” of a market is quoted by central banks and brokers all world wide, for instance, the present worth of the EURUSD Foreign exchange pair is quoted because the “spot worth”. OTC markets (this implies over-the-counter markets) haven’t any central change and buying and selling is completed electronically, straight between two events (comparable to a dealer and a retail dealer such as you) and this buying and selling relies on the spot worth of the underlying market. Contract sizes and the worth per level worth can differ from one dealer to the following.

CFD – This stands for Contracts For Distinction. It’s a product supplied by establishments or brokers which mirrors the underlying monetary product. So, if you’re buying and selling a CFD you aren’t dealing straight with the underlying market, you’re buying and selling a ‘mirror’ market and that is how retail merchants generally entry it. These mirror markets are created ‘on prime’ of a futures or spot market. So, you’ll be able to commerce a Gold CFD for instance, which mirrors the Gold futures market (referred to as a futures cfd) or you’ll be able to commerce a Gold CFD that mirrors the spot Gold market (referred to as a money cfd).

- Gold (and another markets) is traded as each a spot market and futures market and with MetaTrader you’ll be able to commerce a money CFD which relies on the spot market, over-the-counter the market. The precise futures product is on a regulated change usually in Chicago, New York or London. Totally different contract sizes and totally different worth per level worth are widespread between brokers.

- Foreign exchange is just a spot market, nevertheless, there are forex futures traded on main exchanges however we don’t commerce these.

- Commodities and Indices could be supplied on a spot market or a futures market however the place you need to commerce spot they flip right into a money CFD and the place you need to commerce futures it’s a futures CFD.

Be aware – To commerce the identical markets I talk about on this article, you’ll be able to entry them by way of the MetaTrader platform I take advantage of right here.

The Major Markets that I Commerce Are…

I repeatedly have a look at and observe the most important Foreign exchange pairs, S&P500, SPI200 (and different main inventory indices), Crude Oil and Gold are my favourite commodities. These are the majority of the markets I wish to actively watch and commerce however I do have a look at others occasionally. In recent times, these markets have contributed considerably to my buying and selling earnings and I additionally traded them within the latest buying and selling competitors that I received.

EURUSD – Euro/Greenback Foreign exchange forex pair

The EURUSD, often known as the Euro/greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I take advantage of. The spot worth of the EURUSD at any given time displays the present change charge between the Euro and the U.S. greenback. For instance, if the speed is 1.1700, which means 1 euro is price 1.1700 U.S. {dollars}, in different phrases, the euro is stronger than the greenback (as it’s now).

- Market conduct & worth motion tendencies

The EURUSD tends to be essentially the most closely traded forex pair. Because of this, in can get considerably uneven extra so than the GBPUSD or AUDUSD for instance. That stated, worth motion indicators, particularly on the 4-hour and every day chart time-frame are inclined to repay very often on this pair. It tends to respect help and resistance ranges fairly properly and is marked by sustained trending intervals adopted by considerably prolonged durations of sideways motion particularly inside giant buying and selling ranges. The EURUSD is a favourite market of mine primarily as a result of so many individuals commerce it that most of the apparent indicators are usually “self-fulfilling”

GBPUSD – Sterling/Greenback Foreign exchange forex pair

The GBPUSD, often known as the Sterling/greenback or Pound/greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I take advantage of. The spot worth of the GBPUSD at any given time is exhibiting the present change charge between the British pound and the U.S. greenback. For instance, if the speed is 1.3100, which means 1 British pound goes to get you 1.3100 U.S. {dollars}, in different phrases, the pound is stronger than the greenback (as it’s now).

- Market conduct & worth motion tendencies

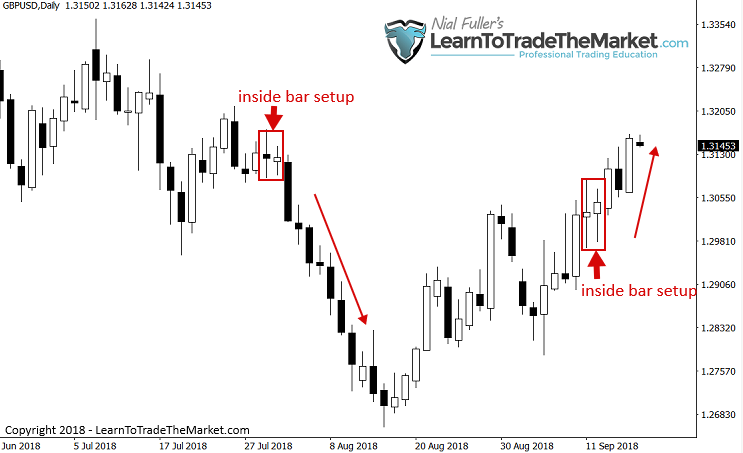

The GBPUSD tends to have larger volatility than the EURUSD, for instance. This implies it tends to expand strikes, greater breakouts, greater tendencies, and so forth. The worth motion indicators are usually bigger / extra pronounced on this pair than different FX pairs. Total, I actually get pleasure from buying and selling the GBPUSD and since it’s not fairly as fashionable because the EURUSD and has larger volatility, it tends to maneuver extra and consolidate a bit much less, which interprets into extra potential profitable trades for a talented worth motion dealer.

USDJPY – Greenback/Yen Foreign exchange forex pair

The USDJPY, often known as the Greenback/Yen is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I take advantage of. The spot worth of the USDJPY at any given time is exhibiting the present change charge between the U.S. greenback and Japanese Yen. For instance, if the speed is 110.00, which means 1 U.S. greenback will web you 110.00 Yen, in different phrases, the greenback is stronger than the Yen (as it’s now).

- USDJPY market conduct and worth motion tendencies

I would be the first to confess the USDJPY could be a uneven market to commerce. It will probably make some erratic strikes even on the upper time frames. That stated, it does get into some sustained and really predictable tendencies generally, and worth motion indicators are inclined to work nicely on this pair. It’s also a really technical market, which means, it tends to respect key ranges very predictably and precisely. Simply be careful for the “chop”.

AUDUSD – Aussie/greenback Foreign exchange Foreign money Pair

The AUDUSD, often known as the Aussie/Greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I take advantage of. The spot worth of the AUDUSD at any given time is exhibiting the present change charge between the Australian greenback and U.S. Greenback. For instance, if the speed is 0.7200, which means 1 Australian greenback will web you .72 cents of a U.S. greenback, in different phrases, the USD is stronger than the Aussie greenback (as it’s now).

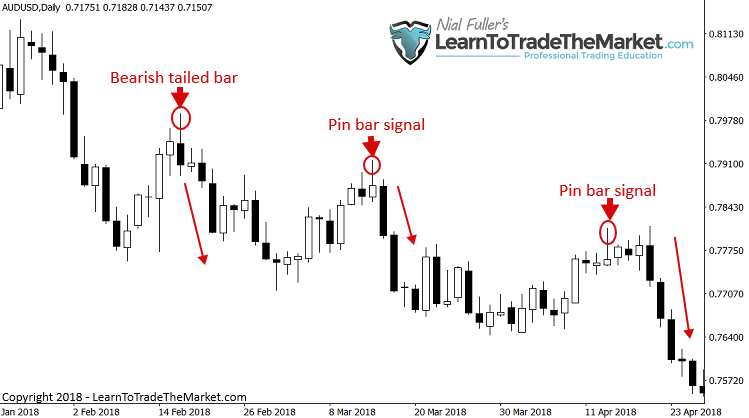

- AUDUSD market conduct and worth motion tendencies

Being from Australia, the AUDUSD might be my total favourite forex pair to commerce. As I wrote in my article on why you need to have a favourite market, I recommend you choose one Foreign exchange pair that you simply actually really feel snug with (maybe your native forex vs. one other main) and actually get “intimate” with that pair. As I stated within the intro, turning into a specialist dealer is the way you generate profits. It’s not totally different than some other area, whether or not it’s medication, sports activities, enterprise or investing; the extra of a specialist you turn into, the more cash you’re going to make. The AUDUSD tends to be a bit decrease in volatility than the GBPUSD and EURUSD nevertheless it’s a really technical market. When it tendencies it’s very good to commerce and it respects ranges very nicely. Each day chart indicators have a tendency to return off very properly. I really like buying and selling the AUDUSD.

NZDUSD – Kiwi/Greenback Foreign exchange Foreign money Pair

The NZUDUSD, often known as the Kiwi/Greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I take advantage of. The spot worth of the NZDUSD at any given time is exhibiting the present change charge between the New Zealand0 greenback and U.S. Greenback. For instance, if the speed is 0.6500, which means 1 kiwi greenback will web you .65 cents of a U.S. greenback, in different phrases, the USD is stronger than the kiwi greenback (as it’s now).

- NZDUSD market conduct and worth motion tendencies

KIWI similar to the AUDUSD. Clearly, New Zealand and Australia are subsequent door neighbors so they have an inclination to have comparable catalysts for what strikes their currencies, for this reason the NZDUSD and AUDUSD charts typically look fairly comparable. Nonetheless, be aware that the NZDUSD can have very uneven intervals, this chart will transfer sideways about 50% of the time. For that reason, I want the AUDUSD over the NZDUSD in most conditions, however the NZDUSD remains to be an excellent main FX pair to look and commerce when a sign presents itself.

Gold – Commodity (treasured steel)

I commerce spot Gold (XAUUSD) which is in truth a money CFD. Gold is clearly the most well-liked treasured steel on this planet and can also be essentially the most broadly traded.

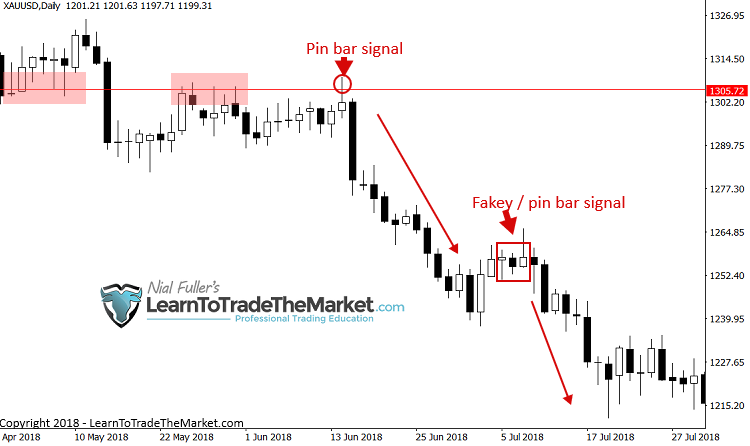

- Gold market conduct and worth motion tendencies

Gold tends to pattern extraordinarily nicely in between intervals of consolidation. The consolidation could be very uneven and troublesome to commerce at instances, nevertheless. Gold could be unstable and enormous directional strikes usually are not unusual, this implies enormous potential for revenue, but additionally for loss if you’re not expert and well-prepared. Gold is one in all my favourite commodities to commerce.

Crude Oil – Commodity (power)

Crude oil is obtainable as a money CFD (spot image – USOIL) or a futures CFD (image – WTI.fs), both one is okay to commerce simply remember that the costs are totally different. Crude Oil is the most well-liked power commodity to commerce and together with Gold is one in all my prime two favourite commodities.

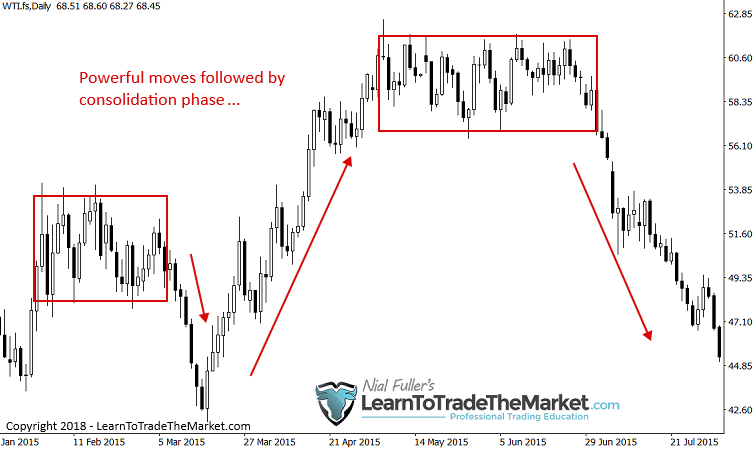

- Crude Oil market conduct and worth motion tendencies

Crude Oil is a market I commerce fairly steadily, most likely much more so than Gold. I might say it’s my favourite commodity to commerce, and for good motive. Crude tends to expertise extended intervals of sturdy trending / directional strikes and it additionally respects key help and resistance ranges very nicely, usually. Oil could be very unstable nevertheless, so it’s not for the novice or inexperienced dealer.

- Crude oil will typically consolidate for weeks or months after an enormous transfer

S&P500 – U.S. Inventory Index S&P500

The S&P500 is obtainable as a futures or money CFD on the Metatrader platform I commerce on. You will note the futures cfd image as S&P.fs and the money CFD image is US500.

The S&P500 is comprised of 500 of the most important and most essential, predominantly U.S.-based corporations and is taken into account to be the world’s main benchmark for traders of every type. All shares within the S&P 500 index are traded on the New York Inventory Change and NASDAQ.

- S&P500 market conduct and worth motion tendencies

The S&P500 is one other market that I commerce very often. It’s a excellent market to ‘purchase and maintain’ as U.S. shares are inclined to need to pattern larger. Nonetheless, in instances of recession or financial turmoil, this market can sell-off extraordinarily rapidly, wiping out good points quick. So, while it’s a comparatively ‘straightforward’ market to commerce, it does take a strong understanding of worth motion and market dynamics to revenue in it over the long-run.

SPI200 – Australian inventory index

The SPI 200 Futures contract is the benchmark fairness index futures contract in Australia, based mostly on the S&P/ASX 200 Index. It offers all the normal advantages of fairness index derivatives. The SPI 200 is ranked within the prime 10 fairness index contracts in Asia by way of traded quantity.

The SPI200 is obtainable as a futures or money CFD and you will notice the futures CFD image as SPI200.fx and the money CFD image is AUS200.

- SPI200 market conduct and worth motion tendencies

The SPI200 is a specialty of mine, so to talk. I’ve been following it and buying and selling it for greater than a decade. This market tends to rotate from key ranges and so is one which we need to look to ‘fade’ typically, in different phrases, when worth makes a transfer right into a key degree, we glance to commerce the opposite path or fade that degree. This could throw many merchants off as a result of simply because it’s beginning to make a robust transfer it can typically reverse strongly, the opposite path. However for a well-versed worth motion dealer, these sturdy actions from key chart ranges are sufficient to make your mouth water.

DAX – German Inventory Index

The DAX (German inventory index)) is a blue chip inventory market index consisting of the 30 main German corporations buying and selling on the Frankfurt Inventory Change.

The DAX is obtainable as each a futures and money CFD on Metatrader, and you will notice the futures image as DAX30.fs and the money CFD image is GER30.

- DAX market conduct and worth motion tendencies

The DAX trades much like the S&P500 in that it’ll typically pattern upwards fairly properly and generally for a sustained interval, then, seemingly out of nowhere the market will nose-dive 10 – 15% in a number of days. Not for the faint of coronary heart to make sure. Nonetheless, this volatility is a blessing in the event you perceive it and know find out how to learn the worth motion and get in after which exit your trades correctly.

Why I Don’t Take a look at EVERY MARKET…

One factor that’s most likely in your thoughts is why don’t I commerce many various markets? In spite of everything, I might commerce tons of of merchandise you’re considering! Nicely, I slender it all the way down to essentially the most liquid merchandise after which I slender it down additional to the markets that I see the worth actions indicators producing extra constant outcomes in, so I do know I’ve an edge.

Let’s have a look at a pair examples of why I select the most important market over the extra ‘obscure’ or less-traded counter-part:

GBPUSD vs. EURGBP:

Under, we see a every day GBPUSD chart. Discover the highly effective down and up strikes and the inside bar indicators which have labored out nicely to date. That is simply the present every day chart view of the previous couple of months and we will see it’s transferring properly and never very uneven in any respect.

Examine the GBPUS chart above to the EURGBP chart beneath, exhibiting the identical time interval, and you’ll see it’s a way more complicated and barren chart to commerce (not many good indicators, if any). This chart appears ugly and in the event you had been following this one on a regular basis and attempting to commerce it, you’d most likely lose.

Gold vs. Silver:

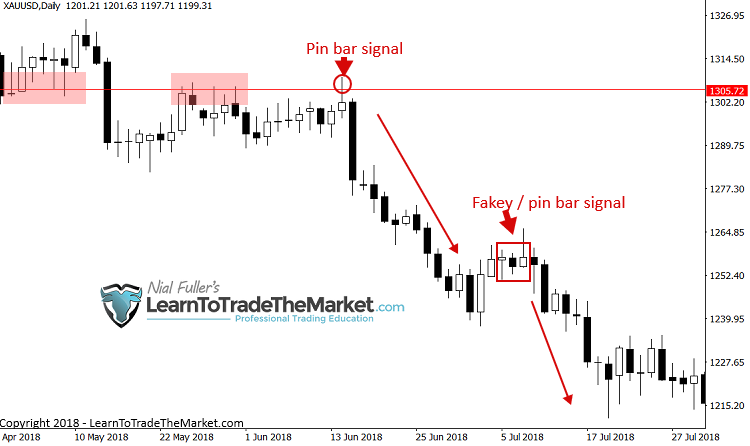

I want Gold over silver. It’s extra liquid and broadly adopted and it strikes higher, and who wouldn’t need to commerce Gold? It tends to swing quite a bit and pattern quite a bit (good issues for worth motion merchants) and the indicators that kind are usually fairly pronounced.

Within the every day Gold chart beneath, discover the good pattern and the clear indicators that shaped inside that pattern. Examine this to the Silver chart beneath it (exhibiting the identical time interval) and you will notice fairly a distinction.

This chart is messy and uneven, therefore it’s a lot tougher to commerce this than the Gold chart above, it doesn’t take a rocket scientist to determine why…

Conclusion

The proprietary worth motion buying and selling technique I work with is relevant to many various international markets, not simply Foreign exchange, as you’ll be able to see by the above examples. Nonetheless, simply because there are actually tons of of various markets you’ll be able to commerce doesn’t imply you need to commerce all of them. I’ve discovered that turning into a specialist on sure markets, you’ll considerably improve your probabilities of long-term buying and selling success. You possibly can commerce each single treasured steel on the market, however why? I commerce Gold, as a result of it’s the most important and the most effective treasured steel market to commerce and it’s worth motion indicators produce essentially the most constant outcomes.

If you would like my weekly and every day evaluation on the above markets, I analyze their worth motion and talk about potential commerce indicators in my members every day commerce setups e-newsletter. Additionally, all my course teachings and techniques can and needs to be used on indices, commodities and Foreign exchange, as mentioned above, and might even be utilized to main equities. As I discussed above, if you study to learn and commerce off the “footprints” left behind by the worth motion on a chart, the alternatives are close to limit-less. Nonetheless, not all alternatives are created equal and that’s the reason you must turn into a specialist!

Be aware – If you wish to commerce the identical markets I’ve mentioned on this article, you’ll be able to entry them by way of the MetaTrader platform I take advantage of right here.

What did you consider this lesson? Please go away your feedback & suggestions beneath!