Two of the first options of any value chart which can be crucial parts for any value motion dealer to totally perceive, are help & resistance ranges and value motion occasion zones.

You might be in all probability extra acquainted with “help and resistance ranges” since they’re one of many extra primary technical evaluation ideas and are fairly straightforward to grasp.

Nonetheless, value motion occasion zones (additionally known as occasion areas) are one thing I got here up with years in the past and they also could also be a bit much less acquainted to you. However, they’re equally as vital as customary help & resistance areas, if no more.

In at the moment’s lesson, I needed to take a while to show you about each of those items of the technical evaluation ‘puzzle’ in addition to help you in differentiating between the 2.

An elephant by no means forgets, neither does the market…

Elephants are mentioned to have among the finest reminiscences within the animal kingdom. The market, additionally has an incredible ‘reminiscence’ in that main turning factors on a value chart are likely to carve out ranges and zones that stay related for months and years into the longer term.

What number of occasions have you ever seen a market flip, nearly on a ‘dime’, and you then zoom the chart out and see that very same degree was additionally a significant turning level a number of years in the past? THESE are the kinds of value motion ‘footprints’ that we NEED to be taught to comply with and make the most of.

While I’ve written an article about occasion areas earlier than, titled The Market By no means Forgets, I need to reiterate precisely what these vital areas on the chart are…

An occasion space (or zone) is a big horizontal space on chart the place an apparent value motion sign fashioned OR from which a large directional (up or down) transfer initiated (resembling a large sideways buying and selling vary breakout, for instance). You’ll be able to and may consider these occasion zones as a “sizzling spots” on the chart; a big / vital space on a chart that we must always proceed watching rigorously as value retraces again to it sooner or later. We’ve an expectation that subsequent time / if value re-visits these occasion zones, the market will AT LEAST pause and ‘assume’ about whether or not or not it is going to reverse course there.

- Occasion zones are key value motion sign areas or main breakout zones from a key degree or consolidation.

- Help & resistance ranges are apparent horizontal ranges which can be drawn on a chart connecting bar highs or lows which can be at or close to the identical value degree. These ranges can stay related on the chart for days, weeks or years, however they’re, general, much less vital than value motion occasion zones. See my tutorial on how to attract help and resistance ranges for extra.

Worth Motion Occasion Areas

As mentioned above, a value motion occasion space will stay related effectively after it types. If a market comes again and re-tests these areas, they supply a “sizzling spot” and a superb opportunity-area to search for a second probability commerce entry. So, don’t fear when you missed the unique transfer from the occasion space, there may be often one other alternative at an occasion zone and the market will likely be there tomorrow, don’t neglect!

Giant and vital occasions / strikes on the worth charts are remembered and different skilled merchants know this. These previous occasion zones usually turn into self-fulfilling turning factors just because so many different merchants count on value to show there and are already ready to purchase or promote at them.

Let’s take a look at some instance charts…

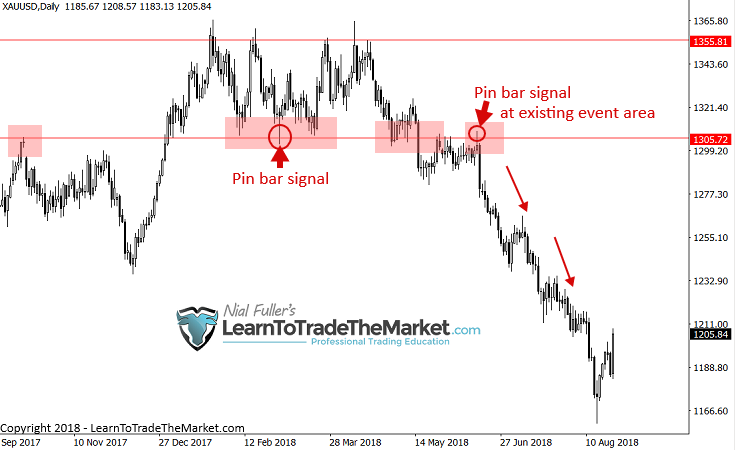

Maybe the best option to perceive a “value motion occasion space” is by a transparent and unmistakable occasion, resembling a pin bar sign. If an apparent value motion sign types and value follows-through in settlement with the sign, making a robust transfer, you now have an occasion space on the degree / space of the sign’s formation.

An vital level to recollect about that is that when you miss the unique occasion transfer, don’t fear! You’ll be able to usually get a second probability entry by merely ready for value to retrace again to that very same occasion space. You don’t even want a value motion affirmation sign on the retrace both, you may enter blindly at an present occasion space. Nonetheless, when you do get one other clear value motion sign on the retrace, as within the instance chart under, it’s even higher!

The occasion space seen under via 1305.00 in Gold, was solidified by each a sign and a breakout. Discover the primary pin bar sign on the chart simply above that degree, then value finally broke down via 1305.00, breaking out, additional hammer-home that this degree was a robust occasion degree.

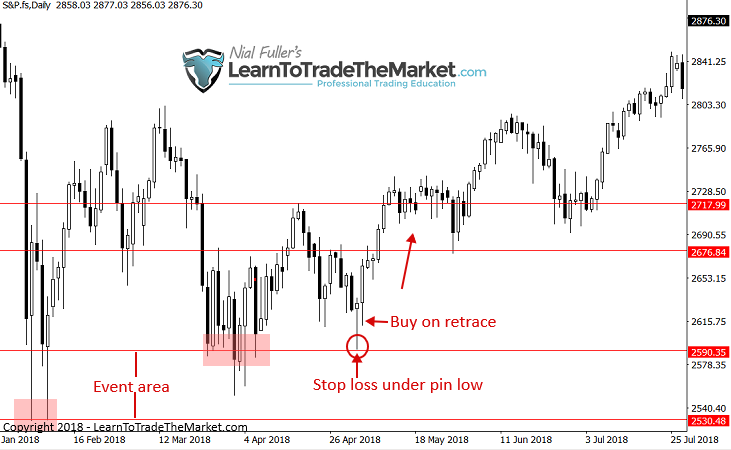

Within the subsequent occasion space instance, we’re wanting on the S&P 500 every day chart. Discover that after a robust down-move, a few long-tailed bullish reversal bars fashioned in early February, resulting in a robust up-move. The event-zone was solid at that time. We now can watch that space as a “hotspot” on the chart to observe when value pulls again to it once more.

Discover the pin bar purchase sign that fashioned after a pull again to that occasion zone. This was a close to picture-perfect purchase sign as a result of we had the confluence of the event-zone in addition to a well-defined sign.

Help & Resistance Ranges

Help and resistance ranges are merely horizontal ranges on the chart that may be drawn throughout bar highs and lows. There may be many help and resistance ranges on a chart, so we primarily take note of the extra vital ones.

I’ve written a number of tutorials on how to attract help and resistance ranges in addition to how professionals draw help and resistance ranges.

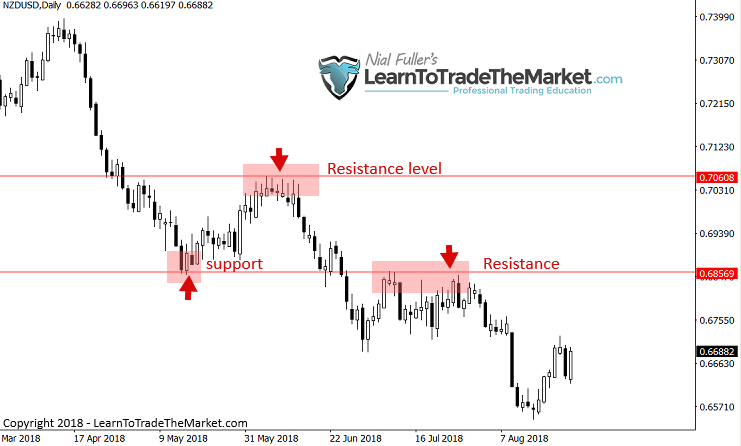

Within the instance under, discover there may be not apparent value motion sign and no robust breakout from consolidation or a degree. These ranges are simply customary help and resistance ranges being drawn in throughout bar highs and lows.

There are often many extra customary help and resistance ranges than occasion zones on a chart, even on a every day chart time-frame / greater time-frame. The principle level to grasp about this truth, is that event-zones are extra vital since they mirror a significant value occasion, whereas help and resistance ranges may be drawn throughout smaller market turning factors which can be usually much less vital. See instance under of normal help and resistance ranges.

What are the primary variations between the 2?

The distinction between an occasion zone and customary help and resistance degree or space can appear fairly refined, however there’s a distinction.

The best option to put it could be, each event-zone can be a help or resistance degree / space, however not each help and resistance degree is an occasion zone.

Right here’s how one can differentiate the 2…

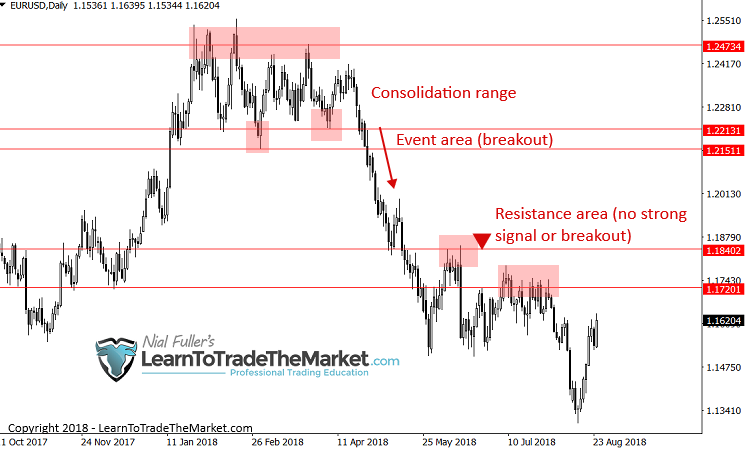

An occasion zone has to both have a value motion sign that led to an enormous transfer OR a significant value breakout from a consolidation space or degree. Let’s take a look at some chart examples to point out this extra clearly:

Beneath, we see a transparent instance of an occasion zone, it was an occasion zone as a result of:

- It was the world on the chart the place a significant breakout occurred. Discover the lengthy consolidation vary earlier than the breakout. Therefore when that breakout lastly occurred, it was a robust value motion “occasion”. This degree on the EURUSD chart will doubtless stay related effectively into the longer term.

Subsequent, we see a transparent instance of help and resistance ranges drawn on a chart. These should not occasion areas as a result of:

- There was no lengthy consolidation previous a breakout.

- There was no robust / vivid value motion sign that kicked off a robust transfer from these ranges.

Occasion zones and help / resistance ranges assist outline commerce danger

One other vital function and advantage of occasion zones and help and resistance ranges is that they assist us outline our danger on a commerce. Extra particularly, they assist us decide the place to position our cease losses and the right way to know when the market has invalidated our commerce concept.

You’ll be able to clearly place a cease loss simply past a help or resistance degree, as a result of if value violates that degree, the considering is that the market is altering and your unique commerce concept is now unlikely to work.

An occasion zone is usually a extra vital help / resistance space so it’s a fair higher barometer of commerce danger than a regular degree. If a market breaks previous an occasion zone, you KNOW your commerce concept will not be working and market sentiment is severely shifting.

You probably have a transparent value motion sign / sample at an occasion zone, you may fine-tune your danger much more, as a result of these alerts are sometimes very-high likelihood and therefore we will place our cease loss on the excessive or low of the sign and infrequently we will then enter on a retrace of the sign, on what I name a commerce entry trick, which permits for big potential danger reward trades:

Conclusion

Turning into a proficient value motion dealer is all about studying to skillfully interpret and correctly make the most of the footprint of cash on the chart, this footprint is left behind as the worth motion performs out over time.

There are numerous ‘instruments’ in a value motion merchants toolbox and the instruments that I train in my skilled buying and selling programs are (clearly) what I really feel are an important ones. Worth motion occasion zones in addition to customary help and resistance ranges are simply as vital as studying particular person value motion alerts and patterns. Occasion zones and help and resistance ranges play the crucial position of serving to you to grasp the general chart context and market dynamics {that a} explicit commerce has fashioned inside. It’s THIS interaction between the precise commerce sign / entry itself and the general market situations it types inside, that constitutes a high-probability buying and selling alternative. Not merely “Oh, there’s a pin bar, I’ll commerce it”.

It will probably take years of display time and expertise to fine-tune your potential to grasp and correctly commerce with all of the completely different items of the worth motion “puzzle”. Nonetheless, studying from tutorials like this one in addition to getting a extra structured value motion buying and selling schooling will go a great distance in decreasing the educational curve and shortening the time required to turn into a grasp value motion dealer.

I REALLY WANT TO HEAR YOUR FEEDBACK IN THE COMMENTS BELOW 🙂