“Let your winners run” they at all times say. Nice! However, HOW do I try this? How do I flip small trades into massive winners? You’ve most likely requested your self this many occasions. As nice as all these outdated buying and selling aphorisms are, they do appear a bit imprecise and don’t actually give us any specifics or particulars on how precisely one accomplishes the fantastic issues they suggest.

Right this moment, we’re going to focus on how one can flip small trades into massive winners, it’s referred to as pyramiding. You’ve most likely heard of pyramiding earlier than, typically it tends to have a adverse connotation to it, however that’s simply because most merchants don’t perceive methods to pyramid correctly.

Not each commerce is a candidate for pyramiding, in truth most aren’t, however the ones which might be could make you some huge cash, rapidly. One pyramid commerce that nets you a ten to 1 winner is likely to be the one profitable commerce you want for 3 or 4 months, that’s why it’s so vital you perceive methods to pyramid correctly…

Pyramiding: Enjoying with the market’s cash

The primary idea to know behind pyramiding, is that it lets you ‘play with the market’s cash’ as a result of as a commerce strikes in your favor you path your cease loss down (or up) to lock in revenue if you add one other place. This mainly means your general danger on the commerce stays the identical or decreases as you lock in revenue, however your potential revenue will increase, assuming you do it correctly (extra on this later).

Nonetheless, it is advisable remember that while the upside profit to pyramiding is giant, the dangers may also be giant in the event you don’t pyramid correctly. If you don’t correctly path your cease to maintain the general danger the identical or much less every time you add a place, you’ll be dangerously cranking up your danger to a degree that would blow out your account. Additionally, because you’ll be trailing your cease loss maybe tighter than you’d on a non-pyramid commerce, because the commerce strikes in your favor it will increase the probabilities of the market snapping again in opposition to you and stopping you out of the whole place.

We solely attempt to pyramid right into a commerce if we’re assured that the market is in a robust ‘a method transfer’ with momentum. It doesn’t need to be a breakout, it simply needs to be a considerable transfer that you simply count on may have sturdy momentum behind it.

Now that we’ve mentioned what it means to ‘play with the markets cash’ and the potential dangers in pyramiding, let’s discuss methods to pyramid correctly, so as to keep away from the key dangers of pyramiding however nonetheless having an opportunity at giant positive factors…

The way to Pyramid right into a place correctly

The fundamental idea of pyramiding right into a place is that you simply add to the place because the market strikes in your favor. Your cease loss strikes up or down (relying on commerce course after all) to lock in revenue as you add heaps / contracts. That is how you retain your general danger at 1R while growing your place dimension on the commerce.

Thus, as you add contracts / heaps, the potential revenue on the commerce will increase exponentially, while preliminary danger (1R) stays fixed. Our hope, as merchants in a pyramided place, is that the market gained’t then snap again and cease us out earlier than it falls or rises additional in our favor.

Give it some thought like this: The market makes an preliminary burst in your favor, maybe to the 1R or 2R reward level, you then add one other place while trailing the unique cease loss on the primary place to interrupt even or to 1R to lock in revenue. You might be nonetheless uncovered to a 1R danger on the second / pyramided place, however you now have double the place dimension as a result of your first lot continues to be reside.

Let’s take a look at an instance of what a correctly pyramided commerce would possibly appear like, this will even offer you a greater thought of the maths behind correct pyramiding:

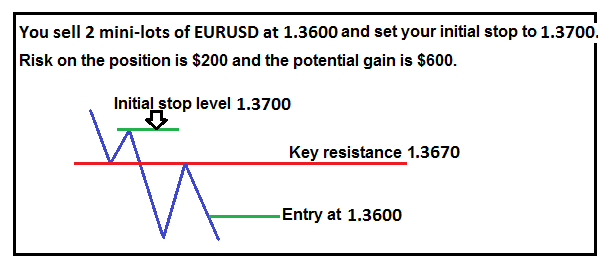

Let’s assume the EURUSD is trending decrease prefer it has been lately. You see a strong pin bar promote sign that fashioned displaying rejection of the 1.3670 resistance degree. You resolve that since value has revered this degree and it’s clearly a key chart degree, it’s place to set your cease loss simply above. So that you resolve to place your cease loss for the commerce at 1.3700, cease loss placement is essential and it’s one thing you shouldn’t take flippantly.

Subsequent, there isn’t a apparent / vital help you can see till about 1.3200, so that you resolve to goal for a bigger revenue on this commerce and see if the development gained’t run in your favor a bit. Your pre-defined danger on the commerce goes to be $200, to maintain the maths easy let’s say you bought 2 mini-lots at 1.3600; 100 pip cease loss x 2 mini-lots (1 mini-lot = $1 per pip) = $200 danger.

You resolve to goal for a danger reward of 1:3 on this commerce, so that you set your preliminary goal at 1.3300 and you intend on including two positions to this commerce, one if you end up up 100 pips and one other if you’re up 200 pips. You intend on doing this as a result of the market is trending strongly and you’ve got a robust intestine feeling that there’s likelihood the development will proceed with out a big pullback.

Here’s what your commerce seems like at entry:

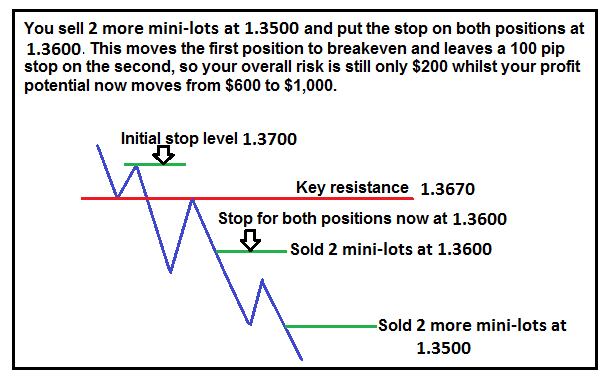

The commerce falls in your favor and so that you proceed as deliberate by including one other 2 mini-lots at 1.3500. So, your full place is now 4 mini-lots or $4 per pip, this implies your potential reward on the commerce is now $1,000 if value hits your goal at 1.3300.

Necessary: Earlier than you enter the second place, you path down your cease loss on the primary one to 1.3600, and that place is now a ‘free commerce’ (at breakeven). The cease loss in your second place can be at 1.3600, thus you’re general danger on each place continues to be simply $200, however bear in mind, you’ve now practically doubled the potential revenue on the commerce…

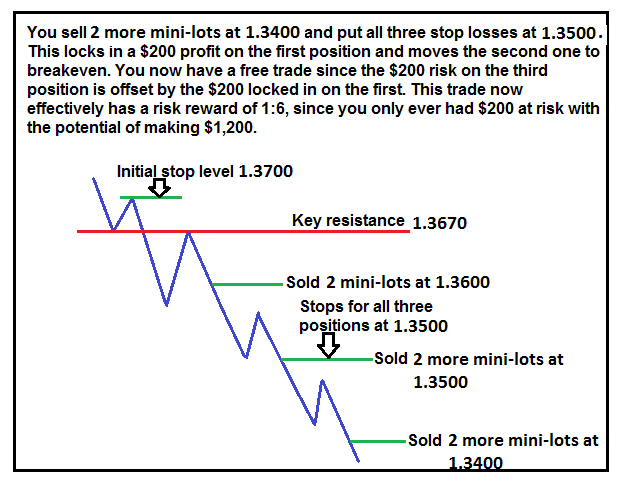

The commerce retains shifting in your favor so that you resolve so as to add your closing place of two extra mini-lots. You now have a $6 per pip general place dimension. You’ve got a possible revenue of $1,200, double what it was if you first entered the commerce, and the most effective half is, your general danger is now at $0…

How’s that attainable you’re asking? You’ve trailed down the cease loss on each earlier positions to 1.3500, locking in a $200 revenue on the primary place you entered at 1.3600 and lowering the danger on the second place to breakeven. The $200 revenue you locked in on the primary place thus offsets the $200 danger you added on the final place, making it a very ‘free’ commerce; that’s the way you ‘play with the market’s cash’…

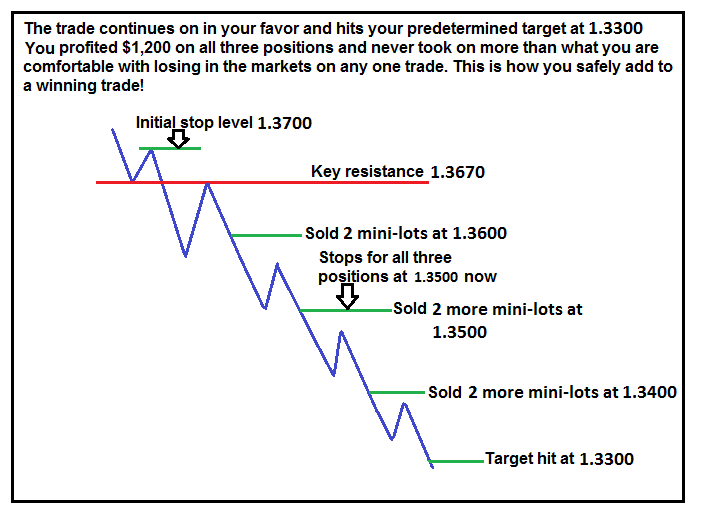

You’ve got but extra luck and the commerce continues falling and hits your goal at 1.3300, all three positions at the moment are closed and also you’ve netted 6 occasions your danger, for a danger : reward of 1:6. You by no means had greater than $200 (1R) in danger at anyone time, but you profited $1,200.

Now you perceive methods to pyramid your approach to earnings…

Last ideas on pyramiding…

Within the instance above, we used a comparatively low danger quantity at $200 per commerce for instance’s sake. However, you possibly can see how rapidly pyramiding can construct your earnings. You’ve got the potential to show $1,000 danger on a commerce into $10,000 in a brief span of time, a ten to 1 winner. These sorts of trades are very attainable in the event you’re buying and selling a clear transfer, that may be a big single-day transfer or a big transfer over the course of every week maybe.

An vital factor to know is that it does take some expertise to know when pyramiding right into a commerce could also be a good suggestion and when it’s not. You additionally should be ready to get stopped out at breakeven, as a result of if you’re trailing your cease loss down like we mentioned above, it doesn’t take a really giant retrace to knock you out of all of your pyramided positions. However, in the event you get only one profitable pyramided commerce each 3 or 4 months, you’ll be doing fairly effectively.

One other vital level is to not let greed take over. It is advisable plan out what number of positions you’ll add earlier than you enter and when you’ll add them, and so forth. Don’t simply completely ‘wing it’, otherwise you’ll find yourself over-trading and probably shedding cash. Every commerce is exclusive and there aren’t any clear and exact guidelines, however the idea of pyramiding and including to winners is common. Simply BE SURE you might be trailing your cease down (or up) to offset the brand new danger you purchase every time you add a place, or else you’ll be doubtlessly pyramiding your losses, and also you don’t wish to try this.

Additionally, by no means add to a shedding commerce, merchants typically make this error and it’s a fast approach to blow out your account. If a market is shifting in your favor you possibly can add to it as mentioned above, however whether it is coming again in opposition to you and strikes again past the entries of your earlier positions, try to be getting out or your cease loss ought to mechanically take you out.

I belief you’ve loved right this moment’s lesson on turning small trades into big trades. To proceed studying my numerous buying and selling methods and philosophies, checkout my buying and selling course and members space for extra info.

Good buying and selling – Nial Fuller