On 8 February 2024, we examined how the alternate charges of the main world currencies had modified in 2023 and mentioned the important thing components that can influence their efficiency in 2024. Moreover, we shared brief and medium-term skilled forecasts for the key forex pairs.

You may go to the RoboForex Market Evaluation webpage for the newest foreign exchange forecasts.

The strongest and weakest currencies in 2023

In 2023, many central banks have been actively combating inflation, leading to comparatively excessive volatility within the forex market. In response to Visible Capitalist, the Mexican peso (MXN) noticed a formidable improve final 12 months, appreciating 14.8% towards the US greenback (USD). This growth occurred amid aggressive rate of interest hikes by Mexico’s central financial institution. When writing, the rate of interest was 11.25%.

The Swiss franc (CHF) additionally demonstrated regular progress of 9.8% resulting from geopolitical turbulence. The British pound (GBP), Canadian greenback (CAD), and euro (EUR) strengthened reasonably inside the vary of 2-5% by year-end as a result of rate of interest hike coverage pursued by the central banks.

The Australian greenback (AUD), New Zealand greenback (NZD), and Indian rupee (INR) ended the 12 months with little to no modifications, declining barely by −0.1%, −0.5%, and −0.5%, respectively. The Chinese language yuan (CNY) slid reasonably by 2.8% in 2023.

The worst-performing currencies of the 12 months have been the Japanese yen (JPY), Russian ruble (RUB), and Turkish lira (TRY), which dropped by 7%, 17.5%, and 36.6%, respectively. The low-rate coverage influenced the yen; the ruble is below strain from the sanctions imposed following the onset of full-fledged battle in Ukraine, and the lira is struggling resulting from home political and financial challenges.

The US Greenback Index (DXY), exhibiting modifications within the US forex worth towards a basket of the world’s main currencies, ended 2023 with a 2.0% decline.

Key components influencing currencies in 2024

Inflation and central financial institution coverage

The vital issue affecting alternate charges over the past two years was a number of central banks’ aggressive rate of interest hike cycles to fight inflation. The US regulator initiated these actions in Q1 2022, with the indicator rising to five.5% in lower than two years.

Many of the world’s developed international locations skilled financial coverage tightening to an analogous extent. The Financial institution of England started to lift the rate of interest on the finish of 2021, a few months earlier than the Federal Reserve, with the speed within the UK reaching 5.25% following 14 consecutive hikes. The European Central Financial institution started to extend the rate of interest in mid-2022, pushing it as much as 4.5%.

The central banks of Australia, Canada, and different international locations adopted swimsuit, whereas the Financial institution of Japan was virtually the one one among the many most distinguished regulators to pursue an adaptive zero-interest price coverage. This strategy dominated the world for the primary two years after the start of the COVID-19 pandemic.

In 2024, currencies might be drastically impacted by a reversal of the above financial coverage developments. Inflation on this planet and particular person international locations has been steadily falling over the past six months, progressively approaching the goal ranges set by the central banks. In response to latest feedback from the Federal Reserve, Financial institution of England, and ECB officers, it may be presumed that charges have in all probability reached their peak values on this cycle.

They’ll seemingly stay on the achieved ranges for some time, doubtlessly lowering progressively later as a part of the financial coverage normalisation cycle, supplied that inflation steadily slows down. Because the Fed has already hinted at this, specialists forecast the primary price minimize as early as March 2024. The rate of interest discount will strain the alternate charges of nationwide currencies.

US elections

Traditionally, the US greenback alternate price tends to rise below Democratic presidents and decline below Republicans. Due to this fact, the forex market turns into particularly risky within the face of uncertainty surrounding upcoming presidential elections within the US, as acknowledged by Enterprise Insider analysts. This occasion will decide not solely the US coverage but in addition the US greenback alternate price towards different currencies.

Donald Trump is anticipated to grow to be the main nominee from the Republican occasion, having gained the primaries within the coming months. He’ll face incumbent Democratic President Joe Biden in a tightly contested election. Their rematch, accompanied by heated rhetoric and the potential for social battle, could have an effect on investor sentiment and forex markets. Trump is dedicated to increased tariffs, which is able to push up inflation and improve the US greenback alternate price, placing the Chinese language yuan, euro, and Mexican peso below strain.

In response to Common Companions, JPMorgan analysts anticipate the 2024 US presidential election to spice up the greenback’s standing, pushed by the prospect of a commerce battle. Financial institution of America means that the election could considerably have an effect on the alternate price of the Japanese forex, as Democratic presidents contribute to the yen’s weakening towards the US greenback, whereas Republican administrations are likely to strengthen it.

Traits within the international financial system

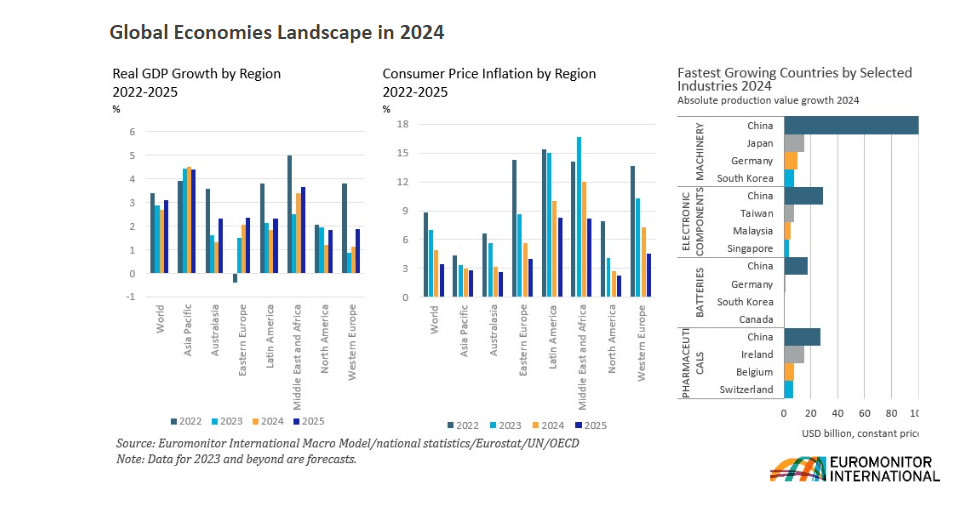

The Worldwide Financial Fund tasks that international financial progress will stay at 3.1% in 2024 and rise to three.2% in 2025. Greater charges and a withdrawal of fiscal help amid excessive debt exert strain on financial exercise.

In most areas, the inflation price is slowing down quicker than anticipated amid unwinding supply-related points and restrictive financial coverage. World inflation is projected to fall to five.8% in 2024 and 4.4% in 2025, with the outlook for the subsequent 12 months being revised downwards.

In response to the Euromonitor Worldwide survey, the worldwide financial system in 2024 will see an additional slowdown in actual GDP progress, with the forecast set at 2.7%. Greater rates of interest and depleting financial savings will result in a slowdown in client spending and decrease enterprise investments.

Geopolitical dangers

- Russian-Ukrainian battle: Army actions proceed to pose a big geopolitical threat in 2024. The complete-scale battle has triggered a humanitarian disaster and elevated dangers in international capital flows, commerce, and commodity markets worldwide. Russia’s invasion of Ukraine has made relations between NATO and Russia extremely unstable. Since neither aspect seems able to reaching a convincing victory shortly, and a ceasefire or battle decision appears unlikely, the anticipated course of occasions will persist. The chance of direct international navy battle between Russia and NATO is at the moment assessed as low, nevertheless it nonetheless exists. If this situation unfolds, the results will likely be dire for the whole world.

- US-China standoff: Regardless of multifaceted relations between these international locations, particularly in commerce, provide chains, and the financial system, latest years have elevated communication complexity. China and the US search to implement insurance policies of accountable competitors, however there is a threat of worsening relations. There are areas of shared pursuits and contradictions between the international locations. China has threatened to promote US treasury bonds, prompting the US to blacklist some Chinese language expertise firms. Considerations are rising in regards to the potential escalation of commerce tensions between the international locations right into a monetary rift. Such a battle may result in extreme disruptions in international monetary markets.

- Center East battle: Occasions on this area are a supply of great uncertainty and create the chance of additional oblique or direct confrontation between international powers. If the battle between Israel and the Gaza Strip escalates right into a full-scale battle, there might be broader intervention by Gulf states, in addition to Iran and the US. Escalating battle with the involvement of latest individuals may set off a humanitarian disaster and immense disruptions to international power costs and provide chains, which, in flip, would influence the whole international financial system and monetary markets.

- Cyber threats: Cyberattacks characterize a geopolitical threat that’s changing into more and more widespread. The digitisation of vital nationwide infrastructure signifies that numerous important constructions, similar to energy grids, water provide, and transportation methods, are more and more weak to potential cyberattacks. Efficiently focusing on any of those methods may have severe penalties, together with lack of human lives and financial injury.

Worldwide cooperation in successfully combating cyberattacks is complicated, particularly contemplating the problematic relations between many international locations. With rising geopolitical tensions between the US, China, and Russia, the chance of large-scale cyberattacks as a software of state confrontation is rising.

Professional forecasts for 2024

EUR/USD

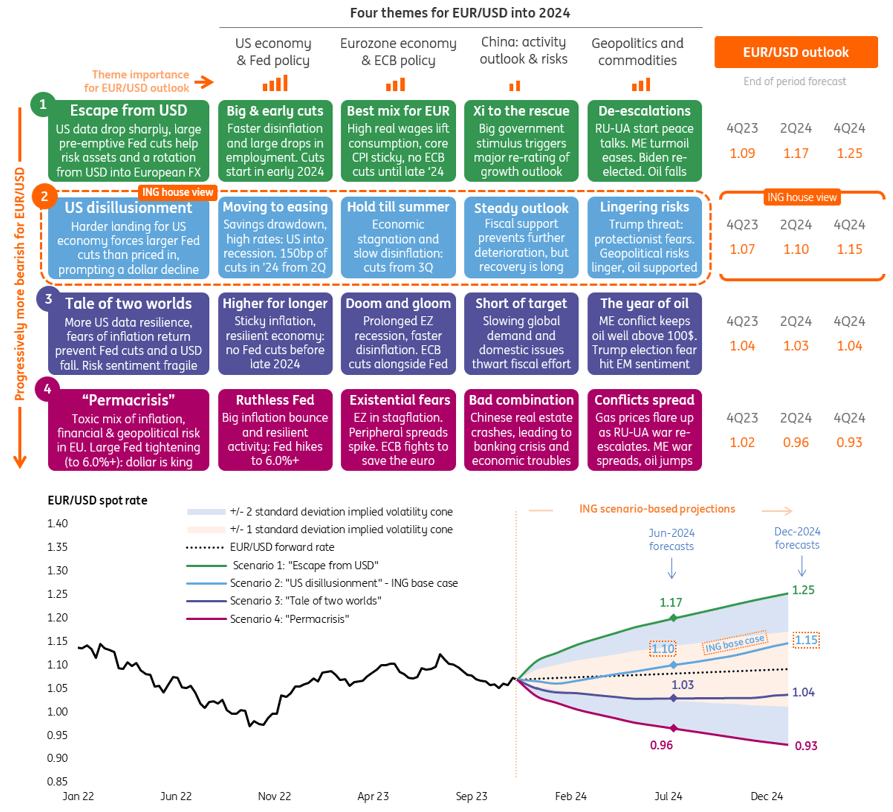

The bottom 2024 forecast from ING Group economists means that the US greenback will comply with a bearish pattern through the 12 months. Specialists anticipate financial progress to be a mere 0.5%, and the Federal Reserve will slash the rate of interest by 150 foundation factors already this 12 months, ranging from the second quarter. The quotes of the EUR/USD pair, which serves as a reference level for the forex market normally, are projected to hover inside a variety of 0.88-1.21. Potential situations of fluctuations within the pair’s alternate price are outlined under:

GBP/USD

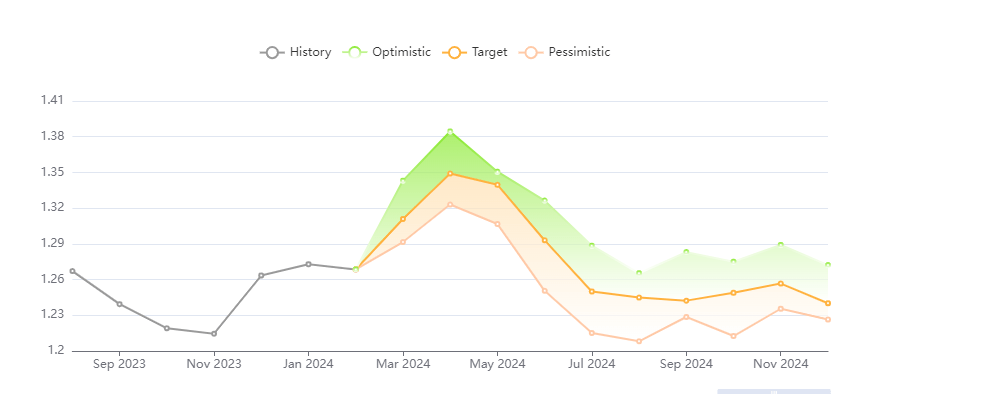

Forecasts for the GBP/USD alternate price fluctuations in 2024 from the Panda Forecast analytical portal embrace three situations: optimistic, pessimistic, and the weighted common goal stage. All three situations are set forth under.

USD/JPY

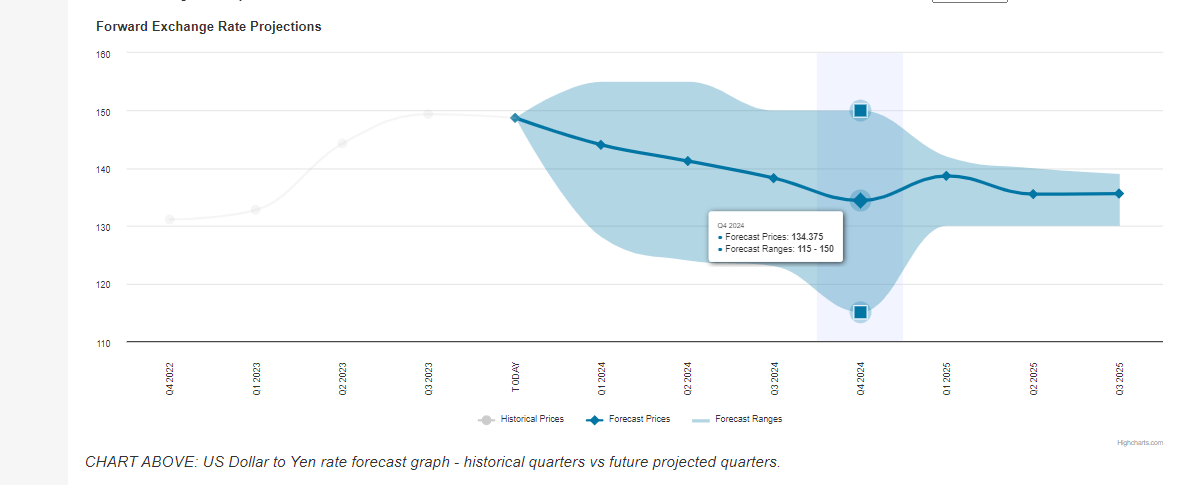

Specialists of the exchangerates.org.uk analytical useful resource anticipate the USD/JPY quotes to stay inside a variety of 115.00-155.00 in 2024. The alternate price is projected to fall to 144.04 by the tip of the primary quarter and 134.37 by the tip of the 12 months.

Conclusion

The US Federal Reserve and different central banks are anticipated to alter their financial insurance policies from tightening to normalisation in 2024. The forex market will likely be considerably affected by components similar to expectations of rate of interest cuts by most distinguished central banks, potential slowdown within the international financial system’s progress charges, US presidential elections, and geopolitical dangers. Specialists forecast that the US regulator would be the first to start slashing the rate of interest, which could place the US greenback below strain towards different main world currencies.