What number of occasions have you ever seen a sign or potential commerce setup available in the market and for no matter motive you didn’t take it, solely to get up the subsequent morning and see the market has taken off with out you on board? This has occurred to all of us in some unspecified time in the future, and I do know it may be very irritating, to say the least. However, what if I informed you that fairly often there are second-chance alternatives to get on board trades you missed?

The concept behind right this moment’s article is to indicate you tips on how to get on board a commerce or transfer available in the market you will have initially missed. Nevertheless, you don’t need to ‘chase’ the market, so it’s important to learn to do that correctly so that you simply nonetheless can get in at an optimum space to get a great threat / reward ratio on the commerce. Listed here are a number of the methods that I make use of to get on board buying and selling alternatives that I could have initially missed…

A commerce is legitimate till it’s not…

It’s vital that we perceive the idea that the value motion alerts we train are literally legitimate till they’re invalidated, or a transfer available in the market is underway till it’s not, which suggests, when the dynamics of the chart change, this may neutralize the earlier sign that had fashioned (the set off). However, till these dynamics change and neutralize a sign or transfer, that sign or transfer remains to be legitimate and trade-able.

What we need to do now, is present you tips on how to get in while the preliminary commerce set off or sign remains to be energetic, as a result of often there’s a second-change to get in. So, subsequent time you see a sign that you simply missed on a chart, don’t panic, come again and re-read this text as your information on tips on how to re-enter that commerce.

How you can discover second-chance buying and selling alternatives:

1. The primary instance I need to talk about is that of a value motion sign that fires off with out you on board. Let’s take a pin bar sign for instance, suppose it begins transferring with out you on board proper after it closes out, you take a look at it and suppose you missed it. There’s a a lot better possibility than leaping in late and chasing the market or not buying and selling in any respect…

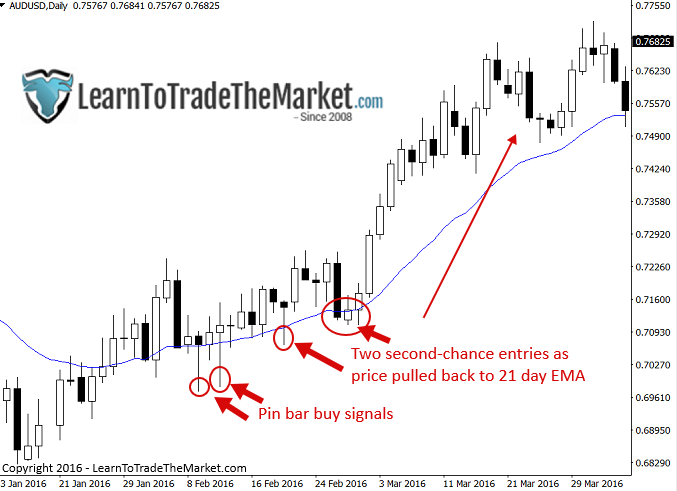

Watch for a pullback. Watch for value to drag again or rotate to a transferring common or horizontal stage of help or resistance available in the market, then look to enter there. So, if we had a bullish pin bar sign for instance, so long as value is above the low of the pin bar, it’s nonetheless legitimate and so any retraces again in direction of that pin bar might be seen as potential entry alternatives. We particularly need to search for pull backs to ranges, comparable to transferring averages or a help stage within the case of a bullish pin bar.

Let’s take a look at an instance…

2. The following instance of getting on board a transfer you will have missed is that of strikes that begin at key help and resistance ranges. If a market has discovered a stage and began to bounce and also you missed the preliminary bounce, don’t freak out, the market will pullback, use that pullback to get in, ideally with a sign however there doesn’t all the time must be a sign, checkout my article on blind entries to be taught extra. A powerful transfer available in the market that began close to a key stage remains to be legitimate till value closes again on the opposite facet of that stage.

Let’s take a look at an instance…

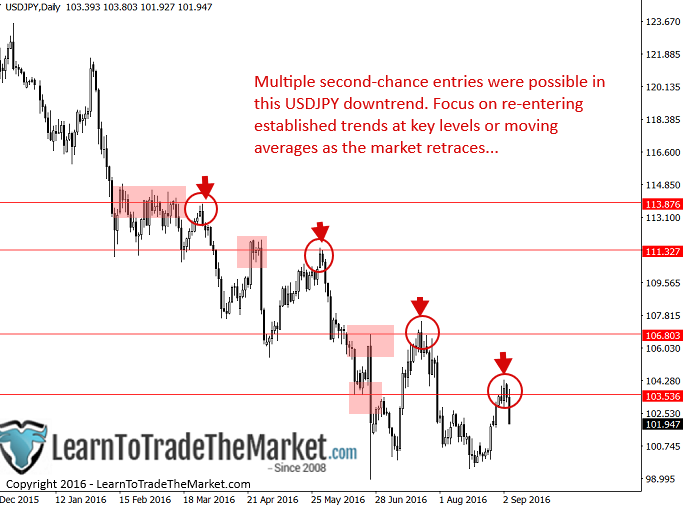

3. The final and maybe not so widespread state of affairs of getting on board a commerce you missed, is that of a runaway development which may have been established weeks and even months previous to you observing the chart.

There’s quite a lot of methods to get in, however the idea is, if it seems to be like a very apparent sustained development that’s rotating again to short-term transferring averages and bouncing each time and (or) the chart has damaged to new highs or lows, the trail of least resistance is clear. You understand the traits I’m speaking about right here, those you take a look at and say “I missed it”, however it simply retains going and going with out you.

Now, the thought to re-enter right here is to attend for a pullback to the transferring averages or a short-term stage (worth areas) and simply hop on the transfer there. You may see a value motion sign on the worth space, you may not, however the concept is to enter at worth.

Let’s take a look at an instance…

One factor you could be considering is, how do I outline my threat reward with these second-chance entry methods? Effectively, it received’t be as simple as in case you entered the commerce from the preliminary entry set off, however a good suggestion can be to seek advice from your present common strikes each day (ATR) and your cease loss needs to be above or under a logical close by stage, transferring common or second sign that fashioned. There’s going to must be a little bit ‘massaging’ concerned, however that’s the worth you pay to get on board a great sign in case you missed it, however it’s higher to be on board than not. The cease loss placement on these second-chance entries could be barely extra arbitrary than the preliminary threat reward on the primary entry, however it’s important to make one of the best with the construction you might have and it is best to be capable to discover one other logical stage or sign to place your cease loss behind. As a kind of fail-safe, seek advice from the common day by day volatility of the market for cease distance.

Conclusion

I hope this lesson has shed some mild on how one can re-join trades and robust strikes available in the market that you will have initially missed. While you miss a great commerce setup, don’t panic and leap proper available in the market at a nasty value. As a substitute, be calm, be affected person and await one of many second-chance entry alternatives I confirmed you above, as a result of most of the time, one will type. Simply keep in mind the methods mentioned above and are available again to this text in case you want a refresher on this subject.

For extra data on my value motion buying and selling methods and buying and selling philosophies, be sure you take a look at my value motion buying and selling course.