How typically do you see large strikes out there like we’ve got seen lately, however you by no means end up profiting a lot from them? How typically do you shut a commerce out prematurely simply because it’s gone in opposition to you a bit and also you ‘freaked out’ since you thought it will lead to a much bigger loss?

Making ‘quick cash’ and constructing a small account into a big one, aren’t issues that simply ‘occur’ to profitable merchants. As any constantly worthwhile dealer will admit, it takes a constant aware effort to hit large winners out there. The inevitable retracements and ‘whip saws’ that hit a market are occasions that shake out most novice and inexperienced merchants. The psychological self-discipline required to easily ‘do nothing’ after you enter a commerce, and as a substitute let the market do the ‘work’, is one thing that not many merchants possess. It’s not acquired in a single day, however it’s one thing that you would be able to develop and develop over time.

Listed below are some recommendations on how one can give your self a greater shot at catching large strikes out there…

The psychology of holding a commerce

A easy reality of buying and selling, is that if you wish to make some huge cash, you’ve bought to have the psychological fortitude to carry trades for longer than you could be comfy with. The irony of buying and selling is that to become profitable ‘quick’ and construct your account up, you’ve bought to have endurance, and to be clear, I’m not speaking about your common daily-life sort of ‘endurance’. What I’m speaking about right here is an iron-clad, bullet-proof, bad-ass sort of endurance that 90 to 95% of the world’s inhabitants merely doesn’t possess.

Take into consideration this for a minute…

Most merchants do very properly on a demo account earlier than they go dwell. Assume again to while you had been on demo, or possibly you’re on demo proper now. I’m prepared to guess you’re holding trades for just a few days or just a few weeks even, and also you’re not interfering with them very a lot. Perhaps you’ve even entered a demo commerce and never checked it for every week since you had been too busy at work, then while you did examine it once more you had been up 20 or 30%, this isn’t unusual.

On a demo account, merchants are typically less-involved with their trades as a result of they merely don’t care that a lot since there’s no actual cash on the road. The tip end result, is that they persist with their unique commerce concept more often than not. That is the principle cause why folks are likely to do very properly on a demo account.

Thus, merchants typically do very properly on demo for the explanations simply mentioned, then they get all psyched as much as begin buying and selling dwell and open a dwell account. Nonetheless, what occurs more often than not, is that merchants change into much more concerned with their dwell buying and selling account, just because there’s now one thing at stake; actual cash. This over-involvement results in the dealer altering their thoughts on trades, leaping out and in of the market with excessive frequency, second-guessing themselves, and a complete host of different buying and selling errors. The tip result’s that they don’t catch any large strikes out there, and they’re going to ultimately most likely lose cash.

The purpose is that this; the psychology of holding a commerce is a really very difficult factor. To succeed on a dwell account, it’s essential to do what you probably did on demo; which is principally simply “much less”. It’s laborious to attain, since actual cash is on the road, however for those who actually need to catch large strikes out there and make large cash, you’re going to have work out a strategy to ‘sit in your fingers’ extra typically when buying and selling a dwell account.

The facility of ‘doing nothing’

Buying and selling could be the world’s most rigorous take a look at of 1’s psychological self-discipline and energy. Within the face of a commerce that’s shifting in opposition to you and in adverse territory, how will you react? Conversely, within the face of a commerce that’s up a pleasant revenue, however has not but hit your goal, how will you react? Probably the most tough factor to do in every of those conditions can also be essentially the most worthwhile factor to do over the long-run; NOTHING.

Closing out a commerce for a small loss, earlier than it hits your cease loss, is an instance of letting worry management you, and doing so straight limits your revenue potential since you’re not giving the commerce correct time to play out and also you’re additionally voluntarily taking a loss.

Closing out a worthwhile commerce too quickly may also be detrimental to your general buying and selling success. In case you have pre-defined your revenue goal or revenue taking / exit technique earlier than getting into the commerce, you’ll solely be doing your self a disservice more often than not by not sticking with that exit technique.

Keep in mind: Something you predefine, earlier than getting into a commerce, goes to be extra logical and goal, and thus worthwhile over the long-run, than any resolution you make while in a dwell commerce, underneath the affect of your hard-earned cash being in danger.

The POWER of merely sitting in your fingers and doing completely nothing while in a dwell commerce, can’t be over-stated. Your true energy and benefit as a retail dealer, lies in your potential to stay affected person and in command of your habits out there.

Examples of the facility of ‘doing nothing’

Within the present market atmosphere, trades are taking longer to unfold and this market is designed to shake you out. There may be numerous volatility throughout the value swings currently.

Let’s check out a few current trades we’ve mentioned in our each day market commentaries to see some examples of how not letting the market shake you out would have netted you some critical beneficial properties…

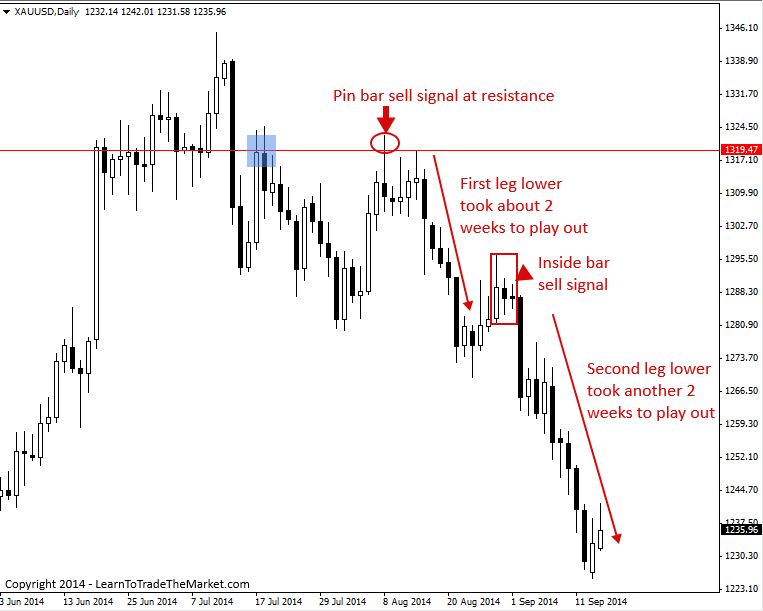

The chart beneath reveals a few current trades within the spot Gold market. The primary, was a pin bar promote sign that we mentioned again in our August 11th commentary. Be aware that the transfer decrease from this pin bar sign took about two full weeks to play out, and the primary week value principally consolidated sideways and drifted larger up the pin bar’s tail. Many merchants probably bought shaken out throughout this time after which sat on the sidelines in frustration as value fell dramatically decrease over the subsequent 5 to 7 days, with out them on board.

The subsequent sign within the Gold chart above was an inside bar promote sign, we first mentioned this sign in our members each day commerce setups commentary. That commerce did come off fairly simply however we will additionally see that had you closed it instantly following the large down transfer on September 2nd, you’d have missed about one other two weeks of draw back motion, which had you simply left the commerce open, would have racked you up some critical income. The 2 trades within the above chart present us a really clear instance of the facility of merely ‘doing nothing’ after you’ve entered a commerce.

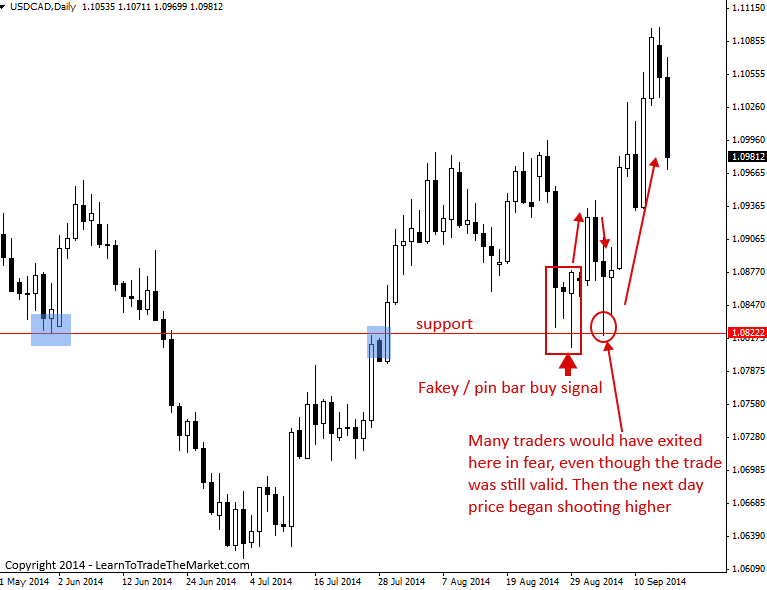

The subsequent instance we’re is a current fakey pin bar combo commerce on the USDCAD each day chart. Be aware, we had a clear fakey / pin bar combo sign from a assist degree, (this was additionally a 50% retrace degree, as we mentioned in our unique commentary on this commerce).

The principle factor to notice right here is that value initially popped larger from this sign, triggering many merchants into the commerce, then over the subsequent two days it started falling once more, most likely bringing anybody lengthy into adverse territory. Nonetheless, most merchants would have had their cease loss close to the low of the fakey / pin bar sign, or simply beneath it, and we will see that value didn’t fairly attain that degree. It might have been very tough to carry that commerce on the time nevertheless, with value retracing again virtually to the cease loss level, and plenty of merchants probably exited prematurely (earlier than their cease loss was truly hit), simply earlier than value rocketed up with out them on board.

It is a clear instance of why ‘set and neglect buying and selling’ is so highly effective and the way merely sticking together with your unique commerce concept and ‘doing nothing’, is the quickest / best strategy to become profitable out there…

Conclusion

In closing, I would like you to do one thing for your self; STOP guaranteeing your losses. In different phrases, give your trades an opportunity to play out in your favor, cease prematurely closing them earlier than your cease loss is hit, simply since you are afraid of absorbing a full loss.

It’s best to all the time predefined what you’re comfy with doubtlessly dropping on a commerce, and simply settle for that as the price of doing enterprise out there. Nonetheless, for those who reduce your commerce earlier than your unique cease loss will get hit, you’re not letting your buying and selling enterprise have the right room it must develop. Sure, chances are you’ll keep away from some full stop-loss size losses by exiting a commerce early, however this is not going to be the case each time, and so the occasions it’s not the case, it means you’re going to be taking a loss whereas additionally eliminating a possible profitable commerce, and that is very harmful and it’s not the way you construct your account or become profitable over the long-run.

One 3R profitable commerce can pay for 3 1R dropping trades. Subsequently, while you reduce a possible profitable commerce out of worry, let’s say that commerce would have been a 3R winner, you might be voluntarily giving up greater than 3R in revenue! (The loss you are taking, assuming it’s rather less than 1R because you exited prematurely earlier than you cease loss was hit in addition to the 3R winner you forfeited).

That is simply not the right strategy to commerce. It’s not the way you catch large strikes out there and therefore, it’s not the way you construct your buying and selling account or change into a professional dealer. Nonetheless, that is how most merchants do in reality commerce, and it’s additionally why about 90% of them don’t become profitable within the long-run.

Listed below are some suggestions that can assist you stick together with your unique name / commerce which can enable you catch greater strikes out there:

- Don’t take a look at low timeframe charts as a result of even small / meaningless each day chart retraces will make you nervous and shake you out for those who’re fixated on them on small time frames.

- Be taught to belief your commerce and belief your intestine. If you happen to don’t be taught belief to your commerce choices and see them via, you’ll by no means make constant cash over the long-run out there.

- Don’t over complicate your buying and selling. Commerce a easy methodology like my value motion buying and selling methodology and keep on with a easy commerce administration plan, which will be so simple as ‘set and neglect’.

- Closing trades early ensures a loss, don’t ever assure your self a loss out there except you actually must! Stick together with your unique name more often than not except the worth motion is clearly altering in opposition to your unique place. About 90% of the time the most effective resolution is to easily let the market do the ‘work’ and let the commerce play out with little to no involvement in your half.

Catching large strikes out there, constructing your buying and selling account from a small one into a giant one and turning into a profitable long-term dealer are all issues that may solely occur in case you are prepared to easily ‘do nothing’ more often than not as your trades play out. So, it’s essential to ask your self, are you able to ‘do nothing’, or are you going to over-complicate your buying and selling, over-involve your self in it and lose time and cash consequently?

Good buying and selling – Nial Fuller