What are skilled merchants doing that you simply’re not? Do they know one thing you don’t? Have they got some ‘inside data’ or some top-secret buying and selling system that you’ve but to find? I wager you’ve requested your self these questions or related ones many occasions, as a result of buying and selling success can look like a little bit of a ‘thriller’, even in case you’ve been buying and selling for years.

The right query to ask is, “How do skilled merchants assume?”, as a result of the first cause any skilled dealer is profitable, is due to how they assume. Conversely, how you consider buying and selling is the explanation it’s possible you’ll not but be a constantly worthwhile dealer.

In right this moment’s lesson, we’re going to go on a journey via a profitable dealer’s thoughts. I’m going to share with you ways we have to assume to achieve the ultra-competitive and very psychological sport we name buying and selling…

Skilled merchants purpose to regulate themselves, not the market

An expert dealer lets the market come to him (or her), he doesn’t chase trades or attempt to power issues. If an excellent commerce kinds that meets his standards, he’ll take it. But when nothing kinds, then he merely doesn’t commerce.

An expert dealer is aware of precisely what he’s in search of available in the market as a result of he has discovered and mastered an efficient buying and selling technique. He’s anticipatory as a substitute of reactive. Which means, he is aware of buying and selling is a sport of anticipation, not response, so he plans trades properly prematurely, has a bias for every market he trades, has key ranges marked after which waits patiently for apparent alerts to kind. That is the way you let the alerts ‘come to you’, as a substitute of making an attempt to power a commerce when there’s nothing there.

Most significantly, skilled merchants perceive that the market is barely going to offer them a specific amount of high-probability alternatives monthly, and so it’s their job to scan the charts every day, as objectively as doable. By turning into a grasp of your buying and selling technique, you’ll have the flexibility to anticipate and plan trades like an expert. I promise you that each skilled dealer on the market already is aware of what she or he is in search of, earlier than they even open their charts every day. Once you method buying and selling from this angle, you might be way more calm and relaxed, since you don’t really feel such as you ‘want’ to commerce. You’re already considering that IF an apparent sign kinds, I’ll commerce it, however IF no apparent alerts kind, then I’ll come again to the charts tomorrow and examine once more.

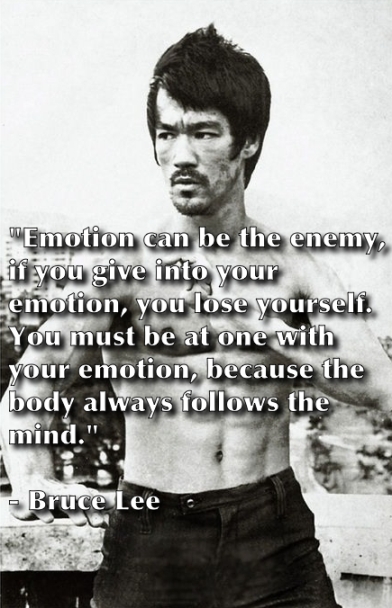

Skilled merchants know feelings are the enemy of success

Skilled merchants perceive that turning into overly-emotional about their trades is a fast recipe for catastrophe. It’s human nature to expertise dramatic swings in emotional ache and pleasure when our hard-earned cash is on the road. So, the skilled dealer is aware of he has to make an effort to curb the results of emotion, in any other case he’ll lose some huge cash.

Skilled merchants perceive that turning into overly-emotional about their trades is a fast recipe for catastrophe. It’s human nature to expertise dramatic swings in emotional ache and pleasure when our hard-earned cash is on the road. So, the skilled dealer is aware of he has to make an effort to curb the results of emotion, in any other case he’ll lose some huge cash.

The best weapon for preserving your feelings at bay is solely understanding your threat tolerance, and by no means exceeding it. It’s important to place every commerce understanding that you can lose, and it’s a must to use this information to regulate your threat to a greenback quantity you understand you’re emotionally OK with doubtlessly dropping. Solely YOU can decide how a lot cash you’re snug with doubtlessly dropping per commerce, so you must determine what this quantity is, and follow it. You shouldn’t really feel lots of emotion whether or not you win or lose on a commerce, and the one technique to actually ensure you don’t, is by managing your per-trade threat correctly.

An expert dealer acts with confidence and conviction, they don’t second-guess their buying and selling choices as a result of as we mentioned above; they already know what they’re in search of, so in the event that they take a commerce, it’s one thing they’ve anticipated and deliberate. Professional merchants perceive that their buying and selling edge takes a collection of trades to play out, and any collection of trades will comprise a random distribution of winners and losers. However, in an effort to see the profitability of their buying and selling edge, they need to STICK TO IT and let it work for them. Due to this fact, an expert dealer thinks about buying and selling success not solely by way of how a lot cash they’re making, but in addition by way of whether or not or not he’s executing his plan and sticking to his buying and selling edge with self-discipline.

Skilled merchants don’t sabotage their very own buying and selling edge

A considerably peculiar attribute of struggling / failing merchants, is that their conduct available in the market displays an underlying perception that they know ‘for certain’ what the market goes to do subsequent. That is the one logical technique to clarify why so many struggling merchants are over-involved of their trades by shifting round stops and targets, including to and lowering positions, and so on.

The FACT of the matter is, nobody is aware of ‘for certain’ what the market goes to do subsequent. We will make educated guesses and ‘intestine’ really feel calls based mostly on expertise, however we by no means know ‘for certain’ what is going to occur subsequent. A skilled dealer is aware of this, and so they recurrently give it some thought, whereas an beginner or struggling dealer, thinks a lot much less, if all of it about it.

Skilled merchants let their trades play out with little to no interference. They know that the market goes to do its ‘factor’; swing round, chop round, surge increased / decrease and so on. On the finish of the day, the professional dealer understands that the commerce both works out or it doesn’t, and most often they gained’t contact the open commerce as expertise and display screen time present that it doesn’t enhance the result.

After all, there are some events for one cause or one other, a dealer might exit a commerce early, however in all probability greater than 70% of the time, {most professional} merchants undertake a ‘set and overlook’ commerce mentality and simply enable the market to do the ‘work’ and let the commerce run its course. It is a mindset, it’s not ‘mechanical’, you simply want to know that in case you let open trades play along with your thoughts and feelings and exit earlier than stops or targets are hit, it’s going to have a detrimental influence in your long-term revenue / loss in addition to your total buying and selling confidence.

I do know you in all probability already can relate to the sensation of interfering with a commerce and making a loss the place there in any other case would have been a winner. There’s NOTHING worse than this sense. Skilled merchants know this, and they also hardly ever fiddle with their trades. They know that they’re extra goal, rational and logical whereas they have been planning the commerce / earlier than they entered, in order that they belief their judgment in that way of thinking reasonably than when the commerce is dwell. They let the market do the ‘work’.

Your buying and selling mindset determines your buying and selling habits

How you consider buying and selling finally develops into your buying and selling habits, or the way you commerce. For those who assume you’ll be able to ‘keep away from’ losses, you’re going to develop a behavior of not buying and selling with a cease loss, shifting cease losses additional away, including to dropping trades and so on. For those who assume the market is a few ATM machine, there on your each want and need, you’re going to over-trade and over-leverage your account and shortly blow it out.

How you consider buying and selling finally develops into your buying and selling habits, or the way you commerce. For those who assume you’ll be able to ‘keep away from’ losses, you’re going to develop a behavior of not buying and selling with a cease loss, shifting cease losses additional away, including to dropping trades and so on. For those who assume the market is a few ATM machine, there on your each want and need, you’re going to over-trade and over-leverage your account and shortly blow it out.

An expert dealer has respect for the market. They know they don’t know every thing and so they assume much more about threat than they do about reward. They consider buying and selling by way of anticipating apparent setups and planning what they’ll do earlier than they do it, so there aren’t any surprises. Considering like this influences correct buying and selling habits which finally results in worthwhile buying and selling choices.

Skilled merchants are affected person individuals who anticipate trades and plan prematurely, they imagine of their edge and execute their trades with confidence and ice chilly blood of their veins. They handle cash and don’t grow to be hooked up to the cash or anyone commerce. Display screen time, expertise and the college of onerous knocks (actual world expertise available in the market) will enhance your efficiency over time, however provided that you develop the considering patterns outlined above on this lesson, I ought to know, I’ve 12 years of buying and selling expertise and over 15,000 college students. If you wish to be taught extra about skilled buying and selling methods and the way an expert dealer thinks and trades the market, checkout my Worth Motion Buying and selling Course for extra data.