How do you intend your trades? What’s your every day routine for analyzing the market, establishing and executing your trades? What do you do after that? How do you handle your trades as soon as they’re stay? What’s your plan?

I assumed you desire to a fast overview of how I plan my trades and what my every day buying and selling routine sometimes appears to be like like.

While it has been a few years since I used to be a starting dealer, I keep in mind very clearly the way it felt. You’ll be able to simply really feel overwhelmed and confused, even misplaced. At present’s lesson will hopefully offer you some steering by serving to you to see what I do when I’m planning a commerce. You’ll most likely notice that you’ve got been making it far tougher than it truly must be…

Right here’s how I plan my trades…

Shortly after waking up and ingesting a giant glass of water, I’ll sometimes examine and reply emails from my college students and I may even have a fast take a look at what occurred in a single day in a number of the main markets I observe. Since I sometimes get up proper round when the USA session is closing, it’s a excellent time for me to have a look at the every day charts and the finish of day worth information to see if any good worth motion trades are establishing. I’ll make a psychological be aware of any apparent trades that I see or any potential trades I see right now.

Now, whether or not a commerce is establishing or not, I’ll shut up my laptop computer and go eat breakfast and possibly make a visit to the espresso store and get a espresso with my spouse.

After that, I sometimes may have one other temporary take a look at the charts, relying on if I noticed a commerce establishing from after I seemed on the charts across the USA / New York shut. If I did see one thing establishing at the moment, I’ll positively take a look on the charts after my breakfast and low, that is when I’ve a better to look to see if I wish to take the commerce, or not. If I didn’t see something establishing then I’m most likely not even trying on the markets proper now, as a substitute, I’m doing one thing else; household stuff, and so forth. Backside line is, I don’t sit round making an attempt to ‘discover’ trades that aren’t there. If one thing doesn’t come out to me immediately after I take a look at the charts within the morning, I don’t pay a lot consideration to the markets for one more 8 to 12 hours.

What I’ve simply described to you is what I’d take into account an finish of day buying and selling method, and it it’s how I like to recommend you commerce. We’re centered on the end-of-day information, and never on all of the little hiccups that happen on the intraday charts. Now, I’m not saying it is best to by no means take a look at intraday charts, as a result of as it’s possible you’ll know, I do just like the 4-hour chart and I even educate the 1-hour chart in my buying and selling course.

Nevertheless, what I am saying is that it is best to solely take a look at these intraday charts I mentioned above when you’re analyzing the every day charts at your often scheduled morning and night market evaluation occasions. Principally, I like to recommend you spend not more than 20 to half-hour two occasions a day, about 8 to 12 hours aside, trying on the charts / markets. The aim right here is 2 issues:

- If no trades are coming out at you within the morning, which means there may be nothing apparent establishing, there may be most likely nothing price risking your cash on.

- The longer you sit there trying on the charts, and the extra occasions you do it all through the day or evening, the extra possible you’re to enter a silly commerce and provides in to the temptation to over-trade. That is the way you lose cash. Get used to not being in a commerce, embrace it, take pleasure in it, as a result of that is the way you protect your buying and selling capital which suggests it will likely be there when a superb commerce does come alongside, which in flip, means you’ll have more cash to commerce a bigger place measurement if you would like.

The evaluation and commerce setup…

OK, let’s assume that I DID certainly see a commerce setup that I favored early within the morning after I first checked the charts that day. IF that’s the case, here’s what I do subsequent:

I’d then carry out a extra in-depth evaluation on the chart to see if the setup I noticed earlier that day is price taking or not.

I’m searching for issues like: Pattern – What’s the every day chart development of this market, if any? Key chart ranges – Are there any key chart ranges close by? Is the sign I like in-line with the every day chart development and / or at a key chart degree?

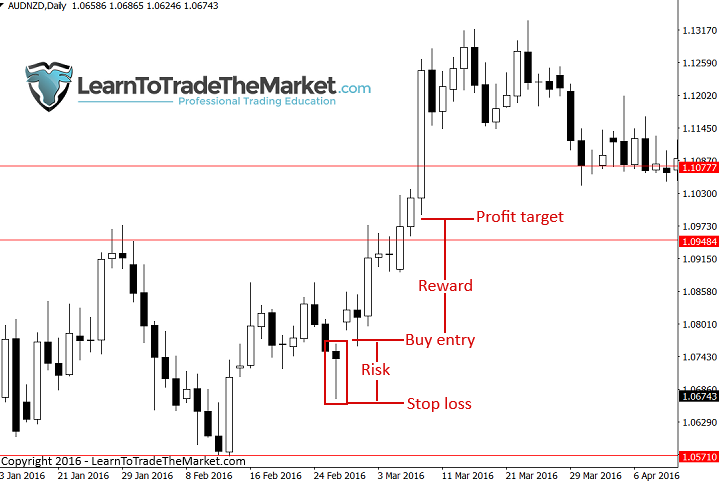

What’s the practical potential danger / reward on this commerce? Can I get a 1:2 danger reward or higher earlier than the following key horizontal degree comes into play?

Keep in mind, as I’ve mentioned in this text, I wish to see at the least 2 out of three of the T.L.S. (Pattern, Degree, Sign) components lining up to ensure that me see the commerce as price taking.

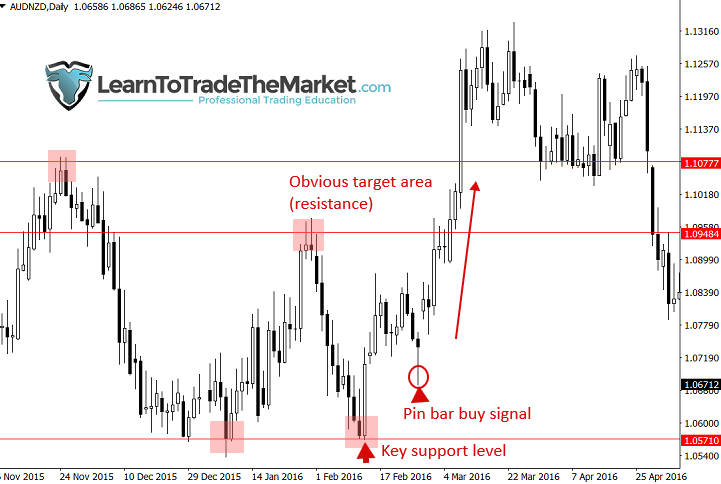

Have a look at the chart beneath, the pin bar purchase sign was a superb commerce to take as a result of it was an apparent sign (well-defined and protruding from close by worth motion), it additionally had the near-term / latest upward momentum behind it and loads of room to run to the upside earlier than the following key degree got here into play.

Subsequent, I’ll determine how I wish to enter the commerce: at market, cease or restrict entry. I may even determine on cease loss placement in addition to goal placement / exit plan.

After the commerce is setup, I cannot sit there watching it, please don’t do that. Depart it alone and go do one thing else. I’ll sometimes examine the commerce earlier than going to mattress, however not on a regular basis. It simply relies on how busy I’m that night. The purpose is, I don’t freak-out worrying about my trades. I’ve performed the planning beforehand and I’m at all times OK with the quantity I’ve risked, so I’ve no downside ready 24 hours to examine on it once more. Settle for the loss beforehand after which something aside from that may be a nice shock. No matter you do, don’t anticipate that you’ll win on any given commerce. As Mark Douglas says, anticipating to win on a commerce is a recipe for emotional buying and selling to start.

Conclusion

This text was a quick overview of how I plan my trades and it might enable you develop the premise of your individual buying and selling plan and buying and selling method. Nevertheless, be mindful, the purpose I’m making an attempt to convey is that my buying and selling routine and plan is absolutely extra about my mindset and total method to commerce administration, than a particular plan that I learn on a regular basis. It’s good to start out out with a buying and selling plan when you’re new and studying to commerce, however ultimately, that plan will simply change into like a behavior and you’ll develop your intestine really feel from it. A buying and selling plan is critical for coaching and to be sure to are staying on observe, each dealer ought to study to construct one and use it till they actually know what they’re doing. I give an in depth instance on how you can construct your individual buying and selling plan in addition to a buying and selling plan template in my superior worth motion buying and selling course.