A dealer might do properly for a 12 months, the technique rocks, then they undergo a interval the place they aren’t as worthwhile. They’re utilizing the very same technique but it surely falls to items the subsequent 12 months, why? This text will assist you keep away from this entice by explaining why it’s essential monitor volatility and use altering volatility to regulate the chance / reward on trades by enhancing your cease distance and revenue goal.

This text is designed to place the thought in your head that as volatility adjustments available in the market, the way in which you take a look at stops and revenue targets ought to change in accordance with it.

Volatility phases

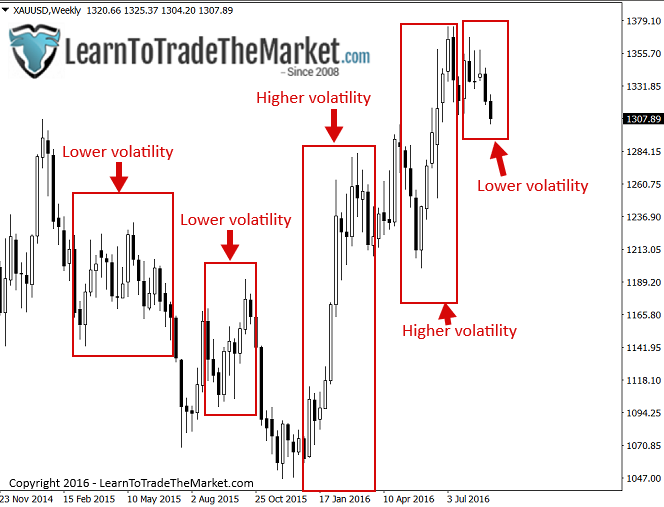

Markets undergo totally different volatility phases and also you want to pay attention to that. What this mainly means is {that a} market might at the moment be going by way of a interval of excessive volatility the place it’s shifting rather a lot every day or week, however that gained’t final perpetually and ultimately it’ll calm again down and the each day and weekly ranges will grow to be smaller. If you don’t regulate your danger reward profiles accordingly, you’ll expertise some issues…

In the event you’ve been doing properly for some time however now your targets cease getting hit, perhaps you simply aren’t adjusting them for altering volatility?

As a market’s volatility or each day value swings change, so ought to your cease losses and targets. Low volatility can look like the market’s hardly shifting in any respect, however in actuality the one factor that’s altering is the volatility, so your cease loss and your revenue targets want to alter accordingly. Within the case of decrease volatility, your stops and targets would must be nearer than they’re throughout increased volatility.

If, for instance, you usually commerce with a 40-dollar goal and 20-dollar cease after which your targets cease getting hit and also you’re dropping greater than you need to have been dropping relative to the chance reward, you didn’t regulate your cash administration because the volatility shifted. As volatility adjustments, so to does the potential danger reward on any given commerce.

In the event you didn’t adapt and also you misplaced 20$ at your cease when you need to have been dropping $15, you’ll be indignant. Equally, in case you don’t regulate your revenue targets for altering volatility you could miss your goal the place it may have gotten hit in case you had a more in-depth goal.

Volatility adjustments because the market strikes a unique quantity on a month-to-month foundation and quarter-to -quarter foundation. Take a look at a 12 months in the past vs. now, get a really feel for a way the volatility compares now to then. Cash administration must be primarily based round present dynamics and will evolve as these dynamics change. Don’t be buying and selling the identical manner you have been 3 years in the past if volatility is now half what it was then.

For instance, if the common weekly and each day value vary adjustments by 50%, then it ought to go with out saying your cease losses and targets want to alter by about 50% too.

Take a look at the chart under, you’ll discover the market shifting from intervals of excessive volatility / huge each day strikes, to a lot decrease volatility / smaller each day strikes. So, once you see these adjustments in volatility happen, it’s essential regulate your cash administration method accordingly.

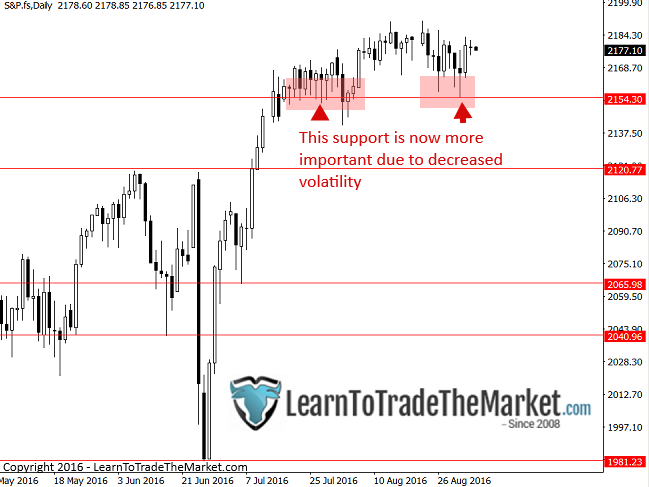

As volatility adjustments, so do horizontal ranges

When you’ve got learn my articles on how to attract assist and resistance ranges or tips on how to place stops and targets like a professional dealer, you already are conscious of the significance of assist and resistance ranges in cease loss and goal placement. Nonetheless, what I didn’t get into in these classes is that as market volatility adjustments, so will close by assist and resistance ranges.

You may be questioning concerning the ATR or common true vary, and the place that comes into play right here. Effectively, the ATR is an efficient instrument to make use of to measure the present / current market volatility, however we’re nonetheless going to be utilizing assist and resistance ranges as vital boundaries to take a look at when putting our stops and targets. You don’t need to simply place your cease loss primarily based on the ATR, as a result of horizontal ranges are all the time the most effective locations to take a look at when deciding the place to position cease losses.

In the event you discover a market’s volatility has elevated or decreased by rather a lot lately, it’s essential additionally take a look at the place the newest assist and resistance ranges are once you go to enter a commerce. If a market has lately had an enormous uptick in volatility, you’ll have to take a look at ranges additional away from present costs, to position your stops. Equally, if a market has lately had an enormous drop in volatility, you need to be trying nearer to current costs to position your cease losses. Additionally, bear in mind, as your cease loss adjustments so should your place sizing on a commerce, if you wish to preserve the identical per-trade greenback danger quantity you usually use.

Conclusion

We can not simply soar into the market and completely disregard the truth that it’s a always altering, dynamic entity. Market volatility is one thing we should concentrate on as merchants. We have to make a behavior out of observing market volatility each time we analyze the market and ensure we regulate our cease losses and targets in addition to place sizes, in accordance with these altering market dynamics.

Studying to acknowledge and analyze altering market dynamics is a operate of understanding value motion and studying tips on how to commerce from value. That is what I’m right here for; that will help you study value motion buying and selling and that will help you make sense of the always altering dynamics available in the market. When you totally perceive tips on how to learn value motion, recognizing altering market volatility shall be no downside for you, it’ll come naturally. To study extra, take a look at my value motion buying and selling course and members’ neighborhood.