On 17 January 2024, we appeared on the prevailing gold (XAU/USD) market developments, exploring historic developments and the important thing components influencing the worth of the dear steel. We performed a technical evaluation of the worth chart and uncovered skilled opinions on the gold value outlook for 2024.

You may go to the RoboForex Market Evaluation webpage for the most recent Gold (XAU/USD) forecasts.

Historic evaluation of XAU/USD costs

Allow us to check out the gold value efficiency over the past 140 years:

- Since 1887, in the course of the gold customary interval, the US authorities fastened the gold value at 20.67 USD per troy ounce. After abandoning the gold customary and devaluing the greenback in 1933, the price of an oz elevated to 35 USD and remained at this degree till 1967

- Later within the Nineteen Seventies, gold costs elevated considerably attributable to worldwide financial and geopolitical instability. From 1971 to 1980, quotes skyrocketed by over 1600%, from 35 to 800 USD per ounce

- Within the Eighties-Nineties, gold costs corrected downwards as the worldwide and US economies skilled a interval of relative stability, with declining oil costs

- Within the 2000s, the worth degree remained comparatively steady till the 2008 monetary disaster, when quotes soared once more from 800 to over 1,900 USD per ounce in 2011. The surge in costs and the tip of the disaster have been adopted by a powerful downward correction in the direction of 1,100 USD

- From 2012 to 2020, the worldwide financial system and inventory markets confirmed regular development, with gold buying and selling inside a sideways value vary from 1,100 to 1,400 USD per ounce

- In 2020, pushed by the COVID-19 disaster, gold quotes resumed their upward motion, surpassing 2,000 USD per ounce

- In December 2023, amid rising inflation and geopolitical turbulence, the gold ounce set an all-time value document of two,150 USD

Regardless of the excessive rates of interest of the central banks, many traders favor to speculate their funds in gold. This steel is a safe-haven asset amid rising inflation and the present financial and geopolitical instability.

Key components influencing XAU/USD

- Financial indicators. This contains inflation, rates of interest, unemployment, GDP, and different financial information. For instance, a excessive inflation price and financial instability might increase the demand for gold as a retailer of worth

- Geopolitics. Buyers historically think about gold a safe-haven asset in opposition to dangers and uncertainty throughout wars, conflicts, sanctions, political and geopolitical instability, and tensions. Demand for gold sometimes will increase throughout such intervals

- New monetary expertise. For instance, the event of the cryptocurrency market might negatively have an effect on the demand for the dear steel. Buyers may put money into digital belongings as an alternative of gold, lured by the potential for top returns

- US greenback alternate price. As international gold costs are set within the USD, the US foreign money alternate price fluctuations may affect the worth of the dear steel. Gold costs typically fall when the US greenback strengthens because it turns into dearer for patrons. Conversely, with a weak USD, gold costs could also be on the rise

- Provide and demand. The valuable steel’s value might enhance, propelled by sturdy demand, for instance, from central banks, traders, and jewelry corporations, or lowered provide induced, as an example, by mining restrictions or a scarcity of latest deposits

2023 XAU/USD value market outlook

2023 noticed a long-term development development in gold costs, with a mean value of 1,950 USD per ounce. Beginning the yr on the 1,823 USD mark, quotes traded inside a value vary of 1,805 USD-2,150 USD all through 2023. A brand new all-time excessive of two,150 USD per ounce was reached in December 2023.

Geopolitical tensions, navy conflicts, financial turbulence, and a world inflation surge drove gold quotes’ development in 2023. The speed hike coverage pursued by the Federal Reserve and different central banks and the strengthening US greenback acted as headwinds. The value decreased after reaching an all-time excessive, exhibiting indicators of a downward correction.

2023 XAU/USD value market outlook*

Technical evaluation of XAU/USD developments

Allow us to study a weekly chart to analyse the present development and the mid-term outlook for the worth of the dear steel. On the time of writing, XAU/USD quotes hovered close to 2,020 USD per ounce.

Since April 2020, they’ve been transferring inside a broad sideways vary, with the decrease boundary at 1,611 USD-1,615 USD and the higher one at 2,070 USD-2,078 USD. The value broke above the vary’s higher boundary in December 2023 however pulled again, failing to realize a foothold above 2,078 USD. Consequently, a ‘false breakout’ technical construction has shaped on the chart.

Though gold has been experiencing a gentle uptrend confirmed by the Alligator and 200-day SMA indicators, there’s a excessive probability {that a} downward correction might develop within the medium time period. This may be supported by a closing value drop beneath the psychological threshold of two,000 USD.

A decline goal could also be a significant assist space of 1,805 USD-1,810 USD. If the quotes break above 2,078 USD once more and set up themselves there, a corrective state of affairs will seemingly be cancelled. Subsequently, the uptrend will most likely be anticipated to proceed, with the worth hitting an all-time excessive of two,150 USD.

Technical Evaluation of XAU/USD Traits*

Knowledgeable XAU/USD value predictions for 2024 and past

- UBS World forecasts that gold costs will rise to 2,250 USD per ounce by the tip of 2024

- Based on Saxo Financial institution’s specialists, the dear steel quotes will attain the two,300 USD mark in 2024

- J.P. Morgan expects gold costs to face at 2,175 USD by mid-2024 amid potential price cuts by the Federal Reserve

- Based on Pockets Investor, the quotes will hover at 2,058 USD by the tip of 2024, rising to 2,104 USD by December 2025

- The Financial system Forecast Company (EFA) analysts recommend that the dear steel value will climb to 2,158 USD by the tip of 2024 and proper to 2,019 USD in December 2025

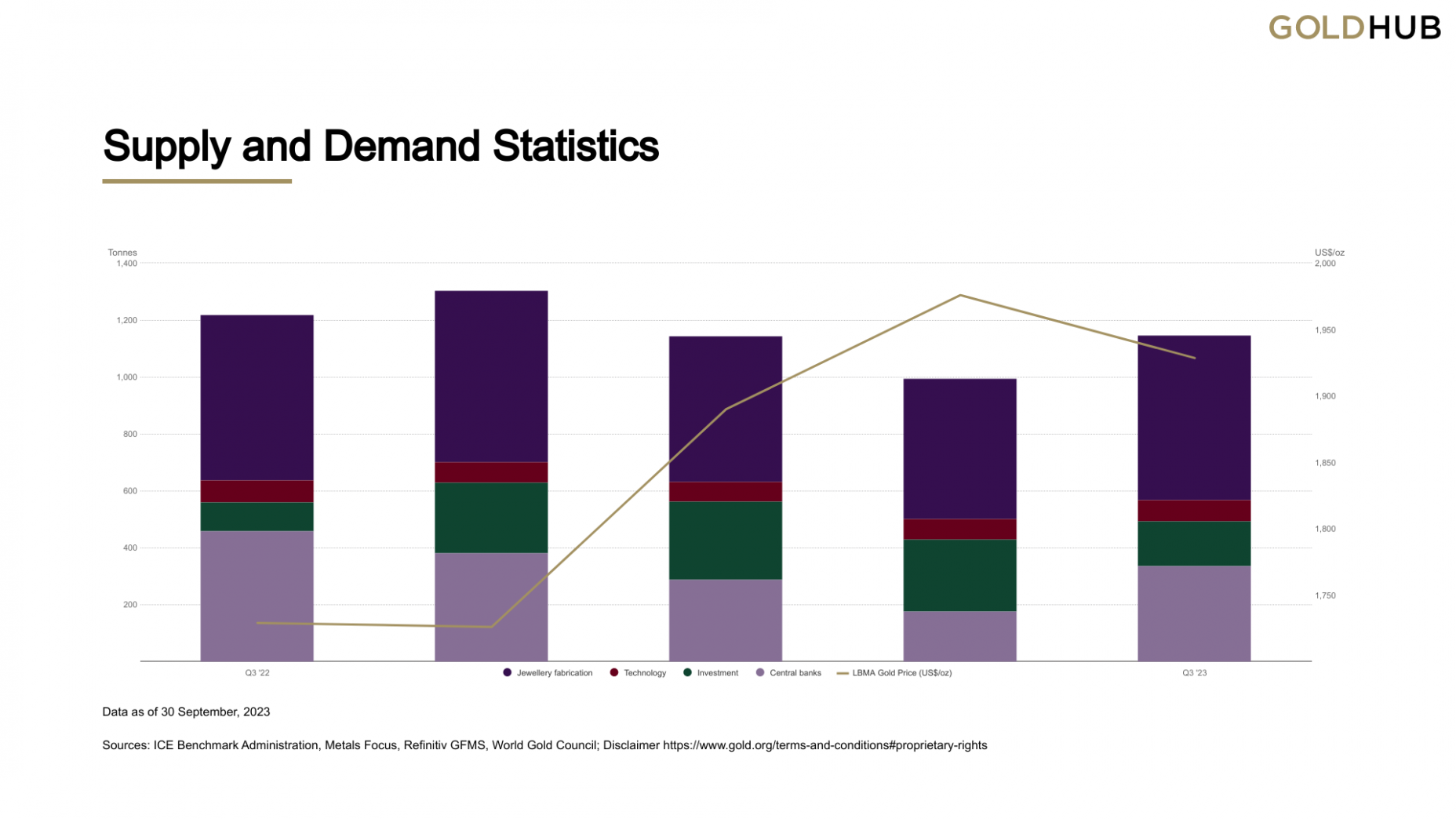

World demand and provide dynamics for gold in 2023

Based on the Q3 2023 survey by the World Gold Council (WGC), international gold demand and provide confirmed the next efficiency:

- Demand was 8% greater than a five-year common, reaching 1,147 tonnes. Complete demand, together with OTC provides, was up 6% from 2022 at 1,267 tonnes

- Central financial institution shopping for was 337 tonnes, falling in need of the document 459 tonnes in Q3 2022. Nonetheless, because the starting of 2023, demand from central banks is 14% greater than in the identical interval of 2022, coming in at a document 800 tonnes

- Bar and coin investments decreased by 14% in comparison with the Q3 2022 outcomes, all the way down to 296 tonnes, though remaining firmly above the quarterly common of 267 tonnes. A decline from 2022 is attributed to a droop in European gross sales

- Jewelry purchases have been down 2% y/y to 516 tonnes amid rising gold costs. Jewelry fabrication sank by 1% to 578 tonnes attributable to a rise in inventories

- Mine manufacturing reached a document 971 tonnes in Q3, marking a 6% enhance from the corresponding interval in 2022. Recycling was additionally greater than in 2022, up 8% to 289 tonnes

Methods for buying and selling XAU/USD

Varied monetary devices similar to futures, choices, ETFs, CFD contracts, and spot can be utilized for buying and selling gold.

Lengthy-term buying and selling – investing

The underlying precept of this technique is to purchase an instrument firstly of a brand new development wave attributable to basic components, anticipating it to achieve peaks once more or set new highs. This technique is comparatively easy however requires persistence to await the projected earnings.

Particular ETFs are sometimes used for investments. Gold ETFs have been created to allow investments in gold with out having to purchase, preserve, and handle the dear steel itself. As a substitute, traders should buy and promote shares of a gold ETF on a inventory alternate, just like inventory buying and selling. One of many largest ETFs like that is SPDR Gold Shares (GLD), with belongings underneath its administration amounting to 58.27 billion USD in January 2024.

Quick and medium-term buying and selling

This buying and selling sometimes includes leverage. Quick-term buying and selling methods intention to maintain a place from one to a number of days, whereas medium-term ones preserve it from a number of days to at least one or two months. Buying and selling sorts similar to swing buying and selling, day buying and selling, and scalping can be utilized for gold buying and selling.

Aside from basic components, the decision-making is predicated on a technical evaluation. Help/resistance ranges and features, value patterns, candlestick combos, value motion patterns, and indicator alerts – all these and different instruments assist discover promising buying and selling alternatives.

The principle precept of such buying and selling is to enter a place utilizing leverage (for instance, based mostly on a technical evaluation sample that has shaped), having small targets and controlling dangers.

Abstract

Gold stays a pretty funding instrument as it’s believed to be a dependable retailer of worth over the long run. In 2023, the worth reached an all-time excessive of two,150 USD per ounce, pushed by rising inflation, geopolitical tensions, and the tip of the Federal Reserve’s financial tightening cycle.

Whereas the dear steel chart exhibits indicators of a downward correction firstly of 2024, the long-term uptrend persists. Consultants anticipate gold quotes to proceed their upward trajectory in 2024 amid potential price cuts by the Federal Reserve, geopolitical tensions, and persisting sturdy demand from central banks. The forecasts vary from 2,058 to 2,300 USD per ounce.

FAQ

XAU is the foreign money code used to indicate one troy ounce of gold within the international monetary markets. This code is derived from the periodic desk of parts, the place ‘Au’ is the image for gold. The ‘X’ in entrance signifies that gold shouldn’t be a nationwide foreign money however a commodity. This coding system is standardised by the Worldwide Group for Standardization (ISO) for treasured metals.

Varied components, together with international financial stability, inflation charges, US greenback energy, rate of interest choices by main central banks just like the Federal Reserve, geopolitical tensions, and demand for gold in jewelry and expertise, affect the worth of XAU/USD. Moreover, market sentiment and funding developments can play important roles within the fluctuation of gold costs.

Consultants recommend that XAU/USD costs in 2024 shall be within the vary of two,058 USD-2,300 USD per troy ounce.

Deciding to put money into gold is dependent upon your particular person monetary objectives, danger tolerance, and funding portfolio. Gold is commonly thought-about a ‘safe-haven’ asset that may diversify your portfolio and hedge in opposition to inflation and foreign money devaluation. Nevertheless, like several funding, it carries dangers, and its value will be unstable. It’s advisable to seek the advice of with a monetary advisor to find out if investing in gold aligns together with your general funding technique.

A number of strategies for investing in gold embrace bodily gold, mutual funds, ETFs, futures, CFDs, and extra. For extra detailed info, please confer with our submit “Learn how to Spend money on Gold“.

* – The TradingView platform provides the charts on this article, providing a flexible set of instruments for analyzing monetary markets. Serving as a cutting-edge on-line market information charting service, TradingView permits customers to have interaction in technical evaluation, discover monetary information, and join with different merchants and traders. Moreover, it gives precious steerage on easy methods to learn foreign exchange financial calendar successfully and affords insights into different monetary belongings.