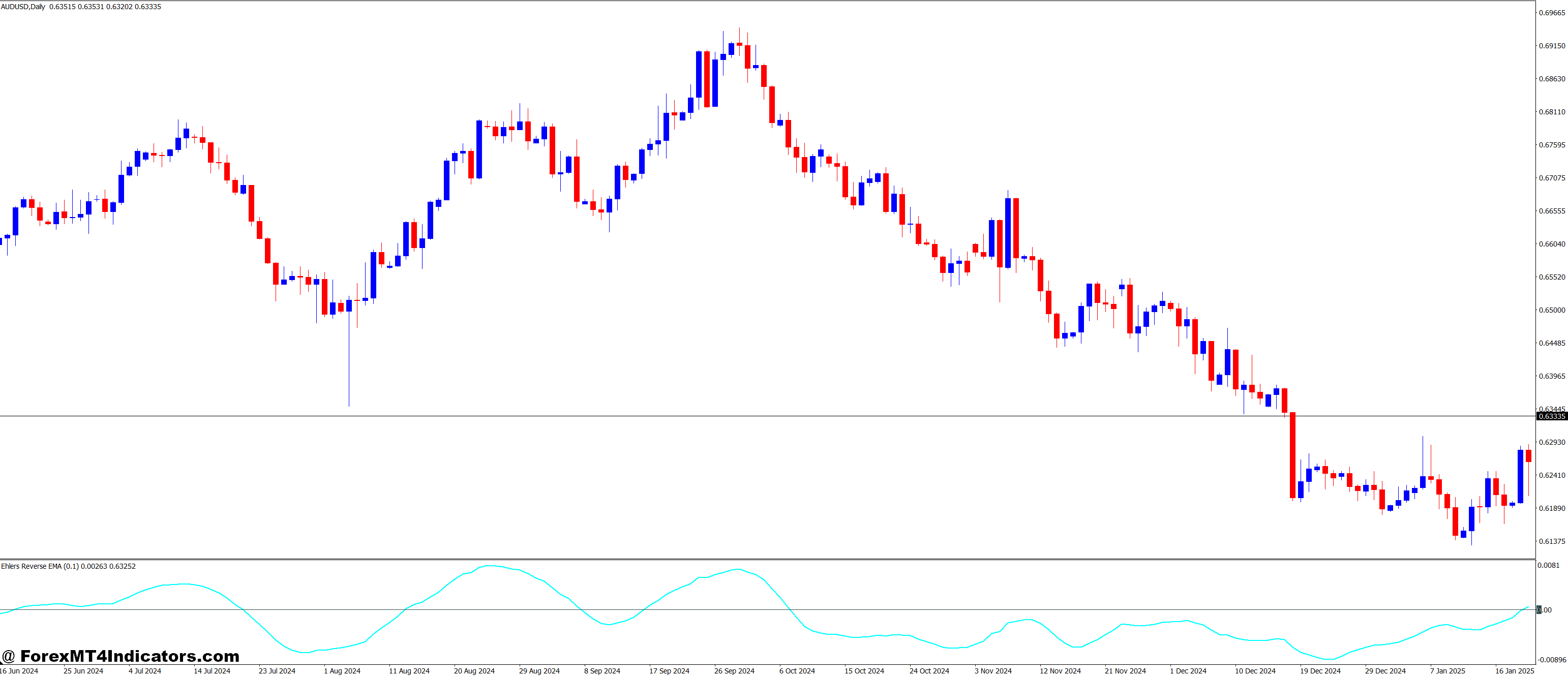

The Ehlers Reverse EMA MT4 Indicator is rapidly turning into a favourite amongst merchants looking for a extra correct, dependable strategy to observe market tendencies and predict value actions. Within the fast-paced world of foreign exchange and inventory buying and selling, counting on conventional indicators usually results in confusion and missed alternatives. This may be particularly irritating for merchants attempting to make sense of market noise and erratic value swings. The Ehlers Reverse EMA Indicator, nonetheless, addresses these challenges with its superior methodology, serving to merchants make smarter selections with confidence.

What Is the Ehlers Reverse EMA MT4 Indicator?

The Ehlers Reverse EMA MT4 Indicator is a complicated technical evaluation software that mixes John Ehlers’ progressive strategy to smoothing knowledge with a reversal technique. This indicator is designed to be used with the MetaTrader 4 (MT4) buying and selling platform, one of the crucial broadly used platforms by foreign exchange merchants. Whereas conventional exponential shifting averages (EMA) assist to clean out value knowledge and establish tendencies, the Reverse EMA provides a singular twist by specializing in potential development reversals. This makes it extremely efficient in recognizing early market adjustments earlier than they change into apparent to the typical dealer.

The Ehlers Reverse EMA MT4 Indicator works by adjusting to the worth motion with extra sensitivity in comparison with customary EMAs. By doing this, it helps merchants catch momentum shifts extra rapidly, providing higher timing for coming into and exiting trades. The distinctive “reverse” mechanism permits it to filter out market noise, making certain merchants get clear indicators with out being misled by short-term value fluctuations. This provides merchants a definite benefit when attempting to navigate risky market situations.

How Does It Work and What Makes It Totally different?

At its core, the Ehlers Reverse EMA MT4 Indicator is an enhanced model of the usual EMA. Whereas conventional EMAs clean out value actions over a set interval, the Reverse EMA applies a special algorithm that adjusts extra quickly to sudden value adjustments. This permits it to detect reversals and development shifts a lot sooner than conventional shifting averages. The Reverse EMA’s algorithm relies on Ehlers’ personal analysis into market dynamics, which emphasizes lowering lag whereas bettering accuracy.

What makes the Reverse EMA totally different from customary indicators is its means to react to cost motion in real-time. Merchants usually face the problem of coming into trades too late, particularly when tendencies change rapidly. The Ehlers Reverse EMA solves this downside by offering extra responsive indicators, permitting merchants to behave earlier than the market has absolutely shifted. It is a perfect software for day merchants and swing merchants alike, providing a stability of sensitivity and precision.

Why Ought to Merchants Use the Ehlers Reverse EMA MT4 Indicator?

Many merchants battle with customary shifting averages, which will be gradual to react to sudden value actions. This delay could cause merchants to overlook worthwhile alternatives or enter trades too late. The Ehlers Reverse EMA MT4 Indicator solves this downside by providing sooner responses to cost adjustments, giving merchants a extra correct view of market situations. By specializing in development reversals, it helps merchants establish potential adjustments in momentum earlier than they change into obvious to others.

One other benefit of the Ehlers Reverse EMA MT4 Indicator is its means to adapt to totally different market environments. Whether or not the market is trending or ranging, this indicator performs properly in each conditions, offering useful insights regardless of the situations. Merchants can use it to verify tendencies, spot reversals, and even filter out false indicators. This adaptability makes it a flexible software that may complement all kinds of buying and selling methods, from trend-following to range-trading methods.

The right way to Commerce with Ehlers Reverse EMA MT4 Indicator

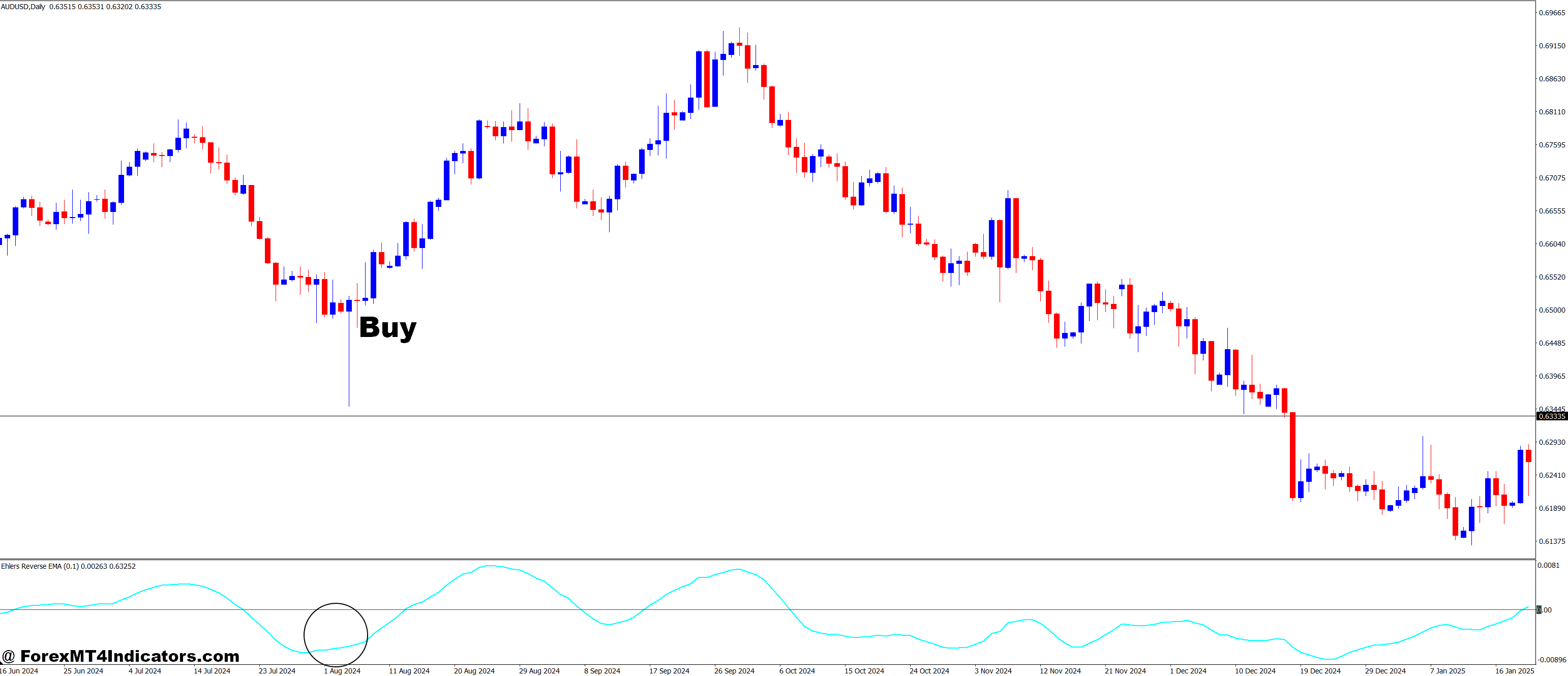

Purchase Entry

- Reverse EMA crosses above the worth: A purchase sign happens when the Ehlers Reverse EMA line crosses above the worth, indicating an upward development is beginning.

- Reverse EMA is shifting up: The indicator needs to be exhibiting an upward slope, confirming that the market momentum is shifting positively.

- Value is above the Reverse EMA line: A robust purchase sign is generated when the worth stays above the Reverse EMA line, indicating robust bullish stress.

- Affirm with development indicators: For added confidence, search for affirmation from different trend-following indicators like shifting averages or RSI (Relative Power Index), exhibiting an general uptrend.

- Keep away from overbought situations: Be sure that the market isn’t in an overbought state (e.g., RSI above 70), as this may occasionally counsel a reversal is close to.

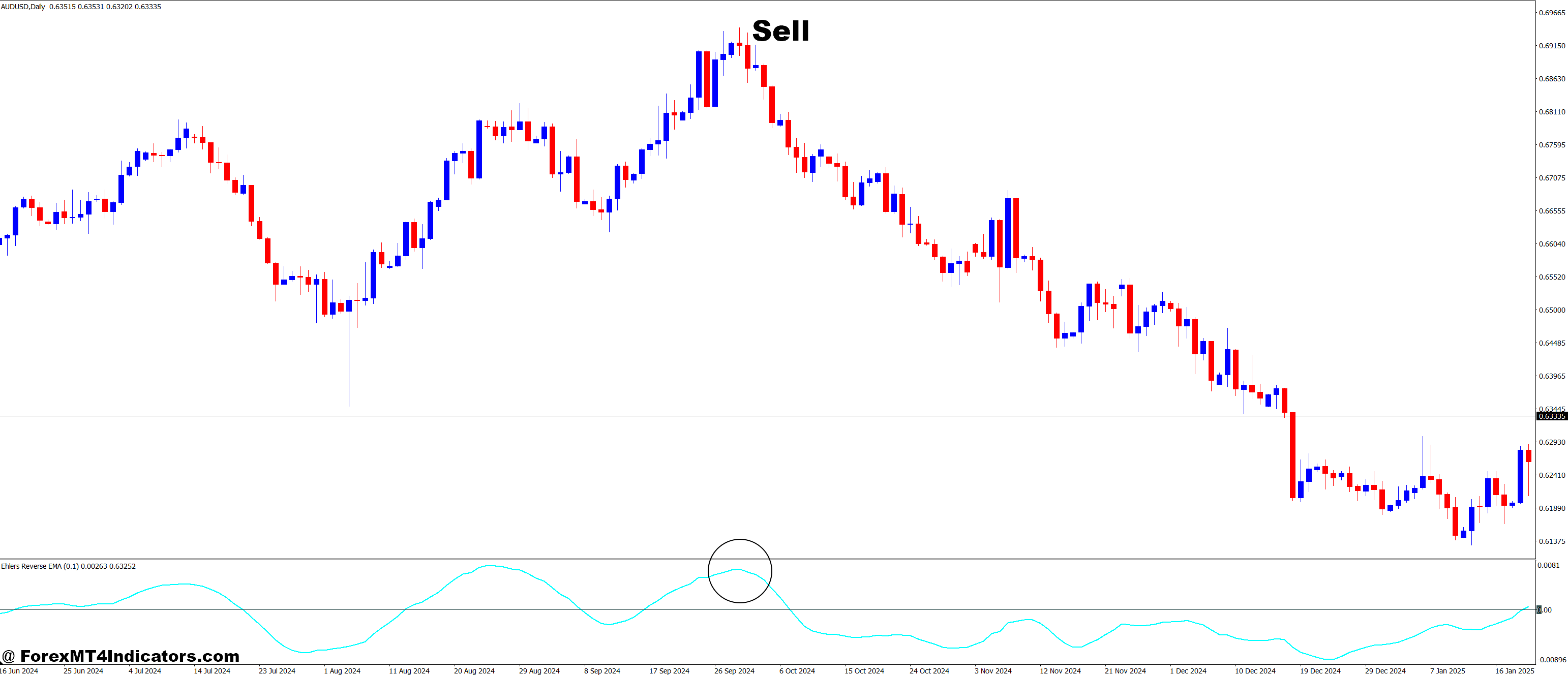

Promote Entry

- Reverse EMA crosses beneath the worth: A promote sign happens when the Ehlers Reverse EMA line crosses beneath the worth, signaling the potential begin of a downward development.

- Reverse EMA is shifting down: The indicator ought to present a downward slope, indicating that market momentum is popping bearish.

- Value is beneath the Reverse EMA line: A robust promote sign happens when the worth is constantly beneath the Reverse EMA line, confirming that bearish sentiment is prevailing.

- Affirm with development indicators: For extra affirmation, examine for bearish indicators from different indicators, such because the MACD (Shifting Common Convergence Divergence) or stochastic, which can counsel additional draw back potential.

- Keep away from oversold situations: Be sure that the market shouldn’t be in an oversold situation (e.g., RSI beneath 30), as this might point out the beginning of a value reversal to the upside.

Conclusion

For merchants seeking to improve their buying and selling methods and enhance market timing, the Ehlers Reverse EMA MT4 Indicator presents a strong answer. Its means to establish development reversals early and filter out market noise makes it a extremely efficient software for staying forward of the market. By offering extra responsive and correct indicators, the Reverse EMA helps merchants make smarter, extra assured selections. Whether or not you’re a seasoned dealer or simply beginning out, incorporating this superior indicator into your toolkit can provide the edge wanted to navigate the complexities of the foreign exchange and inventory markets.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐