I do know precisely what you’re going by means of as a dealer, as a result of I used to be precisely such as you and I’ve acquired hundreds of members such as you. You see a very good commerce setup however for some motive you don’t take it though your ‘intestine’ is telling you to, then you definitely sit there watching because it strikes aggressively in your favor with out you on board.

Convincing your self out of completely good commerce setups and wishing you had been in trades you didn’t take, are two issues that may actually make you are feeling like you’re going insane. The hindsight ‘syndrome’ is a big downside for a lot of merchants; worrying about what “may have been” will maintain you caught on the buying and selling mistake prepare and may really behave like a illness in your thoughts.

As we speak, I’m going that will help you perceive why you’re making these buying and selling errors and make it easier to conquer them as soon as and for all…

The hindsight ‘syndrome’

I do know precisely what you undergo frequently as you commerce, I’ve been buying and selling personally for about 14 years and have mentored hundreds of merchants in my time. I do know that some days you spend half the day simply wishing you didn’t miss that good commerce. Sadly, we don’t have time machines that we will use to return and keep in that good commerce that we bailed on method too early or leap on that setup that was ‘excellent’ however for some motive we nonetheless didn’t take.

The hindsight ‘syndrome’ is a big downside for a lot of merchants and it might actually destroy your buying and selling mindset, buying and selling account and your life when you let it. The “hindsight syndrome” is principally only a way of thinking whereby you might be nearly consistently feeling remorse and frustration over lacking good buying and selling alternatives as a result of you don’t but belief your individual buying and selling talents sufficient.

Two issues have a tendency occur when you may have this hindsight ‘syndrome’: One, you sit there and want you had adopted your intestine and traded a very good sign you noticed and also you simply can’t consider you didn’t take the commerce. Or two, you had been about to enter a commerce however determined towards it on the final minute since you ‘noticed one thing’ that modified your thoughts (you satisfied your self out of it). You didn’t belief your intestine and then you definitely regretted it. Nothing is worse in buying and selling and in life than seeing one thing play out in your favor with out you onboard since you didn’t belief your intestine feeling about it.

You NEED to eradicate the hindsight syndrome if you wish to be a persistently profitable dealer. Not having confidence in your buying and selling capacity may cause over-analysis and second-guessing, this will flip right into a kind of dependancy that causes you to consistently look backward and fret over what you probably did improper, as an alternative of wanting ahead and being optimistic.

Profitable merchants have shedding trades too, however they don’t get consumed with remorse or fear about what “may have been”, as a result of so long as they’re trusting their intestine and sticking to their buying and selling plan, they know they don’t have anything to get upset about. Within the long-run, their buying and selling capacity and extra importantly, their confidence on this capacity, brings them strong earnings.

Cease making an attempt to ‘verify’ good trades

I do know I’m in all probability going to get some unfavorable suggestions for this because it’s considerably ‘controversial’ within the fashionable buying and selling world, however then once more when you’ve been following my weblog for a while you in all probability already know I’m no stranger to controversy within the buying and selling trade and doing issues towards the ‘established order’…

I do know I’m in all probability going to get some unfavorable suggestions for this because it’s considerably ‘controversial’ within the fashionable buying and selling world, however then once more when you’ve been following my weblog for a while you in all probability already know I’m no stranger to controversy within the buying and selling trade and doing issues towards the ‘established order’…

A HUGE mistake that you simply’re in all probability making frequently is one thing you in all probability by no means even thought-about to be a ‘mistake’ earlier than: ‘confirming’ your trades.

Fairly merely, if you must try to verify an apparent commerce setup, it’s in all probability not value taking. Learn that final sentence about 10 occasions earlier than you go on.

The most important method you persuade your self out of completely good commerce setups is by making an attempt to ‘verify’ their legitimacy by taking a look at different variables. So, I’ve acquired a quite simple resolution for you immediately; if you wish to eradicate A LOT of frustration, second-guessing, doubt, worry and even anger, then merely STOP making an attempt to ‘verify’ your trades. You aren’t ‘confirming’ them, belief me, all you’re actually doing is convincing your self out of them and setting your self as much as really feel all of the unfavorable feelings and emotions I simply talked about.

I’m speaking about principally all the things right here. From financial information reviews to CNBC to decrease timeframe charts, different foreign money pairs / markets, common information, and so on., you can see a close to infinite quantity of issues to contradict a superbly good commerce setup when you actually attempt to. You’ll at all times discover a motive to not commerce when you attempt to, don’t be a type of folks that’s at all times searching for proof to not again your intestine really feel and authentic judgment and so on.

At a sure level, you’ll want to simply ignore all exterior variables and actually get ‘intimate’ together with your buying and selling technique and keep on with it, when you don’t do that you simply’ll by no means know when you’ve actually acquired what it takes to commerce efficiently or not, since you’ll consistently be in a state of doubt, confusion and frustration because of taking a look at too many variables exterior of your buying and selling methodology.

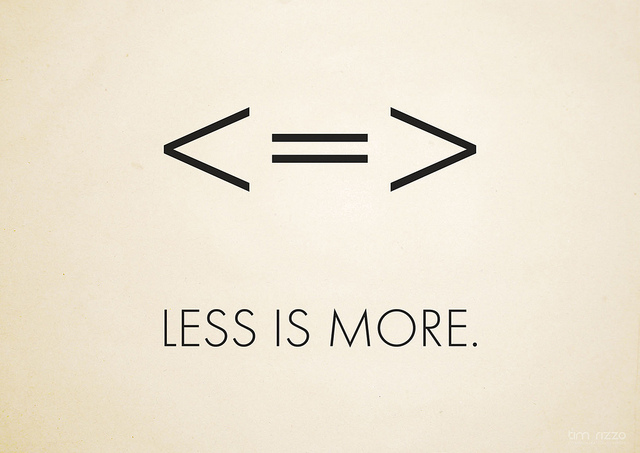

In all probability probably the most prevalent causes of ‘convincing’ your self out of a very good commerce is taking a look at a decrease timeframe or one other market to try to ‘verify’ a sign you’re occupied with taking. In the event you see a very good setup in a market, commerce the market and the setup independently of different variables, don’t persuade your self out of a very good commerce by analyzing different variables, it simply is senseless! Now, that is assuming the setup you’re contemplating is a GOOD one, which is determined by your buying and selling ability and talent to seek out high-probability commerce setups. However, when you have a very good setup in your radar, it simply is senseless to seek out causes to not commerce it. Grasp an efficient buying and selling technique like worth motion, construct a strong buying and selling plan round it, then scan the market every day for trades, and STOP over-complicating it!

Much less work and stress, extra revenue potential

Lastly, the most important level to remove from immediately’s lesson is that you’re losing your time, cash and psychological sanity by making an attempt to ‘verify’ commerce setups and likewise by worrying about what “may have been”.

Lastly, the most important level to remove from immediately’s lesson is that you’re losing your time, cash and psychological sanity by making an attempt to ‘verify’ commerce setups and likewise by worrying about what “may have been”.

Not one of the variables that you simply’re in all probability taking a look at proper now to ‘verify’ your trades matter, and also you don’t even should take my phrase for it. All you’ll want to do is observe a pair so known as ‘vital’ financial information reviews and see how they have an effect on the market. In the event you observe a number of of them you’ll ultimately see what the analysts ‘predict’ ‘would possibly’ occur because of the information is usually the exact opposite of what the worth motion exhibits. Thus, the worth motion of ANY MARKET is all you really want to fret about. I promise, you’ll arrive at this identical conclusion ultimately all by your self, however I’m right here making an attempt to save lots of you from shedding cash by telling you this now so that you don’t should be the ‘guinea pig’.

One other vital level to recollect; don’t let remorse eat you. Perceive that even when you grasp an efficient buying and selling methodology and observe it with strict self-discipline, you’ll nonetheless miss out on some good trades, you’ll nonetheless have losses typically and also you’ll nonetheless exit too early typically, it’s simply a part of the sport. However, in case you are sticking to what you realize and following your plan, there may be NO motive to really feel remorse or let the ‘hindsight syndrome’ infect your mindset. Profitable merchants already know this, and it’s why they don’t get emotional and really feel the frustration that you’re feeling. You may be part of them if you need it unhealthy sufficient. The trail will not be difficult, until you make it so.

Think about you are attempting to develop into a worth motion buying and selling ‘specialist’, you wouldn’t be making an attempt to ‘verify’ your worth motion trades by taking a look at variables aside from worth motion, it simply is senseless. Start by studying and mastering an efficient buying and selling technique like the worth motion methods I train in my buying and selling training programs, and focus PURELY on that, ignore all different variables and temptations.