On Could 9, 2025, my three new MetaTrader buying and selling indicators formally launched: Burning Grid Low, Medium, and Excessive Threat. Every is powered by my Knowledgeable Advisor, Burning Grid, a structured grid buying and selling system designed to mix efficiency with strict threat administration.

With over 2,100 trades executed within the first 4 weeks and all methods operating on simply 500 € preliminary capital, the system has already confirmed its energy, consistency, and resilience.

🔍 What Makes Burning Grid Completely different

Burning Grid is just not a traditional martingale or hope-based grid EA. Its design focuses on management, scalability, and consistency, with a set of strong options:

-

Strictly restricted variety of open positions per image

-

Fastened grid spacing – not dynamically adjusted to market noise

-

Auto-lot calculation primarily based on obtainable steadiness

-

No martingale or exponential lot will increase

-

Built-in occasion filter to keep away from buying and selling throughout high-impact information

-

100% automation with no handbook intervention

You possibly can learn extra in regards to the system’s logic and philosophy in my detailed technique weblog, or discover the indicators immediately on the product web page on MQL5.

⚠️ Capital Allocation: Operating on 500 €, Beneficial 10,000 €

All three dwell indicators are at the moment operating on solely 500 € – a deliberate option to reveal the EA’s capability to carry out even on very small accounts.

Nonetheless, for long-term and productive use, I strongly advocate at the least 10,000 € beginning capital per sign, to permit the system’s full security mechanisms to unfold – notably throughout prolonged grid phases or greater volatility intervals.

📊 Sign Evaluation: In-Depth Assessment

🔸 Burning Grid Low Threat – The Fortress

Essentially the most conservative technique. Centered on capital preservation, low drawdown, and excessive stability.

| Metric | Worth |

|---|---|

| Complete trades | 406 |

| Successful trades | 404 (99.5%) |

| Dropping trades | 2 |

| Greatest successful streak | 202 trades |

| Web revenue | +407.44 € |

| Development | +82% |

| Max drawdown | 13.25% |

| Max deposit load | 9.80% |

| Revenue issue | 24.42 |

| Restoration issue | 123.09 |

Key Insights:

-

The system maintained near-perfect consistency: 404 of 406 trades had been worthwhile.

-

The 2 loss trades had been calculated exits – a part of the built-in logic, not stop-outs or accidents.

-

Drawdown remained minimal because of tight management of lively positions and lot sizes.

-

Deposit load <10% means wonderful margin security.

-

With a revenue issue of 24.42, the system earns €24.42 for each €1 misplaced – an impressive ratio.

➡️ Excellent for conservative merchants looking for regular progress and low threat publicity.

🔸 Burning Grid Medium Threat – The Balanced Performer

This technique balances progress potential and threat – splendid for merchants who need each efficiency and peace of thoughts.

| Metric | Worth |

|---|---|

| Complete trades | 749 |

| Successful trades | 745 (99.46%) |

| Dropping trades | 4 |

| Greatest successful streak | 328 trades |

| Web revenue | +792.50 € |

| Development | +159% |

| Max drawdown | 19.77% |

| Max deposit load | 22.00% |

| Revenue issue | 22.25 |

| Restoration issue | 146.76 |

Key Insights:

-

Close to-flawless execution: solely 4 losses in practically 750 trades.

-

Drawdown remained beneath 20%, with capital utilization beneath management.

-

A restoration issue of 146.76 signifies excessive resilience and minimal drawdown length.

-

Commerce cycles are often accomplished inside a day, offering liquidity and suppleness.

-

Sturdy revenue issue and constant execution validate the technique’s stability and progress design.

➡️ Very best for merchants in search of highly effective progress with out reckless publicity.

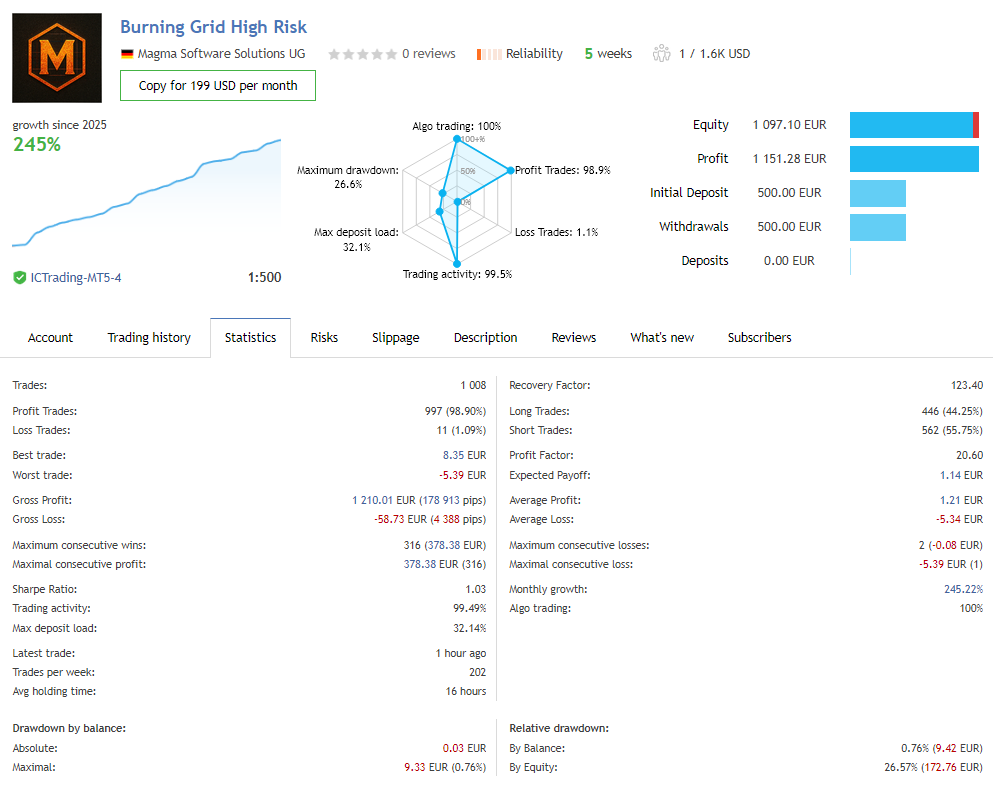

🔸 Burning Grid Excessive Threat – The Accelerator

Designed for merchants looking for most return, accepting elevated publicity inside managed boundaries.

| Metric | Worth |

|---|---|

| Complete trades | 1,008 |

| Successful trades | 745 (99.46%) |

| Dropping trades | 11 |

| Greatest successful streak | 316 trades |

| Web revenue | +1,151.28 € |

| Development | +245% |

| Max drawdown | 26.57% |

| Max deposit load | 32.14% |

| Revenue issue | 20.60 |

| Restoration issue | 123.40 |

Key Insights:

-

Even beneath excessive commerce quantity and aggressive threat, the technique maintained practically 99% accuracy.

-

Drawdown and deposit load had been expectedly greater, however at all times inside outlined caps.

-

No exponential losses – all dropping trades had been managed, not snowballed.

-

Revenue issue of 20.60 beneath high-frequency situations demonstrates the EA’s algorithmic energy.

-

Nonetheless achieved absolutely automated outcomes with out intervention, on simply 500 € capital.

➡️ A high-octane setup for skilled merchants with greater return objectives – and consciousness of calculated publicity.

🧠 Ultimate Ideas: Construction Creates Stability

Burning Grid proves that grid buying and selling doesn’t should be chaotic or harmful. With the proper constraints, logic, and automation, it turns into a scalable, managed and worthwhile technique.

Even with a very small account measurement, the system demonstrated:

-

>2,100 trades with 98.9–99.5% accuracy

-

Sturdy revenue elements (20–24+)

-

Clear correlation between threat degree and drawdown

-

Minimal losses, tightly managed cycles

📌 Curious to study extra?

Take a look at the product web page for particulars or dive deeper into the logic within the official weblog submit.