Immediate gratification is one thing all of us get pleasure from; the earlier we get what we would like, the higher we really feel. Nonetheless, in buying and selling, we don’t usually get what we would like precisely after we need it. The innate human need for immediate gratification is the destroyer of many merchants’ accounts, and perhaps it’s even destroying yours proper now.

Trades usually take longer to play out than we anticipate, and this causes loads of issues for merchants. We’re wired to need to be rewarded straight away, for this reason folks get hooked on issues which are unhealthy for them like medicine and playing; these items present them with prompt gratification, or a ‘fast repair’. Nonetheless, as you’re certainly conscious of, what feels good will not be at all times good for us, and that is very true in buying and selling.

Expectation is usually the enemy of buying and selling success

Trades don’t usually play out precisely as we would like them to. This performs with our feelings as a result of as I discussed above, we’re all naturally wired to need prompt outcomes. Thus, there’s clearly a conflict between what we anticipate from a commerce and from what a commerce often offers us. Certainly, many merchants anticipate some unrealistically massive revenue on practically each commerce they take, in order that they place revenue targets which are 500 pips away from their entry after which when this goal inevitably doesn’t get hit, they expertise emotional ache and misery.

Equally, merchants usually have unrealistic expectations of how lengthy a commerce will take to play out. Hey, I’d like each commerce I enter to right away hit my revenue goal as a lot as the subsequent man, however that simply isn’t actuality. A commerce can generally take weeks to play out, it is advisable to preserve this in thoughts as a result of you’ll by no means make large cash out there for those who don’t give the market time to maneuver in your favor. Among the biggest hedge funds will take positions and journey traits for weeks, making tens of millions consequently, it is a clue to how large cash gamers behave out there.

Subsequent time you place a commerce, you need to be ready to see it out and let it run for days or perhaps weeks if want be. Don’t get scared by an intra-day fluctuation towards your place and exit too early, as it’s possible you’ll miss out on a great transfer or a robust pattern run.

It’s additionally crucial that you simply perceive that every day and every week the market can solely transfer thus far, so don’t have unrealistic expectations of how far your commerce would possibly transfer in a sure time period…

How the Common True Vary (ATR) might help your buying and selling

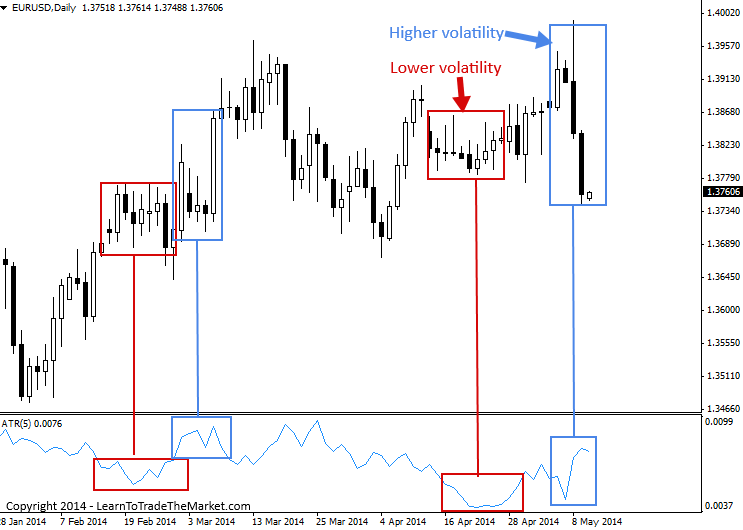

There’s a technical software that may allow you to approximate how far a market might transfer within the coming days and weeks. It’s referred to as Common True Vary or ATR, and it’s a volatility indicator that can provide us an thought of how a lot worth motion to anticipate in any given day or week. Merely put, a market experiencing a excessive degree of volatility may have a better ATR, and a low volatility market may have a decrease ATR. The ATR reveals us how far a market is shifting per day (or no matter timeframe you will have it utilized to), from the day’s low to excessive (every day swing).

For an in-depth tutorial on how we use the ATR software you would possibly need to learn this text right here.

The ATR will not be an ‘precise’ forecast of how a lot a market will transfer, slightly, it reveals us how a lot the market has been shifting not too long ago, in different phrases, how risky it has been. That is necessary as a result of it does present us with a great approximate worth vary to anticipate the market to proceed shifting inside for the days or perhaps weeks forward.

Under is a every day chart of the EURUSD with a 5-period Common True Vary indicator within the decrease pane.

Discover how the ATR decreases in worth because the volatility of the EURUSD decreases, and will increase in worth when the volatility will increase.

I’ll usually use the 5 interval ATR, however 5 days could also be pushed out to 7 or 10 on a every day chart, nevertheless I often keep at 5, particularly for a weekly chart. 5 days of information is one week on the every day timeframe, and it’s an correct image of present market volatility.

The ATR might help us perceive present market volatility, and this might help us plan cease losses and targets. Clearly, you gained’t need to place your cease loss inside the present every day ATR vary, as a result of your commerce wants room to maneuver.

The ATR might help preserve your expectations in-line with actuality, as a result of it’s a reminder {that a} market will solely transfer thus far per day or per week, statistically talking. For instance, let’s say you’re in a commerce and up 180 pips on the GBPUSD and that week the market has moved 200 factors from its low to excessive (or vice versa), and the ATR software reveals the weekly common vary is simply 200…it’s a clue that the transfer for that week could also be over and that you simply shouldn’t be grasping and anticipate extra; it could be time to exit.

You may mix the ATR with key chart ranges for cease losses and targets as properly. Should you see a key chart degree that’s opposing your commerce, and also you’re already up say 120 pips on a commerce and the ATR for that week is 150, properly then the approaching key degree mixed with the truth that you’re approaching higher restrict of the current ATR weekly vary, is an effective clue that you must ‘take your cash and run’.

It’s necessary to notice, the ATR will not be a ‘exhausting and quick’ software, however slightly a information that may assist preserve you grounded and assist preserve you in actuality and out of ‘dream land’. I additionally need to be clear that the ATR will not be an indicator for entry or exit, nevertheless it’s a software that will help you see market volatility and the common current ranges of a market, that will help you plan and handle your trades.

Methods to apply the ATR software in In MetaTrader 4 Platform:

(Be aware: you possibly can obtain mt4 charts right here)

1) Click on on within the ‘insert’ drop down menu on the prime left.

2) Then choose ‘indicators’ for the drop down menu.

3) Subsequent choose ‘Common True Vary’ (ought to be first one)

4) Then you definately simply want to pick out a shade for the ATR and enter the interval. I like to make use of a 5 interval ATR however will generally have a look at the 7 or 10 interval ATR as properly

Settle for the implications of your commerce BEFORE you enter it

In buying and selling, it’s vital that you simply get your expectations in-line with actuality, as we talked about above. This implies taking a sensible and logical strategy to issues like cease loss and goal placement (ATR might help with this as mentioned above), and never anticipating a ‘homerun’ on each commerce. It additionally means not anticipating a winner each time you commerce. The very best merchants on the planet nonetheless have shedding trades and lots of lose 50% or extra of their trades. What they know is that cash administration, persistence and self-discipline is the way you make large cash out there, and these items are naturally at odds with our innate need for immediate gratification.

Ignoring what feels good in the mean time, is a talent you’ll have to develop if you wish to attain long-term buying and selling success. This contains having persistence to let trades play out, as they usually don’t play out as rapidly or seamlessly as we wish. It’s essential to study to keep away from bailing on a commerce on the first flip towards your place, the market ebbs and flows, and strikes towards your place are a standard a part of buying and selling. It’s essential to develop a plan earlier than you enter the commerce, and persist with it, don’t turn into overly-influenced by the traditional every day fluctuations out there. In case your commerce plan continues to be legitimate and is sensible, then it is advisable to let the commerce play out if you wish to see your edge give you the results you want over time.

Utilizing the ATR, as described above, might help you management your expectations of a commerce and preserve them in-line with actuality. Nonetheless, I’ve discovered that what might help much more, is to easily take a while BEFORE you click on that purchase or promote button, and actually settle for the implications of the commerce you’re about to placed on. You must be OK with shedding the cash you’re risking, so it is advisable to actually think about your place dimension earlier than you enter that commerce. Is the greenback quantity you will have in danger an quantity that you simply’re prepared to doubtlessly lose for the chance to see in case your buying and selling thought performs out in your favor?

Should you settle for the implications of your commerce earlier than you enter it, you’ll not be as affected if the commerce takes longer than you anticipated or wished it to. You may be extra apt to sit down there patiently and simply let the market do its ‘factor’. More often than not, interfering with a commerce whereas it’s dwell is a nasty thought. I’ve discovered over time, that simply sticking to my unique buying and selling plan and letting the commerce play out both for a cease out or a revenue, is the perfect path to go. I name this ‘set and neglect’ buying and selling, to study extra about this buying and selling method, checkout this text on set and neglect buying and selling. As at all times, be at liberty to electronic mail me right here when you have any buying and selling questions.