This text is written primarily based on my private experiences and displays precisely how I take into consideration and method the market on a each day foundation. Right here’s a detailed look into how my thoughts truly thinks every single day once I open up my buying and selling screens…

Buying and selling is all about taking part in the chances. You aren’t going to win each commerce; an vital lesson to study early-on in your buying and selling profession. However by taking part in the chances, or buying and selling the chances, you’ll be able to will increase your probabilities of earning profits. Enjoying the chances takes self-discipline, and it includes endurance, however if you wish to earn a living out there, you’ll should study these items.

By understanding issues like market bias, key chart ranges, cease loss placement and having a mastery of your buying and selling methodology, you’ll be able to improve your probabilities of buying and selling success by buying and selling with the chances in your favor…

Develop a ‘really feel’ for the chart

You’ve obtained to first develop a really feel for a chart by creating your bias for that chart. When you’ve performed this, you persist with that bias till it stops working.

By observing the each day conduct of a market, you’ll begin to get a really feel for what it’s doing and extra vital, for what it would do subsequent. That is the way you develop your bias. It’s extra concerned than simply a chart as soon as and saying “it’s happening”. That you must develop a relationship with that chart, actually get ‘intimate’ with it and its conduct, you do that by following the market, beginning on an end-of-day foundation. I’m not speaking solely about ‘developments’ right here, should you watch the finish of day value conduct every day after the New York shut, you can be studying the chart. Very like Neo in The Matrix, you’ll begin to ‘see’ the market extra clearly and get a greater really feel for what it would do subsequent.

Your intention is to develop a deeper emotional reference to the chart, then your bias will come to the floor and you’ll know whether or not you need to be seeking to purchase or promote. When you’ve developed your bias, you’ll be able to commerce the chances by sticking to that aspect of the market till it clearly begins to alter.

If a market continues dying, e.g. the latest euro / greenback, that is if you proceed on the quick aspect; that is taking part in with the chances in your favor. You’ve obtained an edge, and that edge is principally that the market goes decrease, don’t combat it. Your bias in a downtrend, will typically be promoting into power, and your bias in an uptrend will likely be shopping for into weak spot.

Enjoying the chances from key chart ranges

Placing the chances in our favor in buying and selling means not solely creating a bias and buying and selling with that bias, but in addition understanding key chart ranges and the way they permit us to play the chances.

When a market approaches a key chart degree, it offers us with an excellent entry alternative and an excellent threat reward potential. Thus, we’re rising our probabilities of earning profits by ready for such an entry.

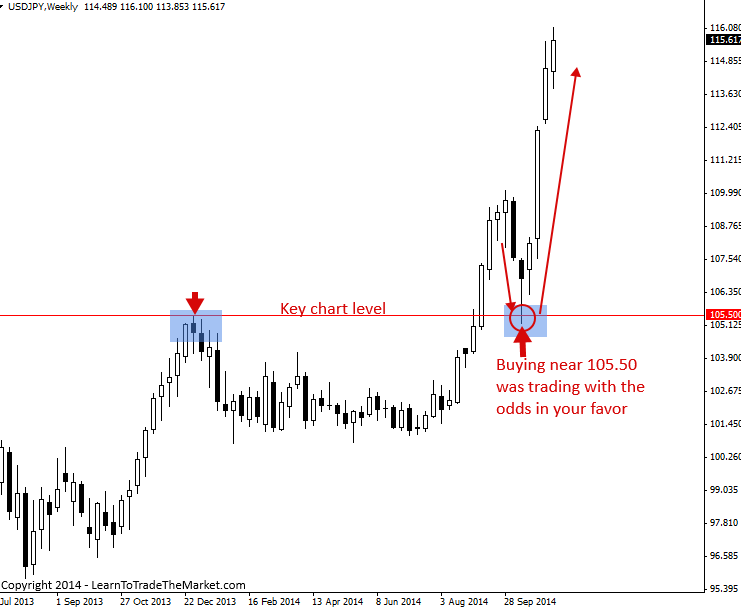

Take into consideration the latest 105.50 key degree on the USDJPY chart (see chart beneath). This was a serious degree throughout the present / general uptrend out there. By in search of a purchase entry from that degree or close to it, you have been taking part in the chances. You’ve obtained a key degree that you just’ve recognized, and everyone seems to be promoting into it as value retraces down, however that is your best probability to purchase. Persons are promoting into a serious degree and the underlying / longer-term momentum is up. This implies, by shopping for at that degree or close to it, you’re coming into the market at your opponents (sellers) worst place, you take on their threat.

The threat reward could be very favorable at key ranges like this since you’re taking part in the chances. If value bounces from that degree, you’ve obtained large upside potential, i.e., a small relative threat for a big attainable reward.

Wider stops assist tip the chances in your favor

Wider than regular stops are one thing that may assist tip the chances in your favor. Many merchants are responsible of buying and selling with too small of cease losses, primarily out of greed, as a result of they wish to commerce an even bigger lot measurement. Nonetheless, buying and selling with too tight of stops has the other impact from what the dealer needs; it causes them to lose cash as a result of they get stopped out extra typically.

A barely wider than regular cease loss helps you keep in a commerce longer and lets your edge play out. That is distinction to a man who’s risking 20 or 50 pips on each commerce; these stops are going to get ‘picked off’ typically, proper earlier than the market continues on in your course (with out you on board). For many merchants, buying and selling with 20 to 50 pip cease losses is like taking part in the blackjack desk at a on line casino, i.e., it’s playing. Take into account that the AUDUSD or the EURUSD strikes round 100 pips a day on common…having a cease lack of lower than 50 pips is a nasty thought.

Checkout this text on correct cease loss placement for extra data, in addition to my article on the commerce entry trick, which discusses the best way to get wider than regular cease losses.

Know your ‘bag of methods’ and belief them nicely

Lastly, buying and selling with the chances in your favor means you recognize your ‘bag of methods’ in and out and also you belief them nicely. By this I imply, you have got mastered your buying and selling technique and also you don’t second guess it. My buying and selling technique is value motion, so once I see a value motion sign seem out there, I consider in it and I belief my intestine. That is one more method I play the chances out there.

By figuring out what my buying and selling edge is (value motion) and solely buying and selling when it’s current out there, I’m buying and selling with the chances in my favor. Buying and selling if you’re edge isn’t current (over-trading) or not having mastered your buying and selling methodology, is buying and selling towards the chances, clearly not what you wish to do together with your hard-earned cash on the road.

In latest months we’ve known as the market very nicely in our market commentaries, and it’s no secret that we use the identical normal formulation on this lesson; just by taking part in the chances and placing all of it collectively, we’ve got a whole plan of motion to sort out the market every day and we all know we’re taking part in the chances and people odds are in our favor so long as we’re in line with our method.

While value motion evaluation is a approach to commerce, it’s one factor to name your self a value motion dealer and it’s one other factor to truly commerce like a value motion dealer. To take your studying a step additional and if you want to place the information mentioned in as we speak’s lesson right into a workable buying and selling plan to sort out the markets, I welcome you to take a look at the buying and selling methods I educate in my value motion buying and selling schooling programs.