After finishing our programs and tutorials, most merchants haven’t any downside studying the charts, they usually can usually discover good trades fairly simply. Nonetheless, there appears to be an enormous hole between with the ability to discover good trades and with the ability to pull the set off on them. The primary factor I discover from speaking to many starting and pissed off merchants is that they’ve an issue with merely executing the commerce, not find it.

What’s it that causes clever people who find themselves correct chart-readers and trade-finders to have such issue deciding to tug the set off on a superbly good commerce?

Right here is why you most likely didn’t take that commerce…

Typically, an enormous purpose why folks don’t pull the set off on completely good trades is that they merely lack confidence of their talents. Merchants, particularly newcomers, typically suppose buying and selling is way tougher than it really is. Thus, they second-guess themselves when taking a look at an apparent commerce setup and as a substitute of simply executing the commerce, they begin questing it and questioning themselves, as a result of it simply ‘couldn’t be that straightforward, may it?’

One more reason why folks have points pulling the set off on completely good commerce setups is that once they transfer from pretend cash to actual cash, issues can change. There’s emotion concerned if you transfer to actual cash as a result of one thing is on the road now. You already know you could possibly lose cash you’ve labored exhausting to earn, this may play havoc along with your buying and selling mindset. Whereas, if you had been demo buying and selling with pretend cash, you most likely had been completely calm and took apparent commerce setups with ease, with no second-guessing. Due to this fact, managing your danger to a greenback mount you’re comfy with probably shedding per commerce, is critically necessary if you begin buying and selling reside, since you should take away as a lot emotion as potential to realize that demo-trading mentality.

Then, there may be the problem of “Murphy’s Regulation”, which suggests mainly that something that may go unsuitable, will go unsuitable. It goes one thing like this, you had some nice calls / trades that you just didn’t take after which one other related commerce comes alongside and also you commerce it and it’s the one out of ten that ends in a loss, then your confidence takes an enormous hit and also you get ‘gun shy’ on the subsequent good commerce, don’t take it, and it seems to be a winner. This will clearly turn out to be a vicious cycle that may trigger you to get pissed off and trigger you to finish up taking dangerous trades in some unspecified time in the future, since you get so mad in any respect the great ones you missed you simply lastly leap in on a nasty one, which leads to extra losses. It’s nearly comical, if cash wasn’t on the road.

There may be additionally one thing I name hindsight habit that impacts one’s confidence in pulling the set off on trades. Many merchants don’t even notice it, however they’re hooked on their hindsight evaluation. They turn out to be afraid to enter a commerce with out with the ability to see what occurs subsequent on the chart. It is a massive purpose why I’m typically not a fan of back-testing, however I favor forward-testing, or demo-trading in actual time, to check your talents earlier than going reside.

Find out how to cease being afraid of excellent trades…

Listed here are some steps you’ll be able to take to coach your self out of those habits and beat your psychological demons…

To rid your self of the concern of pulling the set off on a commerce, you could keep in mind that to earn a living available in the market, you could take as many situations of your buying and selling edge as you’ll be able to, and over time, if that edge is worthwhile, it ought to repay. That is an thought from the late-great Mark Douglas that I clarify extra in-depth in a current article I wrote based mostly on his teachings, learn it right here.

The thought is, you need to be buying and selling the trades you’re assured about in addition to those you’re possibly even solely 50% assured about. On the finish of the day, how assured you’re in a selected commerce sign can differ tremendously, relying on many variables, a few of which even most likely don’t have anything to do with the charts (how your day went, the state of your relationships, and many others).

Now, that doesn’t imply exit and ‘spray bullets in every single place’. You ought to filter your trades, however don’t over-filter them; don’t persuade your self that there’s by no means a commerce price buying and selling. You should filter however not an excessive amount of. Try an article I wrote on filter good trades from dangerous.

The objective is to be assured about your buying and selling edge and again your self when it seems on the charts. You’ll need to suppose like a sniper, however not be afraid to tug the set off.

Some steps you’ll be able to take…

- If you end up struggling to tug the set off, lower your lot dimension in order that at the least you’re in these positions and feeling the affect of actual cash on the road, so this may stop you from hating your self in hindsight for those who name the commerce however don’t commerce it.

- The much less you have a look at your charts, the much less you’ll have time to consider whether or not its proper or unsuitable. Watching a chart will enable anybody to persuade themselves out of something. Restrict display screen time to fifteen – 30 minutes a day. Additionally, specializing in the each day charts and finish of day buying and selling, will assist with the psychology of filtering.

- Don’t simply search for single bar commerce indicators, learn and really feel the chart from left to proper. Consider a chart like studying a ebook from left to proper; it is advisable know what occurred on the earlier web page to know what’s taking place on the present web page and to make a plan for what may occur subsequent. The market is an ongoing ebook, being written as we converse, it’s necessary to know what image is being painted by the market.

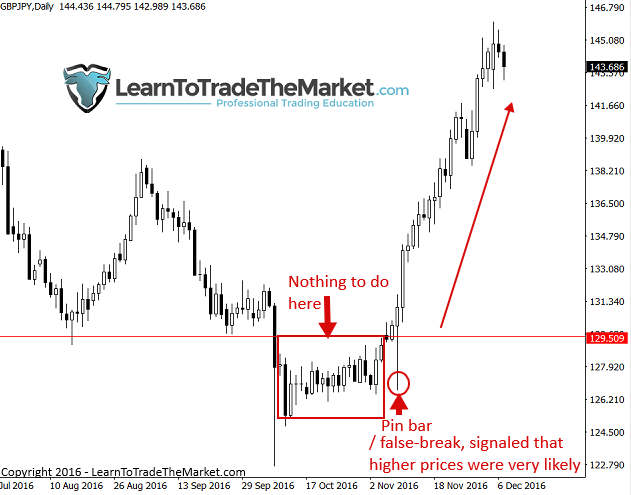

Within the GBPJPY each day chart instance under, there wasn’t something to do via this big interval of information however as soon as we bought that pin we may learn what occurred; consolidation, false-break, affirmation (pin bar sign). We received’t go into element right here, however we noticed a false-break sign on the GBPJPY, those that had been quick bought caught quick, and This pin was a sign and the quick protecting that adopted, fueled the run larger.

The sign itself is affirmation, however to get extra confidence we have to learn what occurred from proper to left…The sign is the FLASHING LIGHT, then go learn what occurred on the chart…

Worth motion evaluation will not be solely about single bar indicators, it’s about studying the charts and studying the ‘story’ the worth motion is telling you from left to proper, very like the pages of a ebook. I devoted a whole part of my skilled buying and selling course to this highly effective idea and for a lot of of my college students this was the ‘ah ha’ second of their buying and selling profession. Glancing at a value chart, with the ability to learn it like a language and confidently anticipate the markets subsequent transfer is a talent all merchants ought to aspire to.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK 🙂

QUESTIONS ? – CONTACT ME HERE