Cross-border funds are the invisible engine behind your worldwide checkout button.

Behind each sale that crosses a border are a bunch of processes invisible to the vendor and shopper, together with foreign money conversions, regulatory points, and financial institution approvals.

As international commerce intensifies, the marketplace for these transactions is scaling quick. The worldwide cross-border funds market is estimated to be value $198.6 billion in 2024. It’s anticipated to greater than double by 2034, reaching roughly $413.1 billion, pushed by a constant compound annual progress price (CAGR) of seven.6%.

Let’s peel again the layers of cross-border funds and break down the important parts that make worldwide transactions work easily.

What are Cross-Border Funds?

Cross border funds are monetary transactions that happen between events primarily based in separate nations, which means the sender and recipient function beneath totally different nationwide monetary programs. Listed here are just a few examples:

- A buyer in Germany shopping for a smartwatch from Amazon Japan; the transaction includes foreign money conversion from euros to yen.

- A contract graphic designer within the Philippines getting paid in USD by a shopper in Canada by way of PayPal or Clever.

- A U.S.-based ecommerce model sourcing eco-friendly packaging from a provider in Vietnam, paying by means of a B2B cross-border financial institution switch.

So, what’s a cross border transaction? In easy phrases, it’s a cost that crosses nationwide boundaries, triggering a series of processes that usually contain:

- Forex conversion

- Regulatory checks

- Settlement by means of varied banks and cost networks

For Amazon worldwide sellers, cross-border funds are a core a part of operations. Sellers have to obtain funds of their native financial institution accounts, even when their clients store from totally different components of the world.

That is the place challenges like a heavy cross-border cost charge come into play. These costs—typically labeled as a cross-border charge—are utilized by banks, card networks, or cost processors for dealing with transactions throughout jurisdictions.

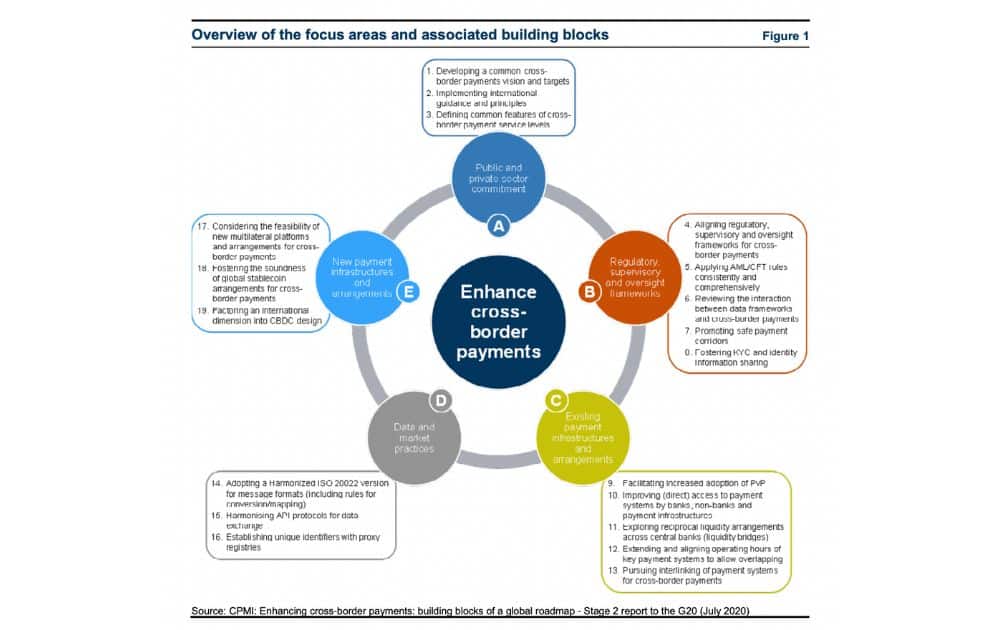

It goes with out saying that cross-border transactions are essential in right now’s international market. In truth, the Monetary Stability Board (FSB) and the Committee on Funds and Market Infrastructures (CPMI) proposed a worldwide roadmap to enhance these funds.

Initiated in 2020 and designed as a multi-year initiative working by means of 2027, the FSB and CPMI’s cross-border funds roadmap is guided by 5 key focus areas:

- Public and Personal Sector Dedication

- Regulatory, Supervisory, and Oversight Frameworks

- Current Cost Infrastructures

- Information and Market Practices

- New Infrastructures and Preparations

The roadmap goals to resolve cross-border funds points, together with excessive prices, sluggish supply, unpredictable charges, and restricted transparency.

Cross-Border Funds vs Home Funds

Cross-border funds differ from home funds in a number of key methods, primarily as a result of added layers of complexity concerned when cash strikes between nations.

Whereas home transactions usually happen inside the identical banking system, foreign money, and regulatory atmosphere, cross-border funds should navigate the next elements:

- A number of monetary establishments

- Totally different currencies

- Time zones

- Jurisdiction-specific compliance necessities

These transactions typically contain foreign money conversion, incur overseas change charges, and take longer to settle because of middleman banks and anti-fraud checks.

Moreover, cross-border funds are extra vulnerable to failures or delays, making optimization important for companies engaged in worldwide funds.

Key Elements of Cross-Border Transactions

Listed here are the core elements that energy seamless cross-border funds for right now’s companies and customers:

Cost Gateways and World Processing Infrastructure

A cost gateway acts because the bridge between the client’s cost technique and the service provider’s financial institution.

For ecommerce funds particularly, choosing the proper gateway could make or break your cross-border technique. To cut back the friction of promoting overseas, main international cost processing suppliers supply options like:

- Fraud safety

- Forex dealing with

- Multi-country settlement

Cost Localization

To spice up conversions, companies should tailor the checkout expertise to every market. Cost localization includes:

- Displaying costs in native currencies

- Providing region-preferred cost strategies

- Utilizing native language interfaces

Forex Conversion and Overseas Trade Charges

When a purchaser pays in a special foreign money than the vendor’s, the quantity have to be transformed. That is the place overseas change charges come into play, usually charged by banks, card networks, or cost gateways. The quantity charged can fluctuate primarily based on a number of elements, comparable to:

- The area

- Cost technique

- Service supplier

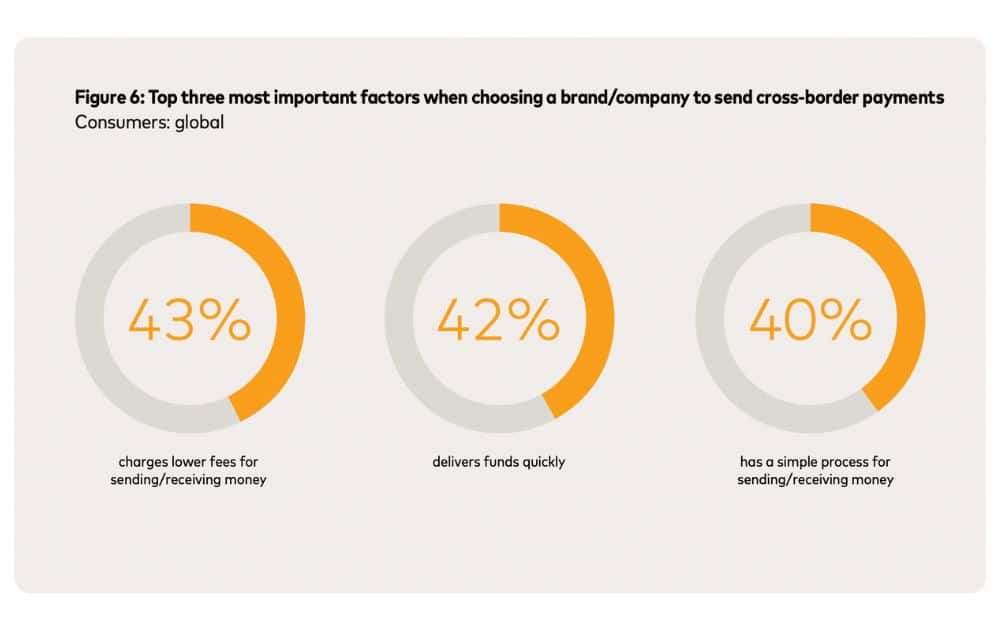

For ecommerce companies, minimizing these charges could make an enormous distinction in total profitability. In spite of everything, customers are fee-conscious. Mastercard’s Borderless Funds Report 2023 reveals that 43% of worldwide customers say that decrease charges for sending and receiving cash are a very powerful issue when selecting a model or platform for cross-border funds.

Compliance, Danger, and Settlement Processes

Cross-border transactions should adhere to a bunch of regional laws. These laws embody the next requirements:

- Anti-money laundering (AML)

- Know your buyer (KYC)

- Information safety practices

Suppliers of cross border cost options typically deal with a lot of this compliance work.

Market Growth Instruments

Firms going international depend on tech platforms that assist market growth by means of options like:

- Multicurrency pricing

- Tax calculation engines

- Built-in logistics

The extra environment friendly your worldwide cost setup, the smoother your buyer expertise.

High Platforms for Managing Cross-Border Funds

Listed here are a few of the hottest cross-border funds platforms utilized by ecommerce ventures across the globe:

Stripe

Stripe is a go-to answer for international ecommerce manufacturers, providing seamless worldwide funds, multicurrency assist, and cost localization instruments. With Stripe Checkout and Join, sellers can attain consumers in over 135 nations.

- Finest for. Startups and on-line manufacturers needing developer-friendly customization.

PayPal

PayPal is without doubt one of the most trusted platforms for cross-border funds, significantly amongst small companies. It helps transactions in over 100 currencies and is broadly utilized by worldwide clients world wide. Sellers may also entry working capital and dispute decision options.

- Finest for. Ecommerce shops concentrating on a broad, worldwide buyer base.

Clever

Clever provides clear foreign money conversion and real-time change charges, serving to sellers decrease their cross-border cost charges. It’s well-liked for B2C and freelancer payouts, with a multi-currency enterprise account for international operations.

- Finest for. Small companies trying to scale back hidden FX costs

BlueSnap

BlueSnap is constructed for international cost processing, providing options like sensible routing, fraud prevention, and assist for over 100 cost varieties. It additionally permits for embedded funds by way of API and checkout customization.

- Finest for. Mid-sized companies and rising ecommerce manufacturers

Payoneer

Favored by Amazon worldwide sellers and international freelancers, Payoneer allows cross-border fund transfers, digital accounts in a number of currencies, and direct withdrawals to native banks.

- Finest for. Market sellers, distant groups, and suppliers needing versatile withdrawal choices

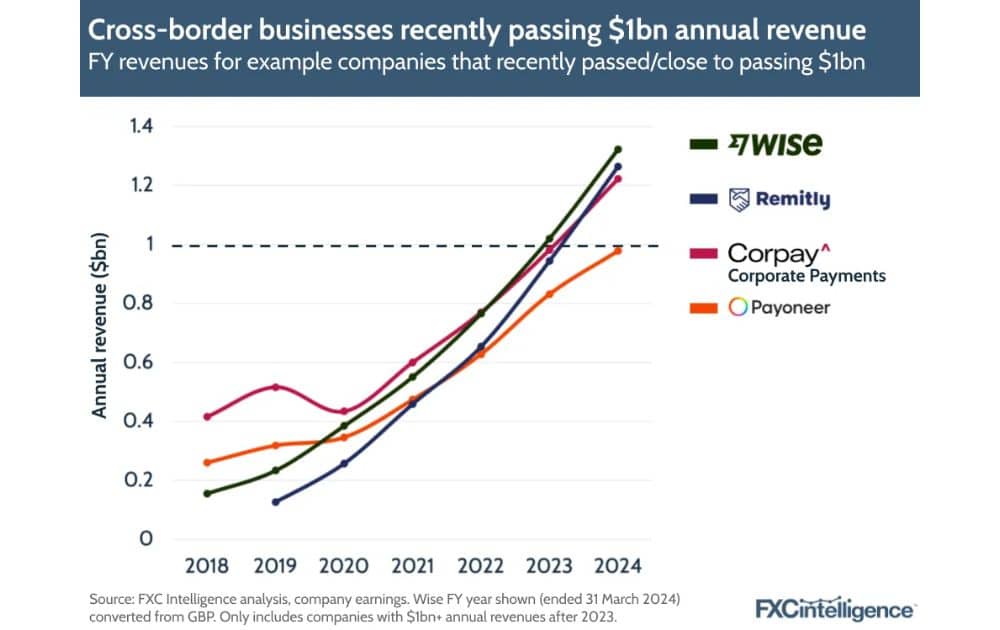

The FXC Intelligence reported over 30 firms projected to earn $1 billion or extra in cross-border funds income in 2024, together with ecommerce-friendly platforms like Payoneer and Clever.

In the meantime, Remitly and Corpay, usually used for remittances and B2B treasury and payroll options, respectively, have been additionally among the many fastest-growing firms inside cross-border cost options.

Methods to Optimize Your Cross-Border Funds

Listed here are key methods that sort out compliance, tax and different monetary implications of promoting internationally, particularly for cross-border ecommerce manufacturers and Amazon World Promoting individuals:

Streamline Tax Registration and VAT Compliance

Promoting internationally means navigating an online of tax obligations, from VAT quantity within the EU to GST (Items and Providers Tax) in Australia.

For those who’re a part of Amazon World Promoting, some areas require a legitimate VAT quantity―just like the UK―to listing merchandise or keep away from account suspension. Not registering correctly can result in surprising charges, fines, or blocked payouts.

Proactively analysis your tax obligations in every goal nation. Use Amazon’s VAT Providers (or a third-party tax platform) to automate filings and keep compliant.

- Actionable Tip. For those who’re not sure the place to begin, seek the advice of AMZ Advisers to get knowledgeable steerage in your ecommerce enterprise, together with VAT registration to assist scale back promoting charges associated to non-compliance.

Consider World Promoting Charges and Forex Trade Prices

Amazon applies varied charges to worldwide sellers, together with Amazon World Promoting referral charges, success prices, and change price charges when changing earnings. Many sellers overlook these of their pricing technique.

Use Amazon’s FBA income calculator to estimate complete prices throughout areas. Construct these charges and potential cross-border funds costs into your pricing fashions to guard margins.

- Actionable Tip. Think about using Amazon’s native financial institution disbursement choice (the place out there) to keep away from unfavorable FX conversions and third-party banking charges.

Keep Forward of Compliance and Regulatory Shifts

Cross-border transactions should adjust to native monetary legal guidelines, particularly round anti-money laundering, know your buyer guidelines, and transaction limits. Not complying correctly can result in frozen funds, chargebacks, and even blacklisting.

Work with a cost service supplier or gateway that displays regulatory updates and automates these processes throughout buyer onboarding.

- Actionable Tip. Audit your cost flows yearly and guarantee your service supplier complies with the most recent laws in each area you promote to.

Remaining Ideas

Cross-border funds might occur within the background, however they carry front-line penalties for ecommerce companies aiming to scale globally.

Whether or not you’re promoting on Amazon or managing your individual ecommerce web site, success comes right down to choosing the proper companions, staying forward of laws, and constructing monetary methods that defend your backside line.

Creator

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of modern options, comparable to ecommerce, digital advertising and marketing, and knowledge analytics.

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of modern options, comparable to ecommerce, digital advertising and marketing, and knowledge analytics.