This text is for these merchants (new or skilled) who’ve hassle reserving income. Do you usually see massive income evaporate because the market reverses towards you, leaving you feeling powerless and confused? If that’s the case, you understand how irritating it may be and you realize precisely what I’m speaking about.

Poor goal placement, lack of expertise, greed, vanity and stubbornness are all points that may trigger merchants to not take income off the desk.

I recognize this text could battle with a few of my core beliefs and teachings on taking income since usually I encourage individuals to purpose for a 2 to 1 danger reward or larger and to set and overlook stops and targets. In principle this is sensible, however in the true world as you possible already know, there are nonetheless a large number of trades that nearly hit your revenue goal or the place a commerce has moved rapidly in the suitable course and your observing a large revenue… after which the following day or week, the market goes the opposite method and your as soon as big revenue has change into a a lot smaller revenue or perhaps a loss.

In right this moment’s article, I’m going to go over defending open income, and find out how to know when to take the cash and run and belief your intestine, and a number of other different suggestions that may assist you begin reserving income and constructing your buying and selling account because of this.

Do you have to take the cash and run?

What number of occasions have you ever gotten up an enormous revenue in a brief area of time as a result of the market popped in your favor straight away? Nicely, it occurs, however not as usually as you (or I) would love. But, I discover that merchants nearly at all times do the precise incorrect factor in these situations…

If you realize a quick and massive transfer in your favor is comparatively uncommon (often trades take longer to play out out there) then it goes to cause you need to attempt to defend most or all of that revenue when you’ve gotten it. The way in which you do that’s by trailing your cease loss near the present market value, after the large transfer in your favor. This fashion, you safe a lot of the revenue however you continue to give the market an opportunity to maintain operating in your favor. The choice right here, is watching value reverse and melt-away all of your open income.

Now, I do know what a few of you’re pondering already: “However Nial shouldn’t I simply set and overlook such as you train?” Nicely, there’s a time for set and overlook buying and selling and a time for actively reserving revenue, and that’s the level of this lesson. We’re all making an attempt to generate income from buying and selling, so whenever you stand up a giant revenue quick, it’s time to begin interested by reserving it. Set and overlook is extra of a default trade-management technique that you need to take into account your baseline administration method. In different phrases, set and overlook your trades except there may be cause to not (like an enormous quick transfer in your favor). Right here’s an instance…

Right here’s one other frequent situation: there isn’t any clear breakout (past a degree) or pattern in place, however the market strikes rather a lot in a brief area of time. On this situation, you also needs to take into account reserving income after they’re there. Right here’s an instance:

This chart was in a buying and selling vary and we see a pin bar purchase sign fashioned close to the underside of the vary. Now, on this situation, it’s apparent you’ll look to e-book revenue close to the resistance of the vary, however you’ll be shocked what number of merchants don’t. As a substitute, they are going to watch that revenue evaporate as a result of they ‘really feel’ just like the buying and selling vary will breakout and so they’ll make even bigger income. That is greed at its ‘best’. You may see what would have occurred had you saved holding that commerce, you’ll have most likely misplaced cash or at the very least made rather a lot much less. Don’t attempt to predict breakouts earlier than they occur; for those who’re up a superb quantity of revenue in a buying and selling vary, BOOK IT!

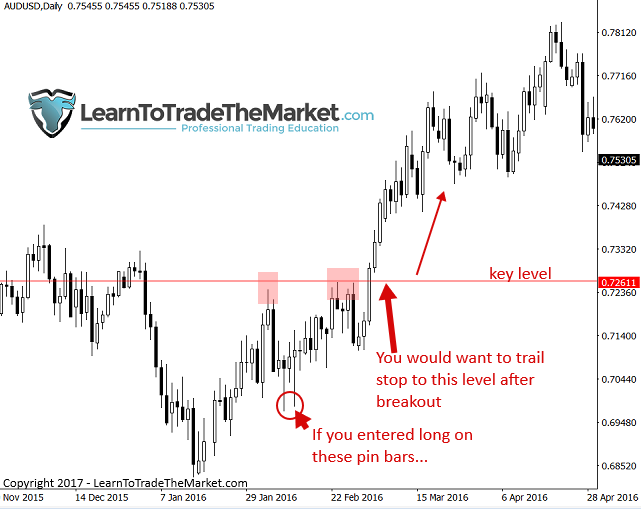

Now, if there is a robust pattern and a transparent breakout inside that pattern, you may look to path your cease loss under or above a logical key or near-term degree. You don’t wish to maintain onto the commerce if the market comes crashing again by a degree it simply broke out from, this might find yourself being a false breakout, resulting in a loss. Within the instance under, we are able to see value broke above a key degree within the AUDUSD, so for those who have been already lengthy from the pin bars marked on the chart, you’ll undoubtedly wish to path your cease up from the pin lows to that key degree or simply under it. Whenever you see an apparent breakout of an apparent degree, view that as a superb degree to path your cease to, as a result of if value comes again by that degree it exhibits the market dynamics have modified dramatically and your commerce thought is probably going invalidated.

Getting emotionally connected to your positions…

Whenever you’re commerce is up 2R or 3R and also you don’t take the revenue since you are solely interested by the revenue you MIGHT miss out on for those who shut it out right here, you’re being grasping and illogical. Bear in mind, the market might be going to retrace quickly (as a result of markets don’t transfer in straight traces for very lengthy), so higher to e-book the revenue whereas it’s there after which you may at all times wait and enter later, after the retrace. You’re in a greater place for those who take the revenue as a result of you’ve gotten the cash within the financial institution and you’ll nonetheless re-enter ought to the market pull again and offer you a second likelihood entry alternative, which occurs usually. It’s not enjoyable to observe a beforehand massive revenue evaporate…

The perpetrator is getting emotionally connected to your positions, you’re feeling like for those who shut it out for a revenue you’re one way or the other reducing your potential to generate income. However that is foolish! You may at all times enter once more! Nonetheless, as soon as that revenue is gone, it might by no means come again! Particularly within the conditions like these talked about above, you’ll want to e-book the revenue when it’s there.

Ideally, earlier than you enter the commerce you’ll have some thought of your profit-taking technique.

- If you’re buying and selling a unstable market that’s making massive swings in both course, be trying to e-book income after massive strikes, don’t look ahead to the opposing swing to occur once more and wipe you out.

- If it’s a robust pattern, then you might elect to let the commerce run for some time and path your cease under or above apparent ranges, and many others. If there are not any apparent ranges then you may at all times path your cease under or above the day prior to this’s excessive or low.

- If the chart is in a buying and selling vary and you purchase close to help, look to exit earlier than or close to the resistance, vice versa for those who promote at resistance (look to exit close to or earlier than help is hit) – don’t maintain on this situation, e-book it!

The factors above are examples of issues you might embrace underneath your revenue taking part in your buying and selling plan. Don’t make strict / inflexible guidelines you need to adhere to, as a result of that is futile, as an alternative, write down some frequent situations and plan what the very best plan of action is for these situations and why, then when you find yourself in that situation for actual, you simply observe your plan, you don’t panic.

Conclusion

The psychology of revenue taking is each fascinating and irritating. Greater than something, you need to take method from this text the purpose that reserving income is nearly by no means the incorrect transfer. Clearly, more often than not you wish to try to take income which are 2 occasions your danger or larger, however there are occasions when holding out for a sure revenue goal will not be the very best transfer. You have to be versatile and capable of adapt to varied market situations to take income efficiently, and thus to commerce efficiently.

I might recommend you’re taking the time to jot down out a profit-taking plan, and embrace varied situations like those talked about in his article and others you’ve discovered your self in, and plan what you’ll do in these conditions once more. Markets are inclined to behave in the identical common situations; trending, consolidating, range-bound or meandering with no course. Make a plan of how you’ll commerce and take revenue for every situation and you can be mild years forward of most merchants already.

I WOULD LIKE TO HEAR YOUR STORY 🙂 PLEASE POST A COMMENT BELOW

QUESTIONS ? – CONTACT ME HERE