I typically get requested if I’ve a favourite worth motion chart sample to commerce, and the reply is sure, sure, I do. As we speak’s lesson is about that chart sample, it’s what I name my ‘abandoned island technique’ as a result of if I have been stranded on a abandoned island and will solely choose one buying and selling technique or sign, it could be the one I’m going to share with you immediately…

Pin bars, usually, are my favourite total worth patterns to commerce, primarily as a result of they’re easy, highly effective and constant. The pin bar has stood the check of time; return and take a look at charts from 50 years in the past, you will notice pin bars labored then they usually work now.

Nevertheless, not all pin bars are created equal, maybe you might assume that is unlucky, however in case you study to determine and commerce them correctly you’ll rapidly change your thoughts. One kind of pin bar specifically, the ‘long-tailed pin bar’, might be a very powerful sign I’ve witnessed in my 15 + years of buying and selling. Lengthy-tailed pin bars are just like the so known as ‘black swan’; uncommon and exquisite and whenever you see one you cease and stare in awe, primarily as a result of you know the way necessary they’re and the way a lot cash you may make from them, and in case you don’t know, you’ll know after studying the remainder of this lesson…

How does a long-tailed pin bar examine to a ‘regular’ pin bar…?

Pin bars are available in all completely different sizes, however they’ll mainly be categorized into two camps: ‘Regular’ pin bars and ‘Lengthy-Tailed’ pin bars. Nevertheless, in case you have no idea something about pin bars, I recommend you cease for a minute and go over my pin bar buying and selling tutorial to get accustomed to them earlier than persevering with.

So, what does a long-tailed pin bar appear to be?

Right here is an instance:

In distinction, here’s a chart exhibiting what I might think about ‘regular’ sized pin bars…

Listed below are a very powerful traits and issues to find out about long-tailed pin bars:

- They’ve a tail or shadow that’s OBVIOUSLY for much longer than the close by or surrounding worth motion.

- They are typically very excessive likelihood indicators.

- They happen a lot much less steadily than different pin bars, however they typically result in main market strikes.

- They are often tough to enter because of extensive cease loss requirement (will focus on this later) and also you generally want to attend for a second likelihood entry to enter them.

- Lengthy-tailed pin bars can set the theme for a significant reversal in development or a significant continuation of development (see examples to observe).

- They provide high-reward to threat, particularly if the entry might be fine-tuned (extra on this later).

One of the necessary issues to grasp about long-tailed pin bars, is they don’t seem to be JUST a sign you commerce one time. Typically, they’re so highly effective that they’ll re-shape the market’s ‘panorama’ for months and even years to return. After a long-tailed pin has fashioned and the market reacts in-line with the pin bar, we will then start to ‘map the market’ primarily based off that pin. I educate merchants to learn the market like a ebook, from left to proper, to grasp the ‘story’ the market is attempting to inform you. When a long-tailed pin bar types, it’s an important a part of the ‘story’ that may have implications for ‘chapters’ to return. For instance, the market could come again and re-test the realm the place the pin bar fashioned, by which case, we might commerce in accordance with my occasion space idea.

You see, long-tailed pin bars aren’t simply commerce indicators, they’re that and much more. They assist us perceive the dynamics of a market and the psychology of the individuals buying and selling it. An extended-tailed pin bar sometimes reveals a ultimate exhaustion level in a market, or within the case of a development continuation transfer, it’s a robust affirmation sign {that a} development will proceed. The long-tail on the pin bar reveals that market individuals grew to become overwhelmingly bearish or bullish at that time, and that may be a crucial piece of knowledge for a dealer, as I’m certain you agree.

The place and the way do you commerce long-tailed pin bars?

Lengthy-tailed pin bars with confluence

One of the simplest ways to commerce a long-tailed pin bar is similar as every other sign that I educate; with as a lot confluence as attainable. Once I speak about buying and selling with confluence, I’m speaking about in search of commerce indicators which have come along with a number of items of proof behind them. The principle ones are T.L.S or development, degree, sign. So, ideally you need at the least two of the three; development and sign, or degree and sign and even simply development and degree (as in a blind entry). Be aware – there are extra components of confluence we will search for and I get into them extra in-depth in my superior buying and selling course.

The chart instance beneath reveals us a very good long-tailed pin bar with confluence of all three components of T.L.S.

Counter-trend long-tailed pins with confluence

Typically, due to the components that result in their formation, long-tailed pin bars will kind counter to an current development or after a robust transfer up or down. With these pins, we wish to search for protrusion by way of key ranges, ideally inside an apparent vary. Or, we prefer to see the tail of the pin bar protruding by way of a degree and making false-break of it. These items act as confluence for counter-trend long-tailed pin bars.

We may even see a significant reversal happen following a sustained transfer, this main reversal is commonly within the type of a long-tailed pin bar like within the instance beneath. Consider it because the market ‘placing on the breaks’ after transferring too far, too quick.

Lengthy-tailed pin bars with development and confluence

Lengthy-tailed pin bars are excellent trend-continuation indicators as properly. We are able to search for them after a pull again inside a development, in addition to at or close to key swing factors.

Search for sign as continuation, however be warned seeing a big pin on the prime or backside of a development transfer can really be a warning signal of imminent collapse and reverse, so watch out on these.

Lengthy-tailed pin bars as breakout performs

A market that has been in a buying and selling vary for a sustained interval will finally breakout in an aggressive method, sometimes. After we get a long-tailed pin bar after a market has been range-bound for a protracted interval, it’s typically an indication that such an aggressive breakout is about to occur…

Lengthy-tailed pin bars can create occasion areas

You will have learn my article on tips on how to commerce occasion areas and in case you have you’ll in all probability keep in mind that I discussed long-tailed pin bars are one of many main methods occasion areas are fashioned. Due to this fact, when a long-tailed pin bar types, we wish to make sure that we watch that space intently because the market pulls again to it, even weeks or months later, as a result of that long-tailed pin bar space is a robust occasion space to search for second likelihood entries at…

enter long-tailed pin bars

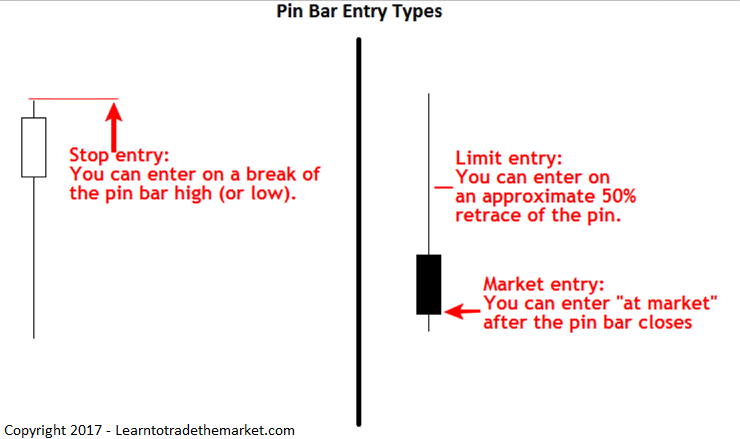

There may be basically three other ways you possibly can enter a long-tailed pin bar sign:

- “At market entry” – This implies you place a “market” order which will get crammed instantly after you place it, at the perfect “market worth”. A bullish pin would get a “purchase market” order and a bearish pin a “promote market” order.

- “On cease entry” – This implies you place a cease entry on the degree you wish to enter the market. The market wants to maneuver up into your purchase cease or down into your promote cease to set off it. It’s necessary to notice {that a} promote cease order have to be underneath the present market worth, together with the unfold, and a purchase cease order have to be above the present market worth, together with the unfold. In the event you want extra assistance on these “jargon” phrases checkout my free foreign currency trading course for extra. On a bullish pin bar formation, we’ll sometimes purchase on a break of the excessive of the pin bar and on a bearish pin bar formation, we’ll sometimes promote on a break of the low of the pin bar. To examine pin bar cease loss placement, checkout my superior worth motion buying and selling course.

- “Restrict entry” – This entry have to be positioned above the present market worth for a promote and beneath the present market worth for a purchase. The fundamental thought is that some pin bars will retrace to round 50% of the tail, so we will look to enter there with a restrict order. This supplies a good cease loss with our cease loss simply above or beneath the pin bar excessive or low and a big potential threat reward on the commerce in consequence. This entry is nice for long-tailed pin bars that retrace as a result of it tremendously improves your threat reward, I’ve a complete article devoted to this entry method and I name it the commerce entry trick.

Recommendations on buying and selling long-tailed pin bars

- You shouldn’t must assume too onerous a couple of long-tailed pin bar. In the event you see one, acknowledge the chance and plan out how you’ll enter it. Don’t over-think it! An extended-tailed pin bar is one that you simply don’t wish to miss!

- Control key chart ranges as that’s the place long-tailed pins will typically kind.

- Lengthy-tailed pin bars with tails which might be clearly protruding out from the encompassing bars / worth motion, are often the perfect ones. Whenever you see a tail protruding into ‘nothing’, it’s time to behave.

- Look ahead to long-tailed pin bars that create false breaks of key ranges, these are particularly highly effective and might typically result in development modifications.

- Watch out with massive pin bars that kind close to the highest of a transfer in an uptrend or the underside of a transfer in a downtrend (so bullish pin close to prime of up-move in uptrend, for instance) as these can really be indicators that the market course could transfer the other method from what the pin bar implies.

- If the market doesn’t respect the long-tailed pin bar and it violates the excessive or low of the pin’s tail, that may be a sign to pay attention to. I’ve a member’s article on what failed pin bars imply, test it out.

- Confluence is King with any commerce sign, long-tailed pins included. Whenever you see a sign coming along with a degree and a development, it’s time to arrange a commerce and make some cash!

While having data of high-probability commerce setups like long-tailed pins is essential, it is just one a part of turning into a profitable dealer. The person or girl doing the evaluation and pulling the set off is JUST as necessary because the technique or buying and selling plan they’re utilizing.

As merchants, we have to develop our unconscious intestine buying and selling really feel on an ongoing foundation, study from the charts and preserve notes and easily communicate with the day-to-day developments within the markets. This helps us develop a very good instinct and intestine really feel which go hand in hand with a very good buying and selling technique.

Conclusion

After fifteen years within the markets and about eight years of instructing merchants, it’s apparent to me that the majority merchants merely don’t know an apparent commerce setup when it’s staring them within the face. With long-tailed pin bars, this downside is basically eradicated, as a result of they’re so massive. Because of this, I like to recommend you make long-tailed pin bars the inspiration of your worth motion buying and selling plan.

So many merchants miss nice trades and so many merchants are inclined to get stung by buying and selling every thing that they “assume” may be a sign. This is sort of a madman with a gun strolling round taking pictures something that strikes. Buying and selling and cash are weapons, so to talk, and similar to a gun, you do have to be cautious with it. It’s essential be affected person and what for the perfect trades…then “choose your targets” and execute the commerce with absolute precision and confidence.

My buying and selling course covers all sorts of pin bars in addition to my different worth motion setups. Mixed with the each day members commerce setups publication, you might have a variety of sources that can assist you spot worth-while pin bar trades. Basically, these sources help you look over my shoulder as I analyze the market, and that is the quickest method so that you can learn to commerce profitably.

PLEASE LEAVE A COMMENT BELOW & GIVE ME YOUR FEEDBACK…

Any questions or wish to speak ? Contact me right here.