Skilled merchants don’t simply react to the market, they anticipate it. If you wish to transfer from the ranks of dropping merchants into the upper-echelon of the buying and selling ‘elite’, it is advisable to grow to be an anticipatory dealer as a substitute of a reactive one.

Most merchants open their buying and selling platform and begin trying by means of the charts considering to themselves, “What can I commerce at this time?”, that is very reactive and random, basically, they’re buying and selling on a ‘whim’. Reactionary merchants see the market go up and so they say, “Oh it’s too excessive, let’s promote it now”, or they see a market go down and say, “it’s too low, let’s purchase”. One other frequent mistake is when a dealer sees an enormous transfer happen in a day after which they get all excited and leap proper into the market consequently – that is reactive buying and selling, and it’s a loser’s recreation.

Winners will strategy the market a lot in a different way; they plan issues out, they’ve picked the areas they need to commerce from and the course they may commerce, perhaps days or even weeks earlier than they know an entry set off is prone to kind. They don’t react, they anticipate.

The mind of a profitable dealer vs. a dropping dealer

The mind chemistry of a drug addict is similar to that of a dropping dealer who’s hooked on buying and selling, sadly. Each persons are caught in a cycle of regularly needing to get their repair of dopamine, a neurotransmitter within the mind that performs a key position in our reward system. Within the case of a drug addict, that repair comes from their drug of alternative, which clearly has extreme long-term penalties on their brains and our bodies, doubtlessly even resulting in early demise. Within the case of a buying and selling addict, their repair comes from coming into trades and being available in the market as a lot as doable, which has extreme long-term penalties to their checking account in fact, however may also have an effect on their psychological well being, relationships and even bodily well being if it goes on long-enough. You see, the buying and selling addict is a reactionary dealer, and should you consider you might be at the moment extra of a reactive dealer than an anticipatory one, you might be in your technique to buying and selling dependancy.

In distinction, a peaceful, collected, skilled dealer, is one who can wait patiently for days or even weeks if want be, for the fitting commerce to return alongside. They’re disciplined and methodical and consequently, they don’t seem to be playing available in the market, they’re buying and selling it with ability and planning. An expert dealer isn’t hooked on the market, she or he doesn’t NEED to be in a commerce on a regular basis to get their repair of dopamine, as a result of they’re viewing and treating their buying and selling as a enterprise that’s indifferent from their self and their feelings. To place it succinctly, knowledgeable dealer is an anticipatory dealer reasonably than a reactionary one.

I’d extremely warning that in case you are at the moment a reactionary dealer you could be hooked on buying and selling or approaching an actual dependancy to the market. That is mainly the identical factor as a playing dependancy which is an actual, documented psychological drawback that individuals precise pay to get skilled therapy for. In case you consider you might be on the trail to buying and selling dependancy and (or) you’re a reactionary dealer, it is advisable to maintain studying as a result of I’m going TO SHOW YOU methods to cease this self-destructive buying and selling strategy…

Easy methods to construct a buying and selling plan primarily based on anticipation

Success is what occurs when correct preparation meets alternative. Learn that once more.

If you wish to succeed at something in life, buying and selling included, you should be correctly ready so when alternative comes ‘knocking’, the fitting factor to do. Each success story, whether or not in enterprise, buying and selling or some other subject, is predicated on planning or anticipating, not solely on being reactionary.

Maybe extra so than in some other subject, anticipating situations and occasions is essential in buying and selling. There’s a endless stream of variables bombarding you each time you open your charts and even take into consideration the markets. Thus, should you do not need a correct framework in place you’re going to find yourself as one other one of many herd of reactionary merchants, impulsively throwing cash at each little up or down tick available in the market.

“Give me six hours to cut down a tree and I’ll spend the primary 4 sharpening the axe.”

― Abraham Lincoln

- Map the market prematurely

Step one in studying to anticipate your trades, is mapping the market prematurely. By this I imply, trying on the larger image, from a top-down strategy to know the story the charts are telling you, so to anticipate what’s almost certainly to occur subsequent. In any case, should you don’t know the place you’ve been, you’ll be able to by no means know the place you’re going.

I all the time begin by mapping out the weekly chart first. To do that, I zoom out in order that I can see a few couple years’ value of value motion, then I begin drawing within the apparent key ranges of help and resistance, as you’ll be able to see beneath…

Subsequent, I’m going to take a look at long-term and near-term or short-term tendencies, to find out which course I’ll commerce in. Within the case of the weekly GBPUUSD chart beneath, the long-term development is clearly up or bullish, so now I’ve my long-term development and key long-term ranges drawn in, time to start out trying on the every day chart.

Now, we’ve the every day chart view; discover among the identical key ranges are seen from the weekly chart above, and I’ve additionally labeled a pin bar purchase sign in addition to a short-term help stage that we had been discussing lately in our weekly GBPUSD commentaries. We had been discussing that after value re-connected above 1.3340 we have been trying to purchase on a pull again close to that stage. In case you had been anticipating this pull again you would have positioned a purchase restrict entry order at 1.3340 to enter blindly IF value pulled again, which on this case it did…

Let’s have a look at one other latest instance of mapping the market after which anticipating a commerce entry, on this instance we’re trying on the latest every day EURUSD chart that we mentioned in our November twentieth weekly market commentary:

Discover that we had mapped the important thing ranges and we have been anticipating a retrace again to help close to 1.1660 space, in order that we might get lengthy as value had lately re-connected again above that stage which switched our bias again to bullish, as talked about within the commentary.

After just a few weeks of value motion, we will see that the market has pulled again and as of this previous Friday (December eighth) fashioned a small bullish pin bar in-line with our current view and on the help zone we’ve been anticipating to purchase from in our latest discussions. Now, there’s no assure value will transfer larger from right here, however there’s a powerful probability we’ll see a transfer larger while it’s above 1.1660 and we now have a possible entry sign…

In abstract: we’ve mapped the weekly and every day charts and decided the speedy course we need to commerce in for the upcoming week; which is up. We now have ranges we’re anticipating trades at and we now can focus our consideration on one course and sure ranges or areas on the chart.

- Decide which entry triggers to search for

I all the time like to incorporate just a few good examples of ‘ultimate’ entry triggers in my buying and selling plan, in order that I always remember precisely what I’m on the lookout for. Then, once I see a really related entry set off at a ‘scorching space’ on the chart that I’ve beforehand mapped (see above), I’ve nothing to consider anymore, I simply have to execute the commerce. Thus, I’m NOT REACTING, I’m ACTING ON MY PLAN or utilizing my anticipation.

My favourite entry triggers are, in fact, value motion alerts. If you’re new to my web site, try the next classes to study extra about three of my favourite alerts:

Pin bar buying and selling alerts

The fakey buying and selling sample

- Concentrate on ranges or areas you need to commerce from

Now that we’ve our markets mapped and we all know the alerts we’re on the lookout for, we will start to focus-in on ranges or areas / zones we wish to see these alerts kind at. I do get into this far more in-depth in my superior value motion buying and selling course, however I’ll contact on this briefly right here.

Bear in mind, context is king, as with most issues in life, however particularly in buying and selling. In case you get a pin bar sign for instance, on the improper place on a chart or going in opposition to a powerful development, even when it seems to be ‘excellent’, it might be nothing greater than market ‘chatter’ or random motion. For a value motion sign to bear any significance, it should happen throughout the correct context on the chart, or on the correct place, that is referred to as buying and selling with confluence.

In fact, for this reason you map the market prematurely; to find out key ranges and course of buying and selling. Then, you have already got your bias and the areas you’re watching, so the context, you simply want a sign to kind that agrees with it. That is the place the ready is available in, and it’s in all probability the toughest a part of buying and selling and the most typical half that individuals screw up. Are you able to sit in your arms for every week? Two weeks? Three? Most individuals can’t, and most of the people LOSE MONEY within the markets primarily as a result of they’ll’t. Sadly, I can not educate you to be disciplined and affected person, all I can do is stress to you the significance of it, YOU should do that half your self, and fairly frankly, should you can not do it you’ll by no means succeed at buying and selling.

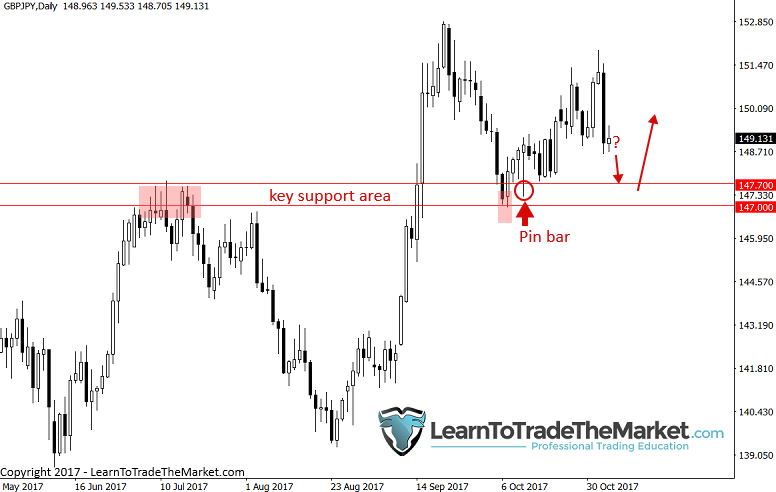

Within the GBPJPY instance beneath, we see a strong stage at 147.00 – 147.70 space, certainly this was a stage we mentioned in our November sixth commentary. Discover we already had a pin bar purchase sign there that paid off, a sign we mentioned in our members every day commerce setups e-newsletter the day it fashioned. Then, as value bounced larger and started pulling again, we have been anticipating that we could get a re-test of that help at 147.00 – 147.70 space for an additional potential shopping for alternative…

It took just a few extra weeks to play out, however value did pull-back to that help and dipped JUST beneath 147.00 earlier than rocketing larger once more. Hopefully, ‘gentle bulbs’ are occurring in your head and you might be beginning to see the POWER of being a affected person and anticipatory dealer!

- Danger administration

In fact, threat administration is one thing each dealer should spend a whole lot of time on, and it has every part to do with anticipation. Nonetheless, on this case, we’re anticipating that we could lose cash on any given commerce, EVEN IF we anticipate correctly as described above.

I’ve written many articles concerning the psychology of why it is advisable to settle for that you simply COULD lose on any given commerce. In case you haven’t learn any of them, try this lesson on the important thing to lasting buying and selling success.

Along with realizing why it’s essential to handle threat correctly on each commerce, it’s essential to additionally perceive HOW to do it. This mainly comes right down to cease loss placement (which is an artwork and ability unto itself) in addition to place sizing. I strongly recommend you click on on the final two hyperlinks to study extra about these subjects.

In closing

I hope now you might have a good suggestion of why it is advisable to grow to be an anticipatory dealer reasonably than a reactionary one, and methods to do it. The extra time and power you place into studying to learn the value motion on the charts and the ‘story’ the market is telling, the higher anticipatory dealer you’ll grow to be. I’ve spent almost twenty years perfecting my buying and selling strategy and if I might summarize it in a single temporary lesson, it could in all probability be the one you simply learn. Nonetheless, I delve into these subjects in far more element in my buying and selling course and members space.

All the things in my course leads as much as the part on buying and selling plans, wherein I share with you my buying and selling plan template and present you precisely how I plan out my buying and selling strategy. I’m making ready you to grow to be an anticipatory dealer with a plan of motion, as a result of that’s how I commerce, and I do know it’s what works. You’ll grow to be the ‘sniper’, not the ‘machine gunner’ and you’ll learn to wait patiently till the time is excellent to ‘assault’ the market.

LEAVE A COMMENT BELOW & TELL ME WHAT YOU THINK …

Any questions or suggestions? Contact me right here.