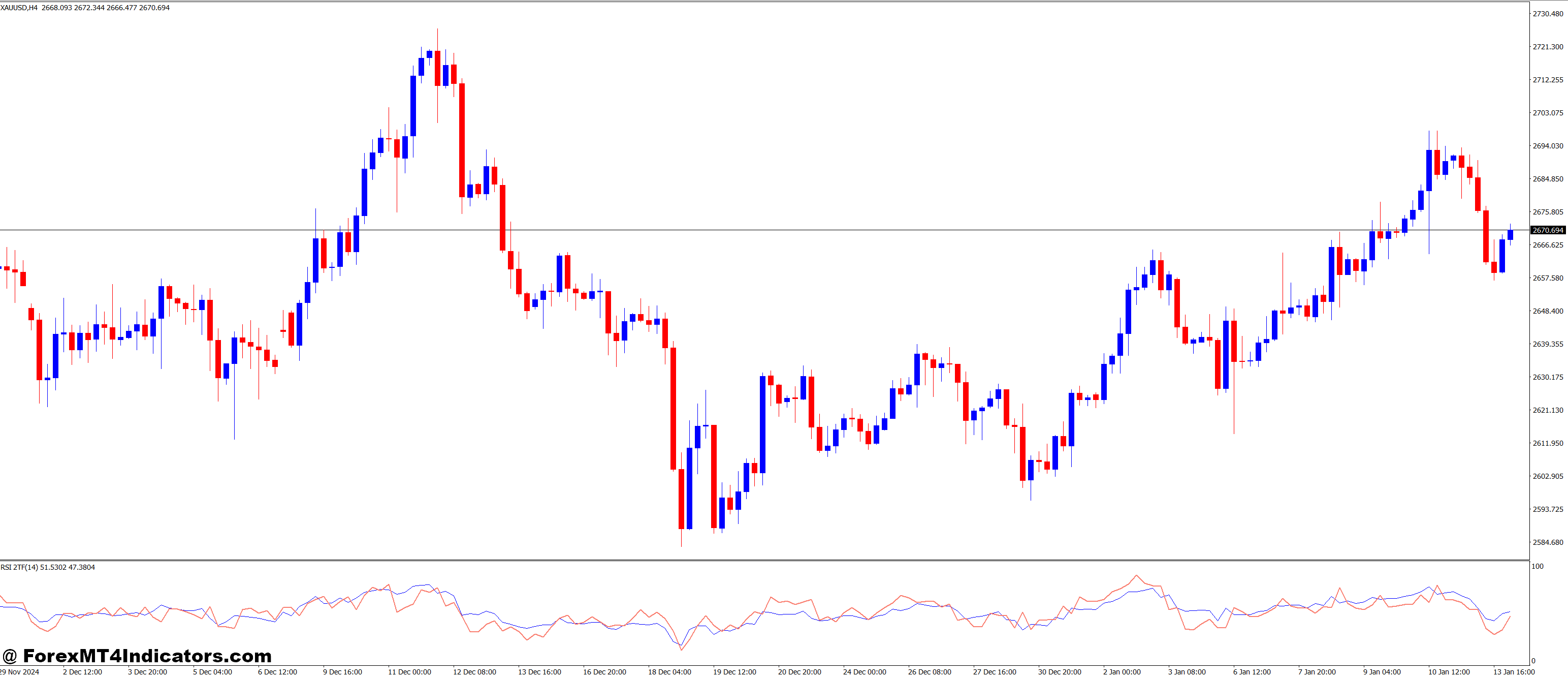

The RSI 2 TimeFrames MT4 Indicator builds on the basic RSI by making use of it to 2 separate timeframes directly. Conventional RSI measures momentum inside one timeframe, usually complicated when indicators battle throughout durations. By displaying RSI readings on each a shorter and longer timeframe, this indicator provides merchants a clearer image of market momentum and development power. This twin evaluation helps keep away from false breakouts and improves the timing of trades.

How It Enhances Buying and selling Selections

Utilizing two timeframes collectively permits merchants to verify indicators earlier than performing. For instance, if the RSI reveals an oversold situation on the shorter timeframe however stays impartial or bullish on the longer timeframe, the dealer features useful perception into whether or not the transfer is a short-term pullback or the beginning of a reversal. This layered data reduces guesswork and helps smarter entries and exits, finally rising the likelihood of worthwhile trades.

Person-Pleasant Options and Sensible Advantages

Designed for the MetaTrader 4 platform, this indicator integrates easily into current buying and selling setups. It affords visible alerts and clear RSI strains for each timeframes, simplifying evaluation with out litter. Merchants can customise the timeframes and RSI parameters to swimsuit their methods, making it versatile for scalping, day buying and selling, or swing buying and selling. By offering dependable affirmation throughout timeframes, it empowers merchants to handle danger higher and optimize commerce timing.

Tips on how to Commerce with RSI 2 TimeFrames MT4 Indicator

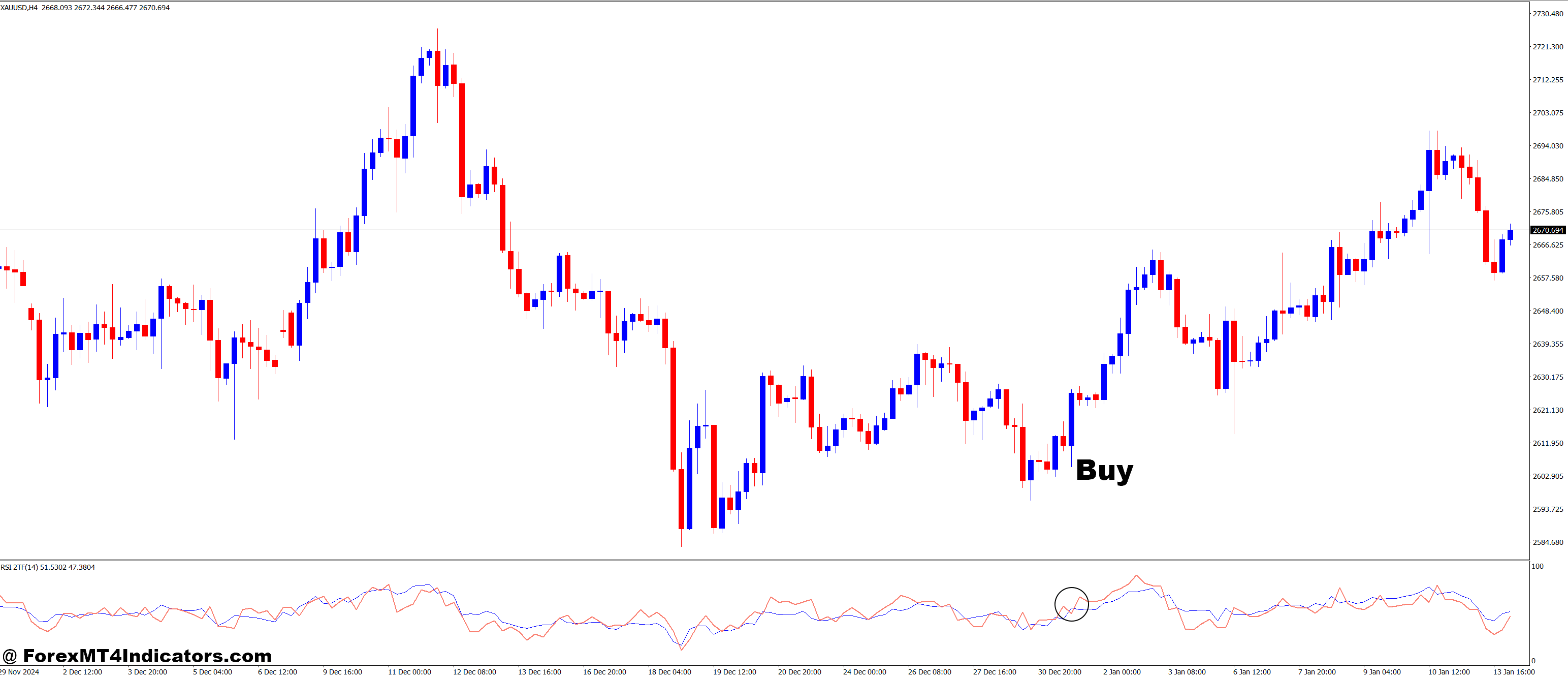

Purchase Entry

- The RSI on the shorter timeframe falls under 10–15 (indicating oversold situations).

- The RSI on the longer timeframe stays above 40 or is trending upwards (confirming general bullish momentum).

- Search for the shorter timeframe RSI to cross again above the oversold stage (e.g., rising from under 15 to above 15).

- Affirm worth motion helps the entry (e.g., bullish candlestick sample or help stage close by).

- Enter the purchase commerce when these situations align, inserting a cease loss under latest help or swing low.

Promote Entry

- The RSI on the shorter timeframe rises above 85–90 (indicating overbought situations).

- The RSI on the longer timeframe stays under 60 or is trending downwards (confirming general bearish momentum).

- Look ahead to the shorter timeframe RSI to cross again under the overbought stage (e.g., dropping from above 90 to under 90).

- Confirm worth motion suggests weak point (e.g., bearish candlestick or resistance stage).

- Enter the promote commerce when confirmed, with a cease loss positioned above latest resistance or swing excessive.

Conclusion

The RSI 2 TimeFrames MT4 Indicator is a useful device for merchants looking for to boost their market evaluation. By combining momentum insights from two timeframes, it addresses widespread pitfalls of single-timeframe buying and selling and helps establish high-probability alternatives. Whether or not new or skilled, merchants can profit from its readability and precision, resulting in extra assured and knowledgeable buying and selling selections.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 50% Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐