Do you know that website hosting charges are tax-deductible for enterprise homeowners? These prices usually qualify as bizarre enterprise bills, whether or not you pay month-to-month or yearly. You can too deduct associated bills like area registration, web site design, improvement prices, and essential software program. Preserve detailed information of all website-related bills and report them on Schedule C of your tax types beneath acceptable classes like “Promoting,” “Workplace expense,” or “Utilities” to maximise your tax financial savings.

Are website hosting charges tax-deductible? Tax season is right here, making it a good time to evaluation what bills you may declare to maximise your return. In the event you run a small enterprise, a number of deductions, like website hosting, may help you retain extra of your hard-earned cash.

The brief reply is sure, website hosting charges might be tax-deductible! However as with most tax matters, the complete reply is determined by a couple of necessary particulars.

On this information, you’ll study when website hosting prices are deductible and how you can declare them in your return. You’ll additionally uncover different technology-related bills you may be lacking that might increase your tax refund.

*Please word: This data applies solely to U.S. residents and U.S. taxes and shouldn’t be thought-about authorized or tax recommendation.

What’s a Tax Deduction?

A tax deduction reduces the quantity of taxable earnings, decreasing the quantity a person or enterprise owes to the federal government.

Deductions are normally bills over a taxable 12 months that may be utilized to or subtracted out of your gross annual earnings. That is finished to cut back the taxes you owe and decide how a lot tax is owed to the federal government.

Tax deductions shouldn’t be confused with tax credit. Whereas deductions can scale back the quantity of your earnings earlier than you calculate the tax you owe, tax credit can scale back the quantity of tax you owe.

Merely put, tax deductions scale back how a lot you pay in taxes by decreasing your quantity of taxable earnings.

The federal tax regulation permits taxpayers to deduct a number of totally different private bills from their taxable earnings annually.

Not each expense supplies tax financial savings; the Inside Income Code specifies the bills you may deduct and people eligible taxpayers. To make sure correct dealing with of deductions, go to the IRS’s Credit and Deductions web page.

Are Internet Internet hosting Charges Tax-Deductible?

Now that we all know what tax deductions are, let’s focus on their software to website hosting charges. The brief reply is sure, you may deduct these charges out of your taxes together with different online enterprise expenses.

Though the IRS hasn’t offered formal steerage on deducting web site prices, website hosting prices fall beneath dues and subscriptions, making them deductible in your return. Generally, the IRS guidelines outlined for software program might be utilized.

Particular Concerns for Completely different Enterprise Sorts

The way you deduct website hosting prices is determined by your enterprise construction. Sole proprietors, LLCs, and firms all report enterprise bills otherwise, together with website-related charges.

- Sole proprietors and single-member LLCs usually report bills on Schedule C of Type 1040. In the event you use website hosting for your enterprise web site, you may deduct these charges as a enterprise expense within the related class (typically “promoting” or “utilities”).

- Partnerships and multi-member LLCs should file Type 1065 and problem Schedule Okay-1s to companions. Hosting charges ought to be tracked all year long and reported as a part of bizarre enterprise bills.

- Firms (C corps and S corps) deduct internet hosting and digital companies as operational prices on their company tax returns (Type 1120 or 1120-S). These bills have to be documented with receipts or digital invoices and ought to be tied on to enterprise exercise.

Regardless of your enterprise sort, it’s necessary to make sure that website hosting prices are used primarily for enterprise functions. Private websites typically don’t qualify until there’s a transparent enterprise operate, like showcasing a portfolio that drives consumer earnings.

What Different Web site-Associated Charges are Deductible?

Fortunately for enterprise homeowners, web site internet hosting charges aren’t the one website-related prices you may deduct out of your taxes.

Along with website hosting, you may usually deduct a spread of website-related bills important to working your enterprise. Right here’s a better take a look at some frequent deductions you may qualify for:

Web Providers

In the event you depend on web entry for every day enterprise operations, a part of your web service charges might be deducted as a enterprise expense. In the event you additionally use the web personally, you may deduct the proportion of time it’s used for enterprise.

Web site Design and Growth

Hiring an expert to design, construct, or keep your web site qualifies as a deductible enterprise expense. In the event you pay a freelancer or contractor $600+ in a 12 months, you’ll have to problem them a 1099-NEC type.

Area Registration Charges

The price of registering and renewing your area identify is usually deductible as both an operational or advertising and marketing expense. Preserve detailed information and receipts for no less than 4 years, in case of an IRS audit.

Software program and Web site Purposes

Software program used to construct, handle, or improve your web site might be deducted. Examples embrace content material administration methods (CMS), safety plugins, backup instruments, or analytics software program. To qualify, the software program have to be used primarily for enterprise functions (no less than 50% or extra).

On-line instruments, Subscriptions, and Templates

Inventory photos, paid web site themes, eCommerce plugins, search engine marketing instruments, and different on-line sources you buy to your web site are deductible. At all times monitor invoices and word whether or not the device straight helps your enterprise actions.

Funds to internet designers or content material creators are deductible, too. In the event you pay an impartial contractor $600+, problem a 1099-NEC. Area charges and business-use software program (used no less than 50% for enterprise) additionally qualify. Preserve information for no less than 4 years for potential audits.

Moreover, you may deduct web site upkeep and development prices–like templates, inventory photos, plug-ins, and on-line instruments–in case your website helps your enterprise earnings.

Sadly, on the subject of reseller website hosting, consumer website hosting prices cannot be deducted or claimed since your consumer pays for this value after they pay you for the server.

In the event you function a reseller internet hosting enterprise, you usually can not deduct the website hosting prices related along with your shoppers’ accounts. When your shoppers pay you for internet hosting companies, these funds cowl the server sources you present, which means the prices are successfully handed by to them, not bills you incur. In consequence, you can not declare these client-related internet hosting charges as your enterprise deductions.

Nevertheless, you may deduct bills associated to sustaining and working your reseller enterprise itself. This contains the bottom value of your reseller internet hosting plan, administrative instruments, billing software program, advertising and marketing bills, and any further companies you buy to handle your internet hosting enterprise. To remain compliant, you’ll want to separate consumer expenses out of your operational prices and keep detailed information of all business-related bills all year long.

Correctly monitoring your deductible bills all year long makes it simpler to assert them appropriately when it’s time to file your taxes.

Tax Implications of Completely different Cost Phrases

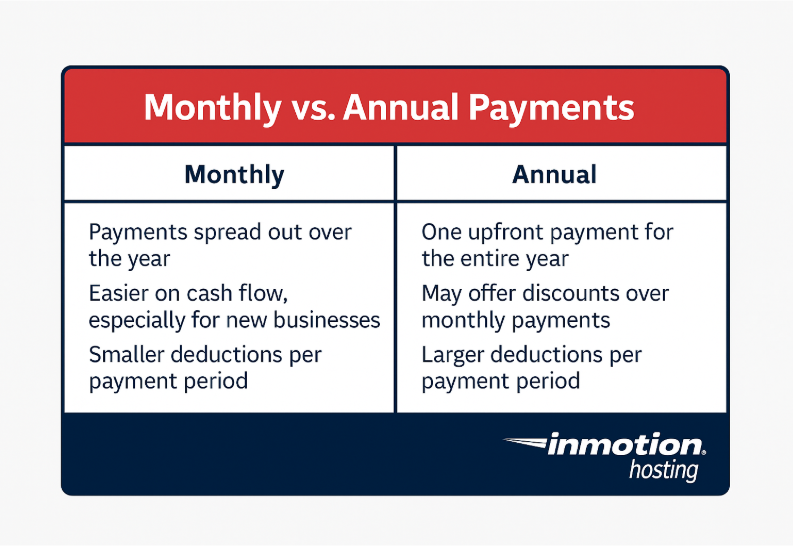

The way you pay for website hosting—month-to-month or yearly—can have an effect on when and the way you deduct these bills in your taxes. Each cost choices are usually deductible, however timing issues for correct reporting.

Month-to-month funds

In the event you pay for website hosting on a month-to-month foundation, you may deduct every cost as a enterprise expense within the tax 12 months you made the cost. This strategy is easy and permits you to align your deductions carefully along with your month-to-month earnings and bills. Month-to-month billing may make it simpler to handle money movement, particularly for newer companies with variable income.

Annual funds

Once you pay for internet hosting or associated companies upfront for the whole 12 months, you may normally deduct the complete value within the 12 months you make the cost. Nevertheless, in some circumstances—particularly for bigger companies utilizing accrual accounting—you might have to allocate the expense over the service interval as a substitute of deducting it all of sudden. Most small companies that use money accounting can deduct the complete annual cost within the 12 months it’s paid, which can provide a bigger one-time deduction and assist decrease taxable earnings extra considerably.

| Cost Time period | How It Works | Tax Deduction Timing | Execs | Cons |

| Month-to-month Funds | Pay smaller quantities every month for internet hosting or companies. | Deduct every cost within the 12 months it’s paid. | Simpler money movement administration; matches month-to-month enterprise bills. | Can value extra over time on account of month-to-month charges; much less alternative for bulk reductions. |

| Annual Funds | Pay upfront for the whole 12 months of internet hosting or companies. | Deduct the complete quantity within the 12 months the cost is made (for many cash-based companies). | Usually obtain discounted charges; bigger single deduction might decrease taxable earnings extra considerably. | Requires bigger upfront cost; much less flexibility if enterprise wants change midyear. |

Earlier than selecting a cost schedule, contemplate your enterprise’s accounting methodology and money movement wants. Maintaining detailed information of your cost dates and phrases ensures you may maximize your deductions whereas staying compliant with IRS necessities.

The right way to Deduct Web site-Associated Charges From Your Taxes

Hosting charges and the opposite bills we talked about might be tax-deductible. That’s nice information, however how does one go about claiming these deductions?

Tax types have a plethora of sections, however on the subject of website hosting charges and different deductions, you’ll want to file these beneath “Schedule C – Revenue or Loss from Enterprise.”

This part is a part of a person’s IRS Type 1040, and it exhibits the enterprise’s earnings for the tax 12 months. That is the place you’ll want to enter your deductible bills.

Underneath Schedule C, discover “Half II, Bills”, and fill out the entry that finest matches the deduction. From what we have now mentioned on this article, the most definitely space to assert these deductions can be beneath these entries:

- #8: “Promoting”

- #18: “Workplace expense”

- #25: “Utilities”

- #27a: “Different bills”

Tax Methods for Completely different Enterprise Sorts

The best way you deduct website hosting prices and different on-line enterprise bills relies upon closely on your enterprise construction. Whether or not you’re a sole proprietor, LLC, partnership, or impartial contractor, it’s necessary to know the methods that suit your state of affairs to maximise your deductions and keep compliant with tax legal guidelines.

Sole proprietors and single-member LLCs

In the event you function as a sole proprietor or a single-member LLC, you usually report enterprise earnings and bills on Schedule C of your Type 1040. You possibly can deduct website-related bills like internet hosting charges, area prices, web companies, and advertising and marketing as a part of your basic enterprise bills. Since your private and enterprise taxes are tied collectively, monitoring deductible prices all year long can considerably decrease your taxable earnings.

Partnerships and Multi-Member LLCs

For partnerships and multi-member LLCs, deductions movement by to particular person companions through Schedule Okay-1 after submitting Type 1065. It’s important to doc website hosting and associated digital bills clearly so that every accomplice claims the proper share. Take into account creating an inside expense monitoring system that categorizes expertise prices individually to simplify end-of-year filings.

Firms (C Corps and S Corps)

Firms file separate enterprise tax returns (Type 1120 for C Corps or Type 1120-S for S Corps). These entities can deduct website hosting and digital service bills as operational prices, but it surely’s important to keep up thorough information exhibiting that these bills are essential for working the enterprise. Firms can also profit from further deductions, like Part 179 deductions for software program purchases, relying on their complete enterprise spending throughout the 12 months.

Nonprofit organizations (501(c)(3))

Whereas nonprofit organizations are tax-exempt, they nonetheless file annual data returns resembling Type 990. Internet hosting and website-related bills that straight assist your nonprofit’s mission, resembling internet hosting for donation platforms or consciousness campaigns, might be reported as operational prices. Sustaining detailed information is important to show that bills align along with your exempt function.

Freelancers and Unbiased Contractors

Freelancers and impartial contractors, typically working beneath their Social Safety quantity with out a formal enterprise entity, report their earnings and bills on Schedule C. You possibly can deduct internet hosting charges, web site upkeep, and on-line instruments so long as they’re straight associated to your freelance work, resembling selling your companies or speaking with shoppers.

eCommerce Companies

In the event you promote merchandise on-line, whether or not by your website or marketplaces like Etsy or Amazon, your website hosting, area, SSL certificates, procuring cart plugins, and different website-related prices are deductible. Classify these bills beneath advertising and marketing, operations, or utilities relying on how every merchandise helps your on-line retailer’s performance.

Regardless of your enterprise sort, a wise tax technique includes holding detailed receipts, categorizing website-related bills appropriately, and guaranteeing that every one deductions align with IRS necessities. Working with a certified accountant or tax advisor may assist you construction your deductions most advantageously primarily based on your enterprise setup.

Conclusion

Operating a enterprise comes with its fair proportion of bills, however tax season provides a beneficial alternative to cut back your monetary burden by eligible deductions. As you’ve seen, website hosting and different website-related prices might qualify, however whether or not you may declare them is determined by your distinctive enterprise state of affairs.

To keep away from points with the IRS, ensure you doc your bills rigorously and seek the advice of a tax skilled when you’re not sure. A little bit preparation now may help you maximize your return and reduce surprises later.

For a full checklist of deductible enterprise bills, please go to the IRS’s Deducting Enterprise Bills web page.