The within bar sample is usually a very highly effective value motion sign for those who perceive easy methods to commerce it correctly. Sadly, many merchants have no idea easy methods to commerce it correctly and because of this, they find yourself dropping cash again and again and turn into annoyed with inside bars.

Like another value motion sign, there are subtleties to buying and selling the within bar setup and studying these refined variations between a ‘good’ and ‘unhealthy’ inside bar sign is usually the distinction between successful or dropping cash with them. That’s to not say that each inside bar commerce shall be a winner as soon as you understand how to commerce them correctly, however you should a minimum of be sure to are placing your self able to earn cash with the within bar sample.

The next three errors are the most expensive errors that I see merchants making with the within bar sample, learn on to be taught what they’re and how one can keep away from them…

1. Not buying and selling inside bars on the every day chart

You in all probability have learn a few of my articles on every day chart buying and selling, for those who haven’t, you must. The every day chart is probably the most highly effective and necessary timeframe for a value motion dealer. That stated, I do educate and commerce some value motion alerts on the 4 hour and 1 hour charts if a sign varieties on these time frames that agrees with my entry standards.

Nevertheless, one value motion sample that I ONLY commerce on the every day chart timeframe, is the inside bar sample. Listed here are my important causes for this:

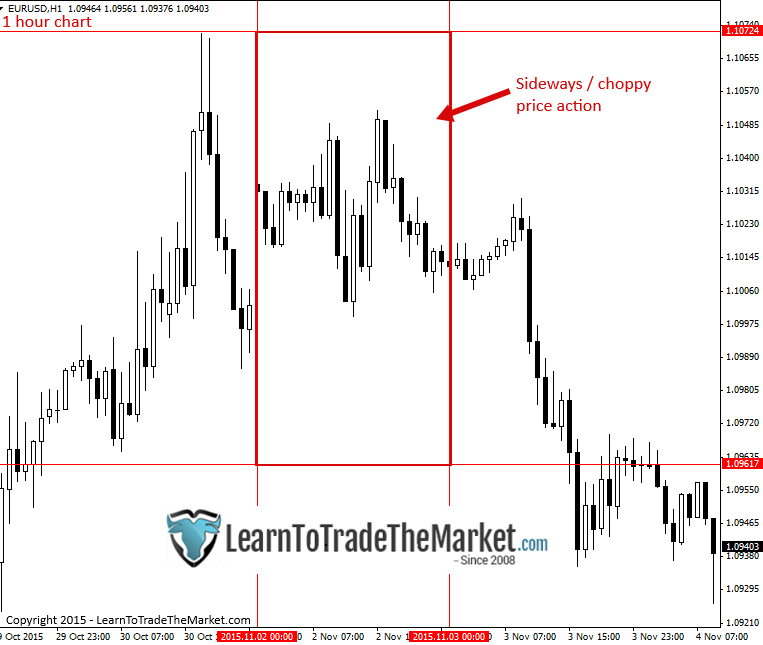

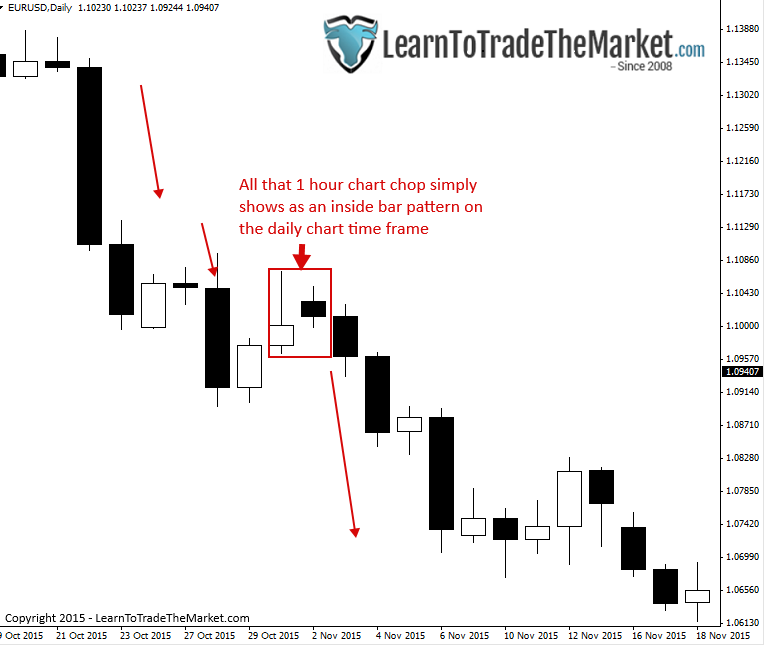

- An inside bar on the every day chart exhibits a interval of consolidation on the decrease time frames and {that a} potential breakout from this consolidation is coming. There’s far more significance with a every day chart inside bar than one on a decrease timeframe as a result of it ‘smooths’ over all that sideways chop and consolidation on the 4 hour and 1 hour (or decrease) charts and represents it merely within the type of one inside bar sample or inside day. This eliminates lots of confusion, over-analysis and second-guessing, which typically results in over-trading on these decrease time frames. Keep in mind, a uneven / sideways market is the toughest to commerce, so the power to take away sideways chop on the 4 hour, 1 hour or decrease time frames, by merely seeing an inside bar on the every day chart, will prevent some huge cash and anguish within the long-run.

- There are numerous, many inside bars on time frames underneath the every day, and lots of false-breaks of them happen. In brief, they’re simply too onerous to commerce on time frames underneath the every day as a result of there are such a lot of insignificant ones, and they aren’t value your time or cash on these decrease time frames.

In case you have a look at the 2 photographs under you will note the ability of the every day chart and why I solely commerce inside bars on the every day chart timeframe. Discover that every one the sideways motion on the 1 hour is represented merely as one inside bar sample on the every day chart, which labored out fairly properly as a promote sign on this instance. Additionally, discover all of the 1-hour chart inside bars, most of which failed; you simply can’t attempt to commerce all these inside bars on the 1 hour…

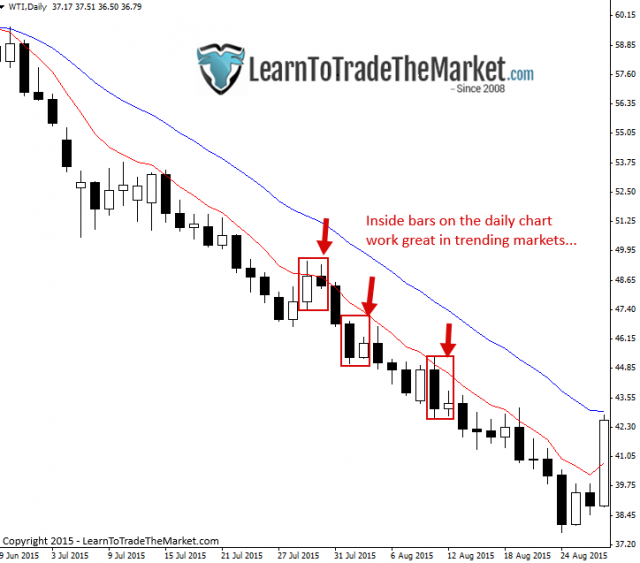

2. Not buying and selling inside bars with the every day chart pattern

I favor inside bars with the every day chart pattern and on the every day chart as mentioned above. Attempting to commerce inside bars towards a every day chart pattern could be very onerous, particularly for those who’re a newbie or comparatively new. It may be completed, but it surely shouldn’t be tried till you might be snug and profitable buying and selling inside bars WITH the every day chart pattern, and it ought to solely ever be completed from key chart ranges.

An inside bar is finest traded as a trend-continuation sample on the every day chart, they are often regarded as ‘breakout’ performs and might present excellent threat reward potential to leap aboard a trending market because it resumes its motion after a quick pause or consolidation.

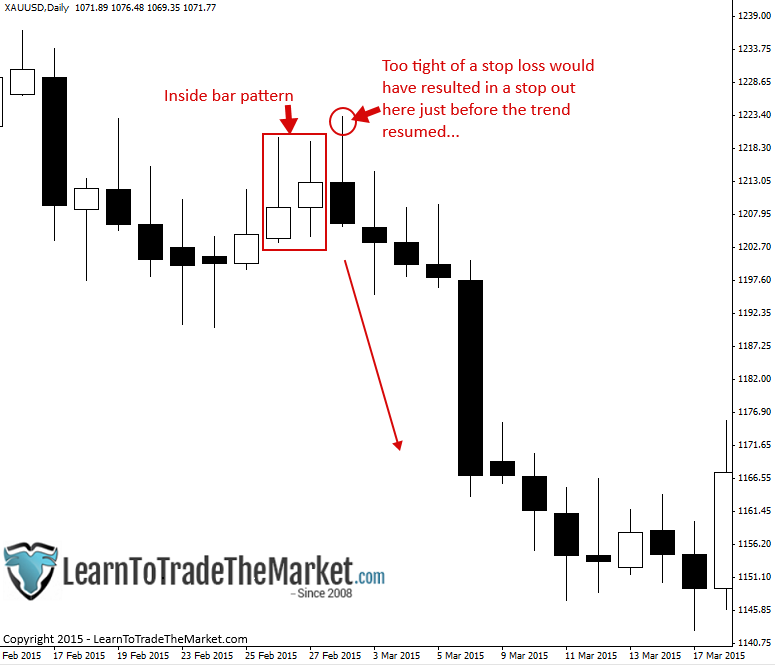

3. Utilizing too tight of a cease loss

Inserting your cease loss simply above or under the mom bar excessive or low of an inside bar can typically be a mistake. When inserting cease losses, you can’t place them primarily based on greed, which means, you may’t place them too near your entry simply since you wish to commerce a much bigger place dimension. It’s important to place them logically, the place they’ve one of the best likelihood of not being hit by the conventional every day fluctuations in value.

I recommend you test the common true vary of the pair or market you might be buying and selling and ensure your cease loss is a minimum of outdoors of that in addition to past any near-term or close by key help or resistance ranges. This would possibly imply decreasing your place dimension to satisfy a wider cease loss distance (in an effort to preserve your 1R threat quantity), but when that’s what it takes to revenue on the commerce, that’s all you must care about.

As I mentioned on this current article on ‘easy methods to commerce with a small account’, you may’t be so targeted on earning profits that you just forgo correct buying and selling habits (like correct cease loss placement). Correct buying and selling habits are what results in long-term success available in the market, whereas principally specializing in ‘income and rewards’ will trigger you to lose your deal with correct buying and selling and in the end will lead to you dropping cash.

To be taught extra about easy methods to commerce the within bar and different value motion patterns correctly, try my value motion buying and selling course.